In the months leading up to Donald Trump’s White House victory, hundreds of fake Facebook accounts flooded the social media site with posts about hot-button issues like gun control and immigration.

Those fake accounts are now part of a broader investigation into Russia’s interference in the 2016 presidential election. And the plot has continued to thicken. After an internal probe, Facebook recently revealed that more than 3,000 of its ads were paid for by a Kremlin-connected company.

While it’s impossible to determine whether those ads — which reportedly reached 10 million people — swayed voters, the fact that they were used to target the swing states of Michigan and Wisconsin speaks volumes about how sophisticated online advertising technology has become.

Although this type of microtargeting has been in the news lately for possibly changing the course of U.S. history, on the less-covert, non-government-sabotaging front it’s become a go-to source for real estate firms to pinpoint clients in specific geographic areas or by socio-economic (and other) criteria.

“It’s really the difference between a buckshot approach, which is what the advertising looked like a few years ago, to more laser-focused precision,” said Jared Seeger, founder of Knightsbridge Park, a real estate marketing company. “You’re really homing in on your desired audience.”

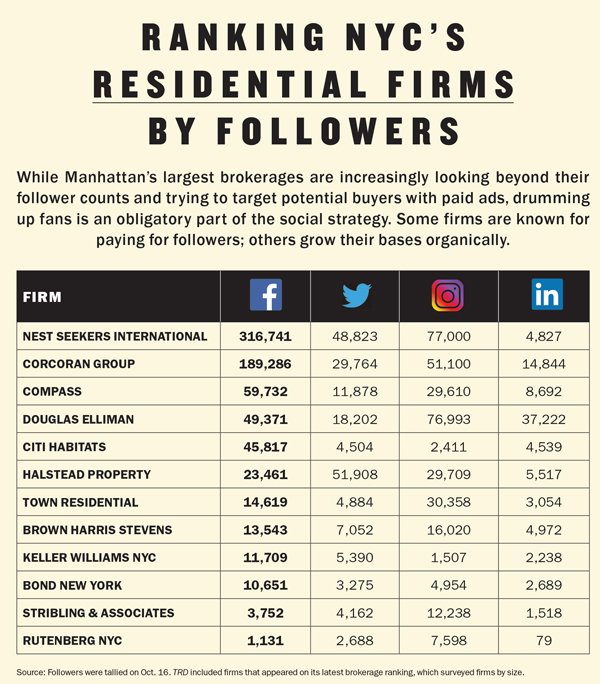

Social media is clearly a fast-moving target that real estate firms — particularly on the residential side — have been pouring resources into for years now. And it has always made for hard-to-quantify results.

When The Real Deal last wrote about sweeping social strategies back in August 2015, many firms were stressing that having followers was not enough and that engaging those followers was key. And while they were already focused on paid advertising back then, that space has grown enormously in the last year.

When The Real Deal last wrote about sweeping social strategies back in August 2015, many firms were stressing that having followers was not enough and that engaging those followers was key. And while they were already focused on paid advertising back then, that space has grown enormously in the last year.

While breakdowns of how much each industry spends on social-media advertising are not publicly available, paid advertising on Facebook skyrocketed 54 percent to $27.6 billion in the last year, according to the site. And real estate companies nationwide will spend a projected $18 billion on online advertising in 2017, according to Borrell Associates, a firm that publishes industry-specific advertising reports. That includes the advertising that many firms are also now doing on listings portals like StreetEasy and Realtor.com.

For the residential sector, the big three social sites — Instagram, Facebook and, to a lesser extent, Twitter — have remained the tried-and-true platforms to drive traffic to listings and post property porn. In addition to the obligatory posting and paid advertisements, developers and brokerages are also increasingly experimenting with live video, less-tested apps like Snapchat and other one-off tactics, like hiring social “celebrities” to post about properties.

“Most people, on a daily basis, have their head either stuck in front of a desktop or stuck in front of their phone,” said Robert Nelson, president of the Nelson Management Group, which manages multifamily properties throughout the city. “It’s a place where you have peoples’ attention.”

Finding an audience

In August, Facebook launched a real estate version of “dynamic ads” — the Big Brother-type advertisements that make users feel like someone is watching their every click.

Here’s how the ads work: If a user is browsing listings on the Corcoran Group’s website, for example, similar listings from the brokerage will start popping up on their Facebook and Instagram feeds. (Facebook has already rolled this out for retailers, which is why the shoes or bag you checked out continues to haunt your social feeds.)

Austin Bradley, director of marketing operations at Triplemint — a startup brokerage that relies heavily on listings platforms to generate leads — said the move by Facebook to launch dynamic ads for real estate illustrates the industry’s growing market share in the paid-advertising game. Bradley declined to disclose how much his firm spends on social sites, but he said the company dedicates a seven-figure budget to branding and advertising.

Seeger said his clients — which include Extell Development, Related Companies and Hines — usually spend between $2,500 to $3,000 per month on Facebook and Instagram advertising. The amount of cash can be spent in a variety of ways. That’s because on Facebook, ads are priced on a bidding system — usually per click or per thousand page views, with minimum bids going for $.01. But the lower the ad price, the lower its potency. Seeger said his clients usually spend $.60 to $.70 per click.

Brett Wolfe, director of sales and marketing at Property Markets Group, said the company — which is co-developing 111 West 57th Street on Billionaires’ Row, among other properties — pays between $5,000 and $7,500 a month per project to advertise on Facebook. He noted that PMG focuses on rentals on Facebook and Instagram, since they are most popular with millennials. “The average Instagram user is 35 or younger,” he said. “We don’t really believe that anyone’s going to buy a luxury condo because they saw it on Instagram.”

Brett Wolfe, director of sales and marketing at Property Markets Group, said the company — which is co-developing 111 West 57th Street on Billionaires’ Row, among other properties — pays between $5,000 and $7,500 a month per project to advertise on Facebook. He noted that PMG focuses on rentals on Facebook and Instagram, since they are most popular with millennials. “The average Instagram user is 35 or younger,” he said. “We don’t really believe that anyone’s going to buy a luxury condo because they saw it on Instagram.”

Microtargeting on Facebook is not entirely new. The social platform started using data provider Acxiom — which allows users to target specific audiences based on employment, income and other demographics — back in 2015. The program can also single out users in specific locations — by country, state, region, zip code or even a 50-mile radius of a selected address.

But while it’s been around for two years, the technology has just recently caught on with more industries, including real estate.

“It’s a lot more now than just putting up pictures of well-curated interiors,” Seeger said. “Now it’s about creating and sharing compelling imagery and stories, but it’s also about audiences you target.”

And it allows companies to more precisely track the effectiveness of an ad through Facebook’s analytics.

Douglas Elliman’s Facebook ads, for example, have reached 2 million people in the past year and drove at least 100,000 visitors directly to the brokerage’s website, according to Dana DeVito, marketing chief at the brokerage, who declined to say how much of the firm’s marketing budget is devoted to the ads.

Josh Cook, director of BerlinRosen’s in-house marketing agency Maiden + John, said that for large New York City developments, 50 percent of the client’s marketing budget often goes to digital ads. He said Facebook ads allow them to closely target prospective tenants who are more likely to be interested in their properties. “The value of social is that it’s providing us a Trojan horse into our [prospective] tenant’s day-to-day,” he said. “There are clear ways to target people on Facebook and Instagram, people who are looking to move.”

Alternative routes

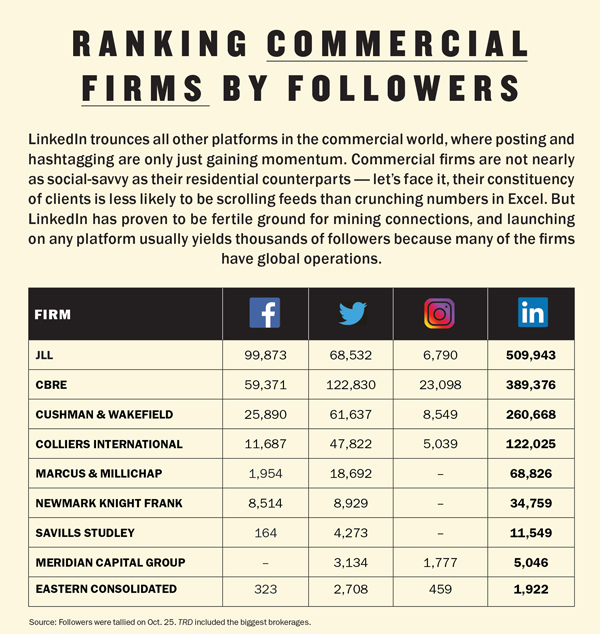

For commercial firms social is, obviously, an entirely different beast. Their constituency — institutional players, landlords, developers, investors and office tenants — are less likely to be scrolling their social feeds for property porn and more likely to be crunching stats in Excel.

But while social media strategies are not playing the same kind of role in their marketing budgets as they are at residential firms, brokers are engaging on social.

Paul Suchman, CBRE’s chief marketing officer, said that the global commercial real estate brokerage is active on Instagram, Facebook and Twitter, though it doesn’t have individual accounts for each of its regions. Overall it has over 59,000 Facebook followers, 122,000-plus followers on Twitter, 23,000-plus on Instagram and 389,000 on LinkedIn (see chart).

Paul Suchman, CBRE’s chief marketing officer, said that the global commercial real estate brokerage is active on Instagram, Facebook and Twitter, though it doesn’t have individual accounts for each of its regions. Overall it has over 59,000 Facebook followers, 122,000-plus followers on Twitter, 23,000-plus on Instagram and 389,000 on LinkedIn (see chart).

He said the firm uses paid ads on Facebook selectively, usually only when it’s trying to amplify a specific campaign. “It’s a finite universe,” he said. “We’re able to reach them as much with organic channels as with paid channels.”

Not surprisingly, LinkedIn’s more corporate ethos has proven to be more fertile ground on the commercial side. Suchman said the site serves as a good platform for promoting the firm’s research. Individual brokers, like Cushman & Wakefield’s Bob Knakal, have also taken to posting articles about issues impacting the industry to showcase their expertise.

And many just use LinkedIn to track down potential clients and mine a large network of professional sources — sort of like a modern-day networking luncheon.

Greg Goldberg, an associate director of Eastern Consolidated’s retail division, said that last year he used the site to locate the owner of Viking Waffles after eating at the store’s Solace Crossfit location in Midtown. The move paid off: He ended up brokering a deal for a new 1,250-square-foot space at 137 Avenue C, where asking rents were $100 per square foot.

Meanwhile, Ira Zlotowitz, CEO of the commercial mortgage brokerage Eastern Union Funding, said that in September, the company closed its first deal initiated through LinkedIn — a small loan for a Newark property. He said the site is a valuable lead generator and an initial conversation starter, but that it’s not setting the real estate world on fire.

While those deals are clearly not blockbusters, the site offers another avenue for connections and doesn’t require photos or clever hashtags. “You don’t need to spend a lot of time there to really have an impact,” said Danielle Garofalo, director of digital marketing and agent strategy at Stribling & Associates.

Early adopters

While Facebook Live, Snapchat and other social outlets may be old news to the millennial crowd, they are only just starting to be tested in the industry.

Snapchat — which for those in the 35-plus crowd is a photo- and message-sharing app that deletes messages seconds after they’re viewed — is probably the most “advanced” of the bunch.

SnapListings, a Snapchat account that allows brokers to promote listings, has been used by several major firms — including Corcoran and Elliman — but it’s not being used in any widespread capacity yet. Still, some have already had Snapchat luck.

Eastern Consolidated’s Goldberg said he signed a tenant, tattoo artist Bang Bang, to a 10-year lease at a 4,440-square-foot space at 62 Grand Street in Soho through a lead on Snapchat.

Eastern Consolidated’s Goldberg said he signed a tenant, tattoo artist Bang Bang, to a 10-year lease at a 4,440-square-foot space at 62 Grand Street in Soho through a lead on Snapchat.

Others have used Facebook Live and Instagram stories to give tours of rental units and condos.

Nelson said his company has done walk-through videos of the Lafayette Boynton apartment complex in the Bronx. He credits that and other social media strategies for the complex’s low vacancy rate (six units out of 972). He said that overall, leasing has increased 14 percent since the company started using social sites.

Meanwhile, some New York real estate companies have also started tapping so-called “influencers” — those with large social media followings — to promote their properties in exchange for breaks on their rent, and in some cases, free apartments.

Two Trees, for instance, hired writer Tavi Gevinson, who has 562,000 Instagram followers, to post about its 379-unit rental 300 Ashland, where she lives, and about the surrounding Fort Greene neighborhood. Similarly, chef Seamus Mullen, who lives at Two Trees’ 60 Water in Dumbo, is paid to promote the rental building on Instagram. “It really derived from a simple premise: The most common question you get from perspective renters is ‘What’s it like living in your building?’” said Brian Upbin, who heads Two Trees’ asset management. “Everyone’s got listings, everyone’s got renderings, but it’s not the full picture.”

Savvy landlords and brokers have also found ways to manipulate the system. With the planned temporary shutdown of the L train in 2019, Brooklyn and Jersey City landlords have started trying to lure Williamsburg tenants through hashtag misdirection.

According to the Wall Street Journal, the hashtag #Williamsburg on Instagram brings up pictures of TF Cornerstone’s 33 Bond Street, a new apartment building in Downtown Brooklyn. And paid links direct prospective tenants searching for Williamsburg rentals to the Offerman House, a Downtown Brooklyn rental building, instead.

Meanwhile, some brokers and marketing agencies are dabbling with a feature of Facebook ads known as messenger bots, essentially automatic pop-up messages that appear when a user clicks on an ad. The bot collects basic information and is programmed to answer regularly asked questions quickly and at any time of day, BerlinRosen’s Cook said.

Other tools, including Facebook Marketplace — a Craigslist-like forum launched in late 2016 — allows users to post listings directly and bypass brokers. But it has yet to make a dent. “It’s still too new to say, ‘Oh my gosh, it’s a threat,’” Stribling’s Garofalo said. “I happen to be one of those people who think we will never replace brokers. It’s a people business.”

— Kerry Barger contributed research to this story