Versailles mega mansion suffers $10M in Hurricane Ian damages

Versailles mega mansion suffers $10M in Hurricane Ian damages

Trending

Insured losses from Hurricane Ian could reach $40B

Construction lenders have about $11B in exposed properties in Florida

As emergency responders continue their search and rescue efforts in the aftermath of Hurricane Ian, a clearer picture of property damage is beginning to emerge, with one rating company estimating insured losses of up to $40 billion.

Hurricane Ian made landfall on Wednesday afternoon at Cayo Costa in southwest Florida, with 155 mile-per-hour winds, bringing with it up to 18 feet of storm surge.

The hurricane, which resulted in paused or canceled real estate deals as it approached the Gulf coast, is sure to put more stress on the state’s already tenuous property insurance market. Premiums, already on the rise, will likely continue to increase as fewer insurers opt to write new policies in Florida, experts say.

Jim Fraser, director of commercial real estate strategy at the construction finance startup Built, said that labor shortages and supply chain disruptions could delay reconstruction and recovery efforts in Florida, and also exacerbate existing issues nationwide.

$25B to $40B in insured property losses

In Florida, insured losses from the storm could range from $25 billion to $40 billion, according to estimates from Fitch Ratings. Ian made landfall as a Category 4 hurricane, creating total destruction in some parts of the region, and killing more than 100 people. For context, insured losses from Hurricane Katrina in 2005 totaled $65 billion, and Hurricane Ida last year resulted in $36 billion in losses, Fitch reported.

Universal Insurance could have the biggest exposure with about 10.5 percent market share of personal property insurance, closely followed by Citizens Property Insurance, which held 10.2 percent market share, according to Fitch.

$11B in construction loan exposure

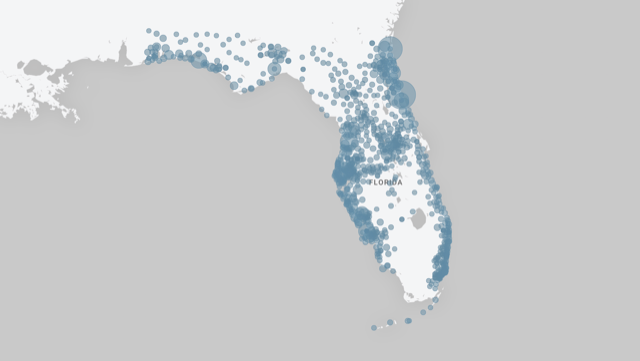

Properties with construction loans that are in FEMA-designated Hurricane Ian disaster areas (Credit: Built)

Statewide, lenders have about $11.3 billion in total construction loan exposure, backing about 7,500 residential and commercial properties in areas designated by the Federal Emergency Management Agency, said Fraser of Built. That represents about 8 percent of all $140 billion construction financing in the U.S. and Canada.

Fraser noted that the $11 billion-plus figure only represents properties in various stages of construction — from vacant sites to recently completed projects — that were in the FEMA-designed zones. That doesn’t mean those properties were damaged.

The majority, or about 4,500 properties, were backed by construction loans that consumers took out, totaling about $3.2 billion in Florida.

If you include South Carolina and North Carolina, the construction loan exposure totals more than $22 billion, spread across about 18,500 properties, according to Fraser and Built’s data.

$52B in securitized CRE loan exposure

Including areas such as Tampa/St. Petersburg, where Ian was expected to make landfall until it veered south, securitized commercial real estate loan exposure in the hurricane’s path totaled $52 billion, according to Trepp. That includes outstanding balances of nearly $12 billion in the Orlando/Kissimmee/Sanford market and $2 billion in the Fort Myers/Cape Coral region, the latter of which was hit the hardest.

!function(e,i,n,s){var t=”InfogramEmbeds”,d=e.getElementsByTagName(“script”)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(“script”);o.async=1,o.id=n,o.src=”https://e.infogram.com/js/dist/embed-loader-min.js”,d.parentNode.insertBefore(o,d)}}(document,0,”infogram-async”);

Read more

Versailles mega mansion suffers $10M in Hurricane Ian damages

Versailles mega mansion suffers $10M in Hurricane Ian damages

Flood-risk data shifted homebuyers’ searches, bids

Flood-risk data shifted homebuyers’ searches, bids

Climate change’s higher tides could threaten $34B of coastal real estate

Climate change’s higher tides could threaten $34B of coastal real estate