IMC Equity Group scored a $43.8 million construction loan for a multifamily and industrial project in West Little River, near its Northside Shopping Center.

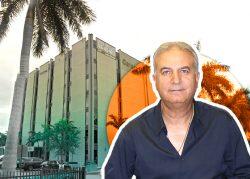

IMC, led by Yoram Izhak, plans a pair of six-story apartment buildings with 161 units, combined, and an adjacent four-story, roughly 123,000-square-foot self-storage facility at 2751 and 2795 Northwest 84th Street and 8400 Northwest 27th Avenue, according to company filings to Miami-Dade County and property records.

The project, called Northside Village, will have about 23,000 square feet of retail space, including restaurants, Carlos Segrera, IMC’s chief investment officer, told The Real Deal.

New York-based Popular Bank issued the construction loan, records show. The financing has a floating interest rate and a three-year term with extension options, according to Segrera.

Construction started in December and is expected to be completed by summer of next year.

The 5.2-acre development site, which is in an unincorporated area of Miami-Dade, consists of three lots. IMC bought two of the lots spanning 4.7 acres as part of its $18 million purchase in 2010 of Northside Shopping Center at 7900 Northwest 27th Avenue. In 2018, IMC added the last piece of the development site, paying $450,000 for a half-acre of land at 8400 Northwest 27th Avenue, according to records.

IMC’s construction loan comes as many other developers hit the brakes on South Florida projects because of expensive financing resulting from high interest rates. Skyrocketing property insurance premiums, as well as expensive labor and materials, have further increased costs.

IMC decided to go ahead with construction financing because it already has a low cost basis, Segrera said.

“When we bought this, it was peanuts,” he said, referring to the $18 million purchase price. “We paid for the mall, for half a million square feet, including the [developable] land.”

Northside Shopping Center is fully leased, according to Segrera. Tenants include Presidente Supermarket, Florida Highway Safety and Motor Vehicles, and dd’s Discounts.

Founded in 2000, North Miami-based IMC is a development, leasing and investment firm with a portfolio spanning over 10 million square feet of commercial and residential real estate, its website shows. Izhak is CEO.

In February, the firm bought the 306-unit Seascape Pointe rental townhouse complex at 1140 Southeast 24th Road in Homestead for $67 million.

IMC also joined other developers who purchased portions of the shuttered Johnson & Wales University campus in North Miami. The university, which offered culinary and other hospitality programs, closed its campus after completing the 2020-21 academic year, allowing students to continue at JWU’s Providence, Rhode Island, or Charlotte, North Carolina, schools.

IMC bought numerous vacant dormitories at the North Miami campus and a former university office building. It plans a multifamily project with up to 338 units on the site of the offices and an adjacent dorm at 12350 Biscayne Boulevard. IMC also is converting the dorms to multifamily at

1705 and 1735 Northeast 124th Street, 1740 and 1725 Northeast 125th Street, 1700 Northeast 133rd Street, and 13025 and 13035 Emerald Drive.

In October, IMC flipped a 3-acre portion of its JWU holdings to Jorge Pérez’s Related Group for $13.6 million.

Read more