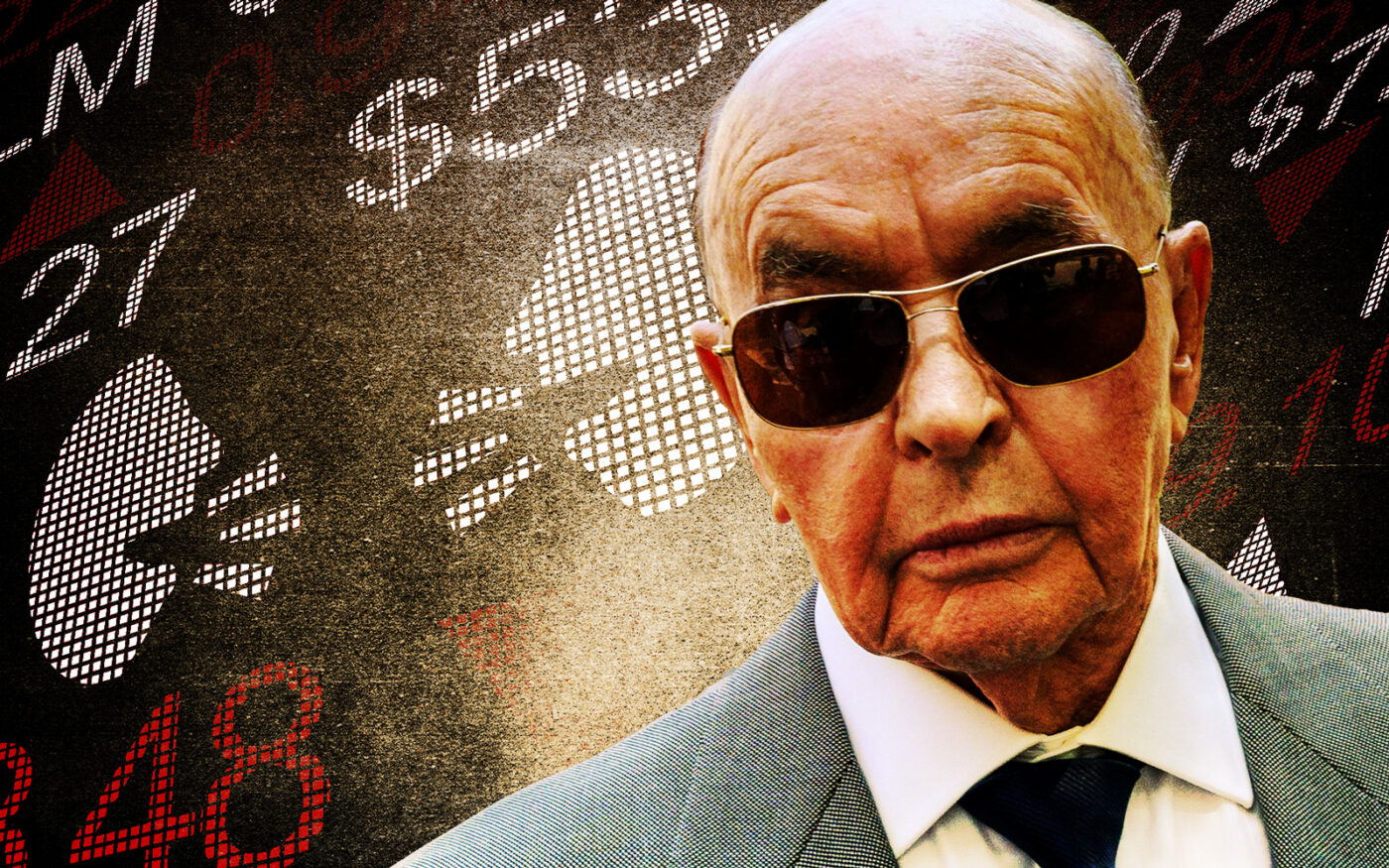

Tavistock Group founder and British billionaire developer Joe Lewis apologized to the judge and pleaded guilty to insider trading charges following his surrender this summer.

He pleaded guilty to two counts of securities fraud and one count of conspiracy to commit securities fraud at the Manhattan office of the U.S. Attorney on Wednesday, Reuters reported. He surrendered to the same office in July, at the time pleading not guilty to allegations that he perpetuated a scheme of securities fraud. According to federal prosecutors, Lewis’ fraud involved illegal tips about his companies to his private pilots, friends and romantic partners, allowing them to make millions of dollars.

“He used inside information as a way to compensate his employees or to shower gifts on his friends and lovers,” U.S. attorney Damian Williams said in a July press release. Lewis’ pilots, Patrick O-Connor and Bryan Waugh, are also charged in the case and have pleaded not guilty.

The 86-year-old Lewis faces federal charges for 16 counts of securities fraud and three counts of conspiracy, Reuters reported. Under the terms of his plea deal, he is only pleading guilty to three charges and will be allowed to appeal if U.S. District Judge Jessica Clarke sentences him to prison time. She may also consider the other charges in her sentencing.

“I am so embarrassed, and I apologize to the court for my conduct,” Lewis said to Judge Clarke, according to the outlet.

Lewis founded the Tavistock Group in 1975, and is now worth an estimated $6.2 billion, according to Forbes. His family trust owns the majority stake in London’s Tottenham Hotspurs football club, which is among the sport’s richest clubs, according to Deloitte’s 2024 Football Money League report.

His real estate endeavors in the U.S. include the planned Pier Sixty-Six in Fort Lauderdale and a contentious proposed development in the equestrian village of Wellington.

Pier Sixty-Six will include three condos totaling 92 units and three hotel buildings with a total of 325 keys. Sales launched for the project in 2022, and prices currently start at $3.9 million, according to the development’s website. Tavistock landed a $175 million construction loan for the project in April.

In Wellington, Lewis’ Tavistock is part of Nexus Luxury Collective, an investor group that includes Tiger Woods, Justin Timberlake, and founding eBay president, billionaire Jeffrey Skol. Developer Mark Bellissimo is partnering with Nexus on a joint venture dubbed Wellington Lifestyle Partners, which is seeking approval for a massive mixed-use development that involves an unprecedented 96-acre land transfer out of the village’s equestrian preserve.

The Wellington Village Council’s initial OK of the controversial project inspired a recall movement that is currently collecting signatures to remove the mayor and several council members. The council is set to vote again Thursday night on Lewis and Bellissimo’s vision for the global equestrian hub.

–– Kate Hinsche