It’s been a year of extreme highs and extreme lows in the proptech industry.

While startups offering catering to digital transactions surged, co-working and flex-office spaces struggled with a sharp drop in business, as Business Insider reports.

Several companies in the sector laid off large numbers of staff and sought financial lifelines in order to survive. Others shuttered office locations and wound down their operations.

“Breather, in its current form as an operator, doesn’t make sense, and, to be frank, I’m not sure it ever made sense,” CEO Bryan Murphy said in mid-December. His flex-office company recently announced plans to close 400 office locations and lay off most of its employees.

But some industry players see the pandemic as a turning point.

“I really think that at a macro level, what’s happening right now with COVID is going to serve with proptech the same way that the financial crisis did with fintech,” Clelia Warburg Peters, a venture partner at Bain Capital and president of Warburg Realty, told BI.

The dramatic shifts in how we live and work created a need for companies that make remote transactions easier. Last month, real estate attorney Peter Zinkovetsky launched InstaClosing, a startup that handles real estate closings virtually. Other companies catering to home sales, including Notarize — which offers virtual notarizations — have already enjoyed successes.

“Any company that is helping real-estate firms operate digitally and operate remotely are generally the massive winners over the past 10-plus months,” Jake Fingert of Camber Creek told BI.

Read more

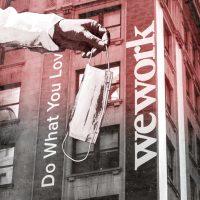

Those with stakes in the office market have had a more difficult run.

WeWork’s botched IPO efforts last year drew attention to the pitfalls of the master-lease model, which has again come under pressure in 2020 as many flex-office and co-working companies try to pivot to property management agreements.

Such pressures will persist as employers try to lure workers back to their offices — no easy feat without a widely available vaccine. But the agility of flex office space could help some companies save money while avoiding long-term commitments with commercial landlords.

“Flex office was a loser in the first part of this year, and no one would argue otherwise,” MetaProp’s Zach Aarons told BI. “They’re losers, but projected winners, those that can survive.” [Business Insider] — Sylvia Varnham O’Regan