The coronavirus pandemic colored many of the stories at The Real Deal in 2020, but our reporters’ picks for their favorite pieces of the year show that not everything was about Covid-19 in the real estate industry.

While some of these stories touch on the ways the pandemic changed real estate in the past 12 months — from creating more opportunities for landlords to pick up distressed properties, to putting pressure on Manhattan’s already shaky condo market — others are deep dives into little corners of the industry, including a profile of one of Los Angeles’ most famous agents and a history of New York City’s most profitable condo.

Here’s a look at some of the most compelling TRD stories of the year, curated by the reporters themselves:

Matthew Blake, Los Angeles reporter

Illustration by Nazario Graziano

“Sizing up Manhattan’s condo crunch following a decade of boom and bust”: It’s hard to make a story based on an overall empirical view of a submarket entertaining and engaging, but I thought Sylvia Varnham O’Regan’s story did it with crisp writing and vignettes about individual developers. When I think of Manhattan I partly think of luxury condos, and I felt like this story authoritatively gave me a view of what’s happening with the new, sleek high-rises that dot the city.

Jonathan Litt of Land & Buildings (Getty Images/iStock)

Kathryn Brenzel, senior reporter

“The Littmus test: Veteran activist investor on his office shorting strategy“: Where there’s unrest over a REIT’s leadership, there’s usually Jonthan Litt. E.B. Solomont digs into the strategy and mindset of the activist investor and how that is shaping his investments during the pandemic. This story offers a rare opportunity to learn more about Litt and the companies he has targeted, underscoring that he both enjoys a relatively low profile while also being near-omnipresent in the REIT world. When he isn’t orchestrating outlandish stunts, he’s quietly sitting through dozens of earnings calls in his office. One constant is that he is a thorn in the side of many REIT executives.

Having learned from missed opportunities a decade ago, family offices are strategically looking for distress opportunities in real estate (iStock)

Erin Hudson, reporter

“Family offices are gearing up to pounce on distressed real estate”: I really enjoyed Akiko Matsuda’s article on how family offices are gearing up to invest in distressed real estate. The activities and strategies of these funds are private and loosely regulated, so any glimpse behind the curtain is both interesting and informative. There was also a fascinating tidbit in the article noting how most family wealth is lost within a few generations. Well worth a read to see how some of these investors are viewing the pandemic.

David Swerdloff and his father (left) with 124 7th Avenue (Photos via David Swerdloff; Google Maps)

Orion Jones, data journalist

“Inside the plight of a small retail landlord”: This is a great role-reversal story. If you think being a landlord means living on Easy Street, consider David Swerdloff, 75, who sold kitchen and bathroom appliances from the same single-story building as his father in Chelsea. After Swerdloff retired in 2006, the chain eatery Le Pain Quotidien leased the space. When the pandemic hit, “lawmakers went to great lengths to protect small business owners from big landlords, but made no effort to protect small landlords from big tenants,” TRD’s Sasha Jones writes. Le Pain entered Chapter 11 bankruptcy in May; Swerdloff is one of 10 million small-time U.S. landlords.

Ziel Feldman (right), Nir Meir and the XI (Illustration by Zach Meyer)

Sasha Jones, reporter

“How HFZ became the face of Manhattan’s condo woes”: This story has two elements that make me proud to work at TRD: in-depth reporting and vivid storytelling. After months of breaking stories surrounding HFZ Capital Group, Rich Bockmann, Sylvia Varnham O’Regan and Keith Larsen piece together the full picture here. Beyond HFZ, this story is a look into what it means to take big risks in the real estate world and potentially lose it all. If that doesn’t entice you, the fast paced action-thriller-esque lede of the story alone will: “What’s the latest?” read the text that popped up on Nir Meir’s phone one Thursday afternoon in July. “Running out of time.”

Irving Langer, one of the city’s largest apartment landlords, is scrambling to refinance his 3K-unit empire. (Credit: Langer by Rob Kim/Getty Images for Gulliver’s Gate; Rivitography via Autogespot)

Georgia Kromrei, reporter

“Multifamily giant Irving Langer racing to refi 3K-unit portfolio”: Irving Langer is in denial. One of NYC’s larger multifamily landlords, Langer cruises around in his Mercedes with “YOLO 120” license plates — when he’s in the city, which is not often, these days. Mostly, he’s living it up in South Florida with two chic condos. Back in NYC, his multifamily loans are in default, Kushner Companies is suing him for breach of lease at a Times Square tourist trap, and he’s unwilling to accept that New York City multifamily values have plummeted. Rich Bockmann’s story gave us a window into the disbelief shared by many post-June 2019.

Kurt Rappaport (Photo by Jeff Newton)

Keith Larsen, reporter

“The life and times of Kurt Rappaport, California’s alpha agent”: Matthew Blake’s captivating profile of the star real estate agent immediately had me hooked. From reading the story, you find out what it takes to be successful in Los Angeles’ celebrity real estate business. In the case of Rappaport, it’s a crazed obsession with doing whatever it takes to get a deal done — for the agent, it appears almost nothing else matters. Matt does a beautiful job of taking us inside Rapport’s mind through clever writing and pointed observations.

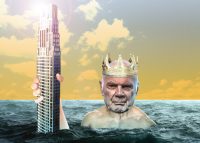

Steven Roth and 220 Central Park South, which has effectively created its own tier of the luxury market.

Kevin Sun, data journalist

“The inside story of 220 Central Park South, the world’s most profitable condo”: The story of 220 Central Park South, the most profitable condo development ever, is in many ways a microcosm of New York City real estate over the past decade and a half, touching on issues ranging from tenant buyouts and zoning disputes to foreign lenders and debates over inequality in the city.

This story by E.B. Solomont and Hiten Samtani makes great use of archival reporting to present a rich cast of characters, including not only some of NYC’s biggest developers but also less well-known figures with equally fascinating back stories. As a source concludes: “We just lived through an era: Make no mistake — these aren’t happening anytime soon.”

Ryan Serhant

Sylvia Varnham O’Regan, reporter

“The brand dilemma: What Ryan Serhant’s new venture says about the future of brokerage”: As a dedicated real estate reporter, I have of course watched all the shows: “Million Dollar Listing,” “Selling Sunset,” an experimental grab bag of apartment tours on YouTube. So when Erin Hudson came out with this story about how brokerages navigate the line between lifting up star brokers without growing too dependent on them, I was all in.

Part feature, part analysis, part insidery window into a fascinating world, this piece sets Ryan Serhant’s stunning departure from Nest Seekers in the context of wider industry shifts, cleverly unpacking the tension between old and new media, brokers and their firms, discretion and visibility. This one is a must read!