Climate change risk isn’t tamping down on the flow of Americans moving to some of the most endangered states, but it is helping send home insurance premiums through the roof.

Homeowners are flocking to the likes of Florida and Texas, despite the growing threat of climate-related weather disasters, according to data from LexisNexis Risk Solutions reported by the New York Times.

Property insurance costs are rising across the country, with premiums up an average of 21 percent since 2015. Those bumps are significantly higher in states that carry more climate risk, however, including Florida (57 percent) and Texas (40 percent).

But that hasn’t slowed down cost-conscious buyers from flocking to those states, which led the nation in population growth last year, fueled by the lack of state income taxes and warmer weather.

It’s that same weather that could cause some unpleasant home insurance bills in the Sun Belt region, which has both the largest climate risk in the nation and some of the biggest population bursts in recent years.

States experiencing population losses last year have felt much more moderate increases in home insurance premiums. No state lost more residents last year than New York, where home insurance payments have only risen by 17 percent since 2015.

Read more

The growing premiums could compound issues for homeowners later on. Two out of every three homes in the country is underinsured. Some homeowners are choosing to forego home insurance that would protect them when a natural disaster hits, though most mortgage lenders require home insurance.

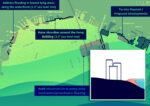

Moreover, flood coverage is separate and not as widely required. The rising tide of severe weather in Sun Belt states — images of streets flooded for days after a hurricane come to mind — make those policies more vital than ever in those states.

— Holden Walter-Warner