Cantor Fitzgerald is one of the biggest backers of smart glass startup View, but it doesn’t appear to see a bright future for the company.

The financial services firm is having discussions with View’s senior lenders and investors about restructuring the startup’s debt or having the startup sell certain assets, according to a filing with the Securities and Exchange Commission reported by Bisnow.

Cantor Fitzgerald was involved in a merger that helped the startup go public via a SPAC in December 2020. At the time, View was valued at $1.6 billion. The SoftBank-backed smart glass manufacturer has since fallen on hard times, prompting concerns the company wouldn’t have enough money to make it through last fall.

The filing suggests lenders are not happy and are looking to get paid, a specialist in mergers, acquisitions and special-purpose acquisition companies at Husch Blackwell told Bisnow.

View holds $227.6 million in debt and has only $65.3 million in cash available. In the past 12 months, the startup lost $426.4 million, only taking in $128.8 million of revenue.

The company has been subject to a myriad of problems, charged by the SEC after its chief financial officer allegedly misstated the cost of replacing faulty windows and forced to pay a $5 million fine for unlawfully discharging wastewater in Mississippi.

Early last year, View laid off close to 170 employees, or approximately 23 percent of its workforce. It was nearly delisted from the Nasdaq Stock Market after being required to audit previous financial reports due to accounting errors.

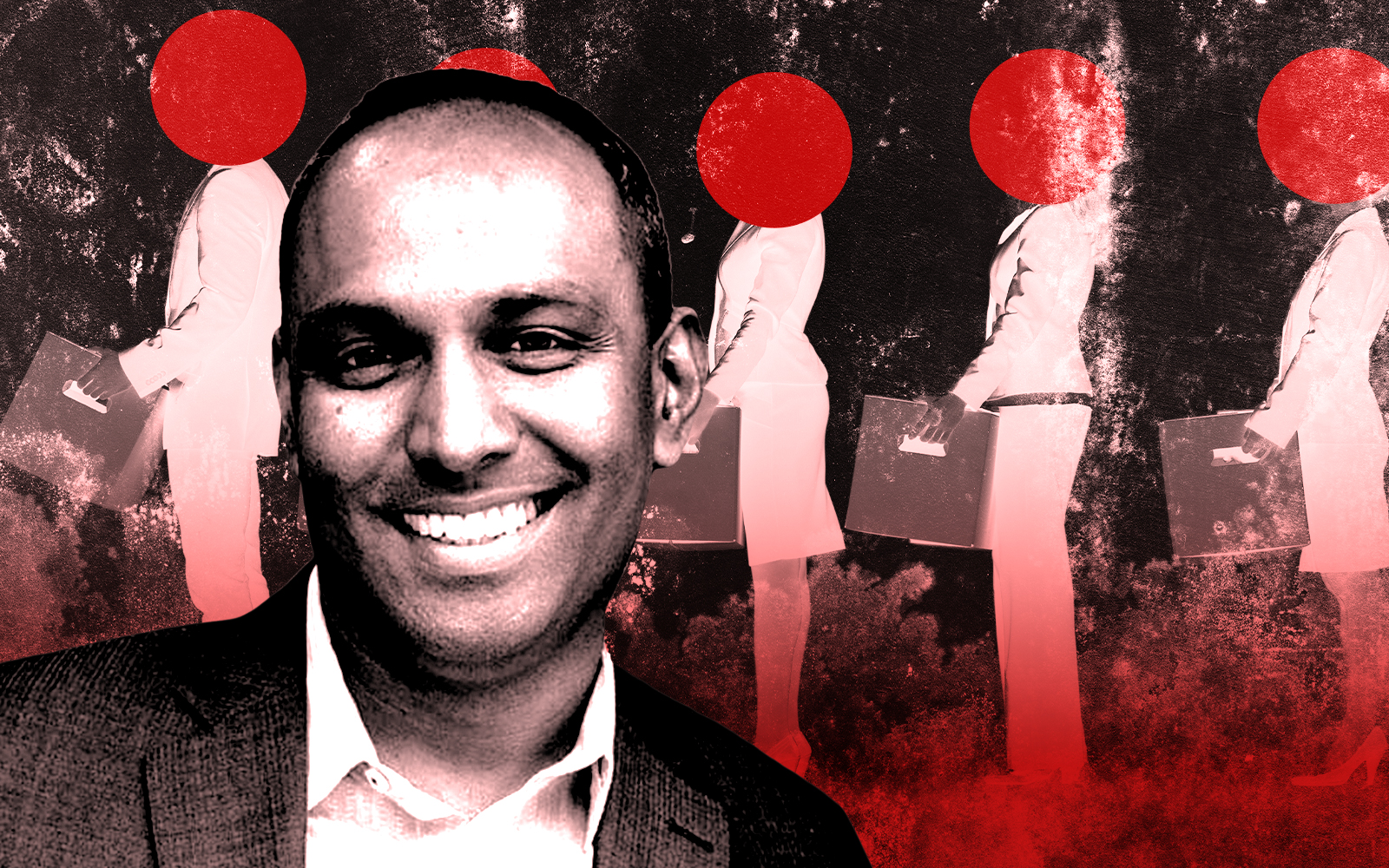

Cantor Fitzgerald owns more than 24 percent of View stock, including some owned personally by chief executive officer Howard Lutnick. Cantor Fitzgerald and View didn’t respond to requests for comment from Bisnow. View also didn’t respond to a request for comment from The Real Deal.

View’s stock has fallen 86.6 percent since the startup went public three years ago. The stock fell 4 percent in the first 10 minutes of trading on Wednesday, collapsing to $1.16 per share as of 9:45 p.m. ET.

The “dynamic” glass manufacturer was founded in 2007, focused on creating windows that could reduce heat and glare and adjust in response to light. In November 2018, SoftBank invested $1.1 billion.

— Holden Walter-Warner

Read more