The city’s condo developers have finally begun to gut the glut.

The number of new condominiums approved for sale in New York City during 2016 was 21 percent lower than in 2015, according to an analysis of accepted offering plans by The Real Deal. And all signs point to it dropping even further in 2017.

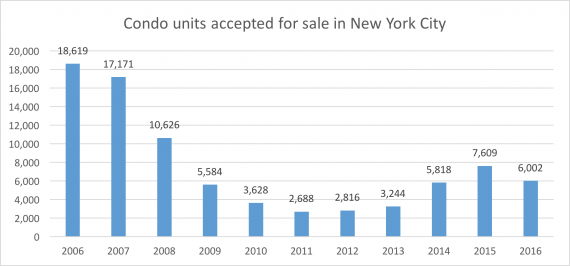

According to TRD’s analysis, the New York State Attorney General’s Office accepted 6,002 new condo units for sale last year, down from 7,609 in 2015. While last year’s figures are higher than in any year from 2008 to 2014, it signals a shift from five straight years of increases in new product. Supply appears to have plateaued due to factors such as a softening luxury market, concerns of oversupply on the high end, and a tighter financing market for new projects. By the end of the year, the total dollar volume of 2016’s accepted offering plans ($13.72 billion) amounted to just half of the 2015’s dollar volume ($27.57 billion), TRD’s analysis shows.

A couple of condo projects accepted in 2016 have already been scrapped. CL Investment’s 40-unit plan for 287 Park Avenue South in Manhattan and a 391-unit plan from Property Markets Group’s and the Hakim Organization’s former development site at 21-10 Queens Plaza South in Long Island City, will not go forward as condos.

In 2016, developers submitted plans for a total of 5,087 units, down 43 percent year-over-year from 8,979 units in 2015. That’s another sign total units accepted will be down in 2017, as many of the plans that will be greenlit this year were filed last year.

Although citywide figures shifted downwards for the year, outer-borough condo supply is trending up. For the first year since 2011, over half (57 percent) condos approved for sale are planned for outside of Manhattan, overwhelmingly in Brooklyn and Queens. Major outer-borough plans last year included Kushner Companies [TRDataCustom], LIVWRK and Rockpoint Group’s 338-unit Austin Nichols condo conversion in Williamsburg and Grand Three, a 280-unit tower at Onex Real Estate Partners’ multi-building Sky View Parc development in Flushing.

| Share of New Condo Units in the Outer Boroughs | |

|---|---|

| Year | Share |

| 2016 | 57% |

| 2015 | 40% |

| 2014 | 42% |

| 2013 | 33% |

| 2012 | 48% |

| 2011 | 66% |

| 2010 | 77% |

| 2009 | 71% |

| 2008 | 65% |

| 2007 | 50% |

| 2006 | 43% |

| Source: TRD analysis of NYS AG data | |

Some lawmakers have recently pushed for tax exemptions that would facilitate even more outer-borough condo production. State Senators Simcha Felder and Marty Golden, both from Brooklyn, are seeking to include larger outer-borough condo projects in the eligibility guidelines for a renewed 421a tax exemption (the most recent proposal caps eligible condo buildings at just 35 units).

Brooklyn condo approvals have increased each of the last three years. In 2016, 2,137 condos were greenlit for the borough, or 36 percent of the citywide total. Williamsburg saw more units approved than any other Brooklyn or Manhattan neighborhood.

But Brooklyn’s growth isn’t enough to balance out the overall downward trend. The total dollar volume of condo projects citywide is dropping alongside the unit count, as TRD reported in September. Through August of 2016, the total sellout price of new projects for the year was $5.7 billion behind the same period in 2015.