Bankruptcy expert Greg Corbin launches new firm as CRE distress rises

Bankruptcy expert Greg Corbin launches new firm as CRE distress rises

3 Gowanus projects hooked $500 million in debt last month

City’s 10 biggest ventures brought in $1 billion in loans

Lenders smiled on Brooklyn and Queens last month as the two boroughs topped Manhattan on May’s list of the city’s largest real estate loans.

The 10 biggest financing deals totaled $1 billion, about half of which went to three projects in Gowanus, where developers are taking advantage of a neighborhood rezoning to build desperately needed housing.

The funding is only about half of the top-10 total of May 2022, when the Federal Reserve began its most aggressive push to raise interest rates since the 1980s.

Here are the details of last month’s biggest real estate loans in New York City.

Carlyle’s canal play | $202M | Gowanus

On an apparent quest to become Brooklyn’s biggest landlord, the Carlyle Group received $202 million from Apollo Global Management’s lending arm, Apollo Insurance Solutions, to buy and build at 267 Bond Street and 498 Sackett Street in Gowanus.

The private equity giant will construct two mixed-use towers on the site with a combined 517 apartments, a quarter of which will be income-restricted. The loan replaces about $30 million in debt from Maxim Credit Group. Construction began after the site’s prior owner, Kevin Maloney’s Property Markets Group, exercised a purchase option for the land in 2021, paying $9 million for both addresses. PMG remains a partner in the project.

Builder Brodsky | $155M | Gowanus

The Brodsky Organization secured $155 million from Buffalo-based M&T Bank to buy a site near the Gowanus Canal and build a 350-unit mixed-use development centered on the popular Royal Palms Shuffleboard Club.

The target completion date is spring of 2025, a year before the construction deadline to qualify for the 421a property tax break. The project, at 499 President Street, will sit due west of 300 Nevins Street, a 654-unit project by Charney Companies on the bank of the canal.

Maddd Joy | $113M | Downtown Brooklyn

Jorge Madruga’s Maddd Equities and Eli Weiss’ Joy Construction secured $143 million from Valley National Bank, including $113 million in construction financing, to raise a large mixed-use building at 202 Tillary Street. The structure will have 465 apartments and span 436,600 square feet. The developers bought the land in 2018 for $30 million.

One down | $112M | Long Island City

Fetner Properties and the Lions Group closed on $112 million in mortgage loans, records show, from Brookfield Asset Management, including $76 million in new debt to build a 49-story residential tower at 26-32 Jackson Avenue in Hunters Point. The tower’s 363 units will average 770 square feet, with 30 percent of units income-restricted. Debt and equity for the project come to $350 million, according to reports. The Carlyle Group recently bought a stake in the project.

Plans for a neighboring building with 164 apartments at 27-01 Jackson Avenue have been approved but funding has yet to be recorded.

Going up | $110M | Gowanus

Gindi Capital and Avery Hall Investments closed on $110 million from Affinius Capital, a partnership between USAA Real Estate and Square Mile Capital Management, to build a 13-story, mixed-use building with 193 apartments at v, according to reports.

The loan includes $69 million in senior construction debt and refinances a $11 million loan held by the Israel Discount Bank of New York, records show.

Condo controversy | $99M | Upper East Side

Isaac Tshuva’s Elad Group closed on $99 million in construction loans from Valley National Bank for a new condo at the corner of Third Avenue and East 74th Street. The 33-story building will have 47 units across nearly 140,000 square feet at 1299 Third Avenue.

Neighborhood activists had opposed the development but to no avail. Valley National took over lending at the property when Elad bought the site last year for $61 million.

Conversion time | $89M | Tribeca

G4 Capital Partners became the senior lender on Don Peebles and Elad Group’s condo conversion at the landmarked Clock Tower Building in Tribeca with an $89 million inventory loan. It is secured by 45 unsold apartments at the 167-unit project, including a penthouse listed at $24.5 million. The Beaux-Arts conversion has attracted a host of celebrity buyers including Keith Urban and Nicole Kidman.

Other lenders on the project have included Goldman Sachs (acquisition), Bank of America (construction), Mack Real Estate and JP Morgan (inventory). Of the $638 million in sellable units, 64 percent have been sold, leaving $242 million without buyers, according to Marketproof. Peebles and Elad bought the former New York Criminal Court building in 2013.

Forced office sale | $71M | Midtown

Deutsche Pfandbriefbank, a German commercial real estate investment bank, lent $71 million to Cyrus and Darius Sakhai’s Sovereign Partners to buy the Tower56 office building in the Plaza District.

The Sakhai brothers’ firm bought the 1980s-era building at 126 East 56th Street in Midtown from Pearlmark Real Estate, which failed to refinance its mortgage on the property, for $113 million including tax. In 2018, Blackstone lent Pearlmark $125 million to refinance the 170,000-square-foot tower, which was about 80 percent occupied with an average of three years left on the remaining leases as of February.

Dorm deal | $65M | Nolita

Forkosh Development Group refinanced an NYU dormitory building at 400 Broome Street with $65 million from Webster Bank, including $15 million in new debt. Debt on the building was previously in commercial mortgage-backed securities issued in 2013 by Citigroup Global Markets Realty.

Goldman + Gucci | $60M | Meatpacking

Goldman Sachs took over lending at 400 West 14th Street, a 24,000-square-foot office building owned by the Rockfeld Group, with a $60 million loan that includes $11 million in new debt. Granite Point Mortgage Trust, a publicly traded REIT, previously held the debt. Gucci opened a 10,000-square-foot shop in the Meatpacking District building last year.

Read more

Bankruptcy expert Greg Corbin launches new firm as CRE distress rises

Bankruptcy expert Greg Corbin launches new firm as CRE distress rises

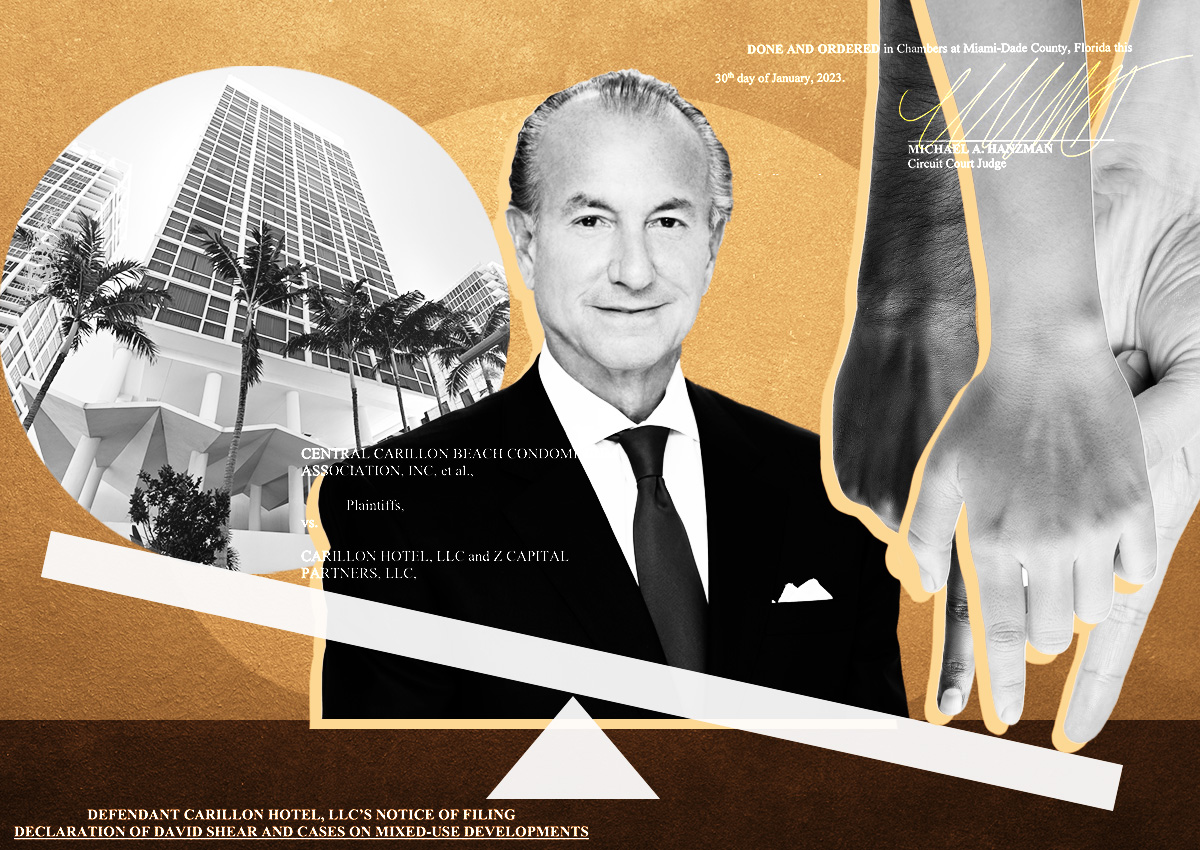

It’s a condo. No, it’s a hotel. Inside the condo-hotel conundrum

It’s a condo. No, it’s a hotel. Inside the condo-hotel conundrum

Debt problems surface at crop of Brookfield malls

Debt problems surface at crop of Brookfield malls