Trending

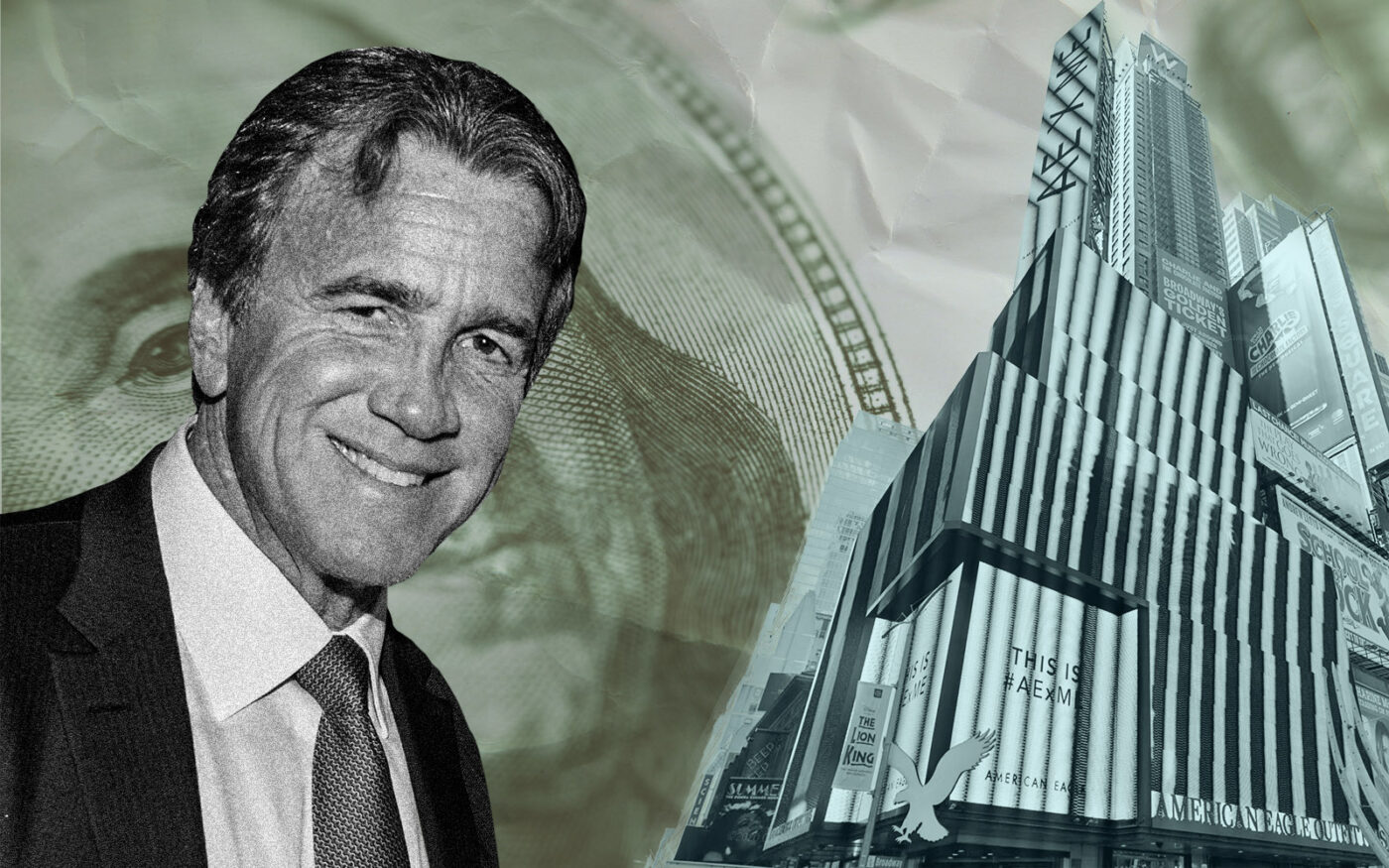

Jeff Sutton snags extension on 1551 Broadway’s $180M loan

Debt backed by Times Square building was sent to special servicing in 2021

An entity tied to Jeff Sutton secured an extension on a $180 million loan for a marquee Midtown retail property, more than two years after the loan was sent to special servicing.

The entity, 1551 Broadway Owner LLC, secured an extension of its CMBS loan backed by the property at 1551 Broadway, the site of American Eagle’s 26,000-square-foot flagship store in Times Square. The extension gives Sutton another two years past the maturity date of 2024.

Citigroup originated the $180 million financing in June 2011 and packaged it into a commercial mortgage-backed security.

The loan matured in July 2021 and Sutton went into forbearance as he tried to refinance the loan and mezzanine debt, according to Trepp, which tracks securitized mortgages. Sutton defaulted on the loan four months later and it went into special servicing.

In 2022, Deutsche Bank filed a foreclosure action on behalf of the CMBS bond holders, alleging that the Sutton entity defaulted on the loan. A source said at the time that Sutton was working things out with a special servicer despite the foreclosure suit.

Sutton bought 1551 and 1555 Broadway in a 50-50 joint venture with SL Green, for a total of $82.5 million in 2005. The pair demolished the buildings and built new retail that opened in 2009; Sutton eventually bought out SL Green’s stake in 1551 Broadway.

Things seem to be improving at the retail property, which has a net operating income of almost $22 million, according to Trepp. The loan was performing as of last month but remains in special servicing, Trepp data show. The current balance is about $154 million.

A Newmark team of Anthony Orso, Clifford Welden and Henry Stimler negotiated the loan extension. Sutton and special servicer LNR Partners could not immediately be reached for comment.

Read more