A Greenwich Village office building tied to controversies involving WeWork in 2019 and now Arch Companies is ticketed for foreclosure.

A bankruptcy judge ruled last week that 88 University Place’s lender, a fund managed by CIM Group, may proceed with foreclosure actions, after finding that an automatic stay prompted by a related bankruptcy filing would not apply to the property.

CIM claimed in court filings that the mortgage and mezzanine loans on the property had been in default since July 2023. In May, CIM, given the chaos at building owner Arch Companies, sought the judge’s ruling “in an abundance of caution.”

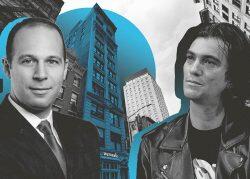

Abundant caution may be warranted. In late 2023, Arch’s then-managing partner Jeffrey Simpson was barred from the firm he co-founded following a dispute pitting him against partner Jared Chassen and the firm’s main investor, 35 Oak Holdings.

In March, Simpson put JJ Arch LLC, which once had a controlling stake in Arch Companies and which controls additional real estate owned by Simpson and Chassen, into bankruptcy.

Last week, bankruptcy judge John P. Mastando III ruled that 88 University was not part of that LLC’s estate, meaning the automatic stay did not apply to the Greenwich office building.

Former WeWork CEO Adam Neumann and fashion designer Elie Tahari purchased 88 University in 2015 for $70 million. IBM moved into the 11-story building in 2017, filling more than three-quarters of its 90,000 square feet and subletting all of WeWork’s space.

The arrangement came under scrutiny in 2019, as WeWork prepared for an initial public offering. Critics called Neumann’s practice of having WeWork lease four buildings that he partially owned self-interested dealmaking, and publicity of these related-party transactions helped sink the IPO.

IBM fled during the pandemic, leaving the building largely empty. By 2022, the building was still only half-full.

That year, Arch secured a $70.5 million refinancing to renovate the building, backed by CIM Group. The upgrades, including a rooftop terrace and gym, were intended to create a boutique, high-end office experience that would entice workers back to their desks.

Neumann is now a passive, minority investor in the building. A source familiar with the arrangement said Neumann is up to date on his pro-rata share to the lender, meaning Neumann himself isn’t delinquent on his obligations to CIM. Neumann, who now runs a multifamily firm called Flow, leases space on two floors in the building, said the source.

As of September, other owners included Tahari Capital — the investment fund associated with the Tahari fashion label — and majority owner Arch Companies. Arch has been managed by 35 Oak since late last year as litigation between the co-founders plays out.

The building’s majority owner could yet put the ownership entity into bankruptcy to halt the foreclosure, a common practice. Representatives from 35 Oak and CIM could not be immediately reached for comment.

This article has been updated with additional details about WeWork’s leasing of buildings owned in part by its then-CEO, Adam Neumann.

Read more