FivePoint taps Irvine Company veteran as CEO

FivePoint taps Irvine Company veteran as CEO

Trending

FivePoint slashes workforce, posts $37M loss

Developer of Candlestick, Hunters Point expects to pay out $19.4 million for executive management restructuring

FivePoint Holdings announced a wave of layoffs earlier this year. Now the Southern California developer with big Bay Area projects reports it has cut nearly one in three workers, according to regulatory filings.

The Irvine-based company has laid off 29 percent of its workforce since January, both to trim costs and optimize day-to-day operations, executives said during an earnings call, the San Francisco Business Times reported.

The company, which had recently purged its C-suite, vowed this spring to “do more with less.” At the end of last year, it had 160 workers, according to its SEC filing. This year’s cuts would leave it with 114.

The layoffs took place largely at the end of the first quarter, interim Chief Financial Officer Leo Kij said during the earnings call, for which it paid out $900,000 in severance benefits.

The publicly traded firm posted a net loss of $36.8 million in the quarter. It expects to see a reduction of $9 million a year to its payroll costs as a result of the layoffs, he said.

The Orange County company has an extensive pipeline of projects across California.

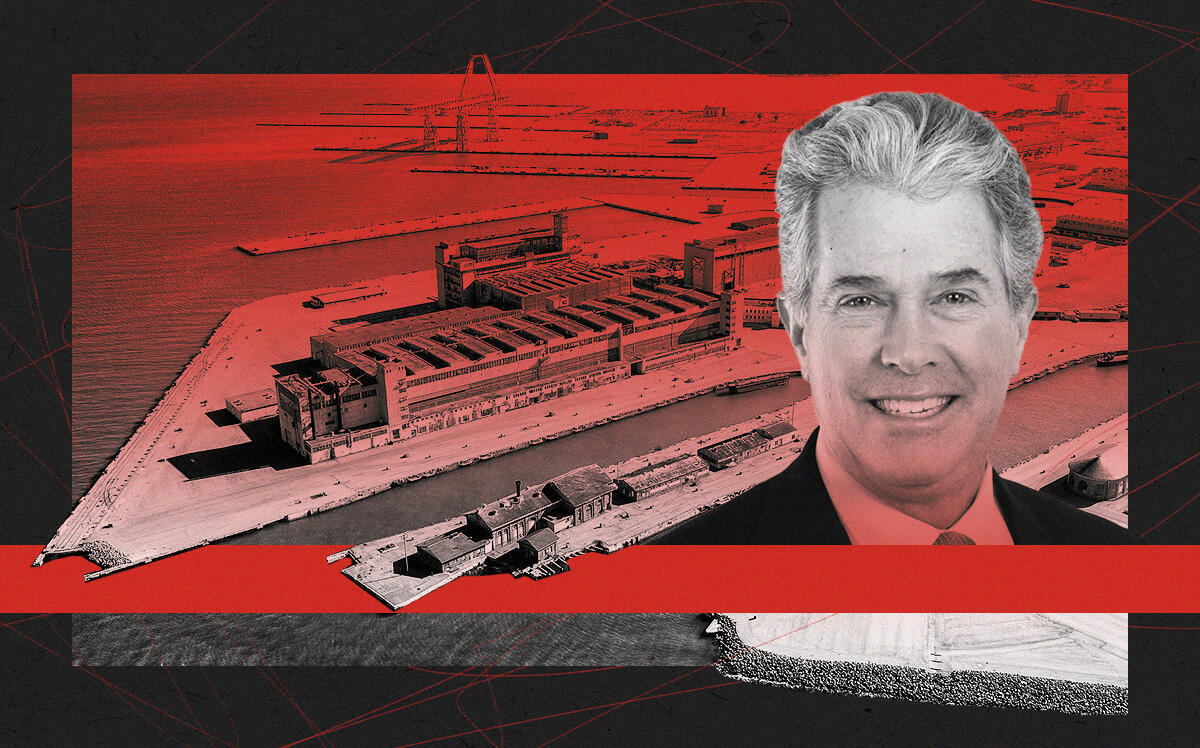

In the Bay Area, FivePoints is redeveloping San Francisco’s Hunters Point Shipyard, a former Navy shipyard, and it’s remaking nearby Candlestick Point, which once housed Candlestick Park.

In Southern California, it aims to build 10,000 homes in the Great Park Neighborhoods in Irvine and 21,000 homes in FivePoint Valencia in Santa Clarita, north of Los Angeles.

The retrenchment has cost FivePoints millions of dollars in severance and management restructuring payments. It didn’t close any land sales during the quarter.

FivePoint reported $16.8 million in selling, general and administrative expenses. And it incurred another $19.4 million in costs related to executive management restructuring, according to the Business Times.

The company expects to pay out a combined $15.5 million in future retainer payments to former President and CEO Emile Haddad and former President and Chief Operating Officer Lynn Jochim, it said.

Haddad stepped aside from day-to-day operations to become chairman emeritus in August 2021. Jochim, who was appointed the company’s dual president and COO in the wake of Haddad’s transition, stepped back from those two titles early this year, also to serve in an advisory capacity.

The company named Dan Hedigan its new CEO in February.

Kij, who was brought on as the developer’s interim CFO after the resignation of predecessor Erik Higgins in January, said the company’s San Francisco projects suffered a combined $700,000 loss for the first quarter.

At Hunters Point Shipyard, FivePoint plans to build 3,500 homes, 4.2 million square feet of commercial space and 656,000 square feet of retail and entertainment space. The project was halted in 2018 on concerns about the environmental cleanup of the 500-acre site.

Last month, a federal judge approved a $6.3 million settlement between homeowners and developers, including FivePoint.

At Candlestick Point, FivePoints plans to build 7,128 homes, a 130,000-square-foot, 220-room hotel, 750,000 square feet of research and development and office space; and 300,000 square feet of lifestyle retail space. Plans were approved in 2019, but the firm hasn’t broken ground at the 272-acre site.

[San Francisco Business Times] – Dana Bartholomew

Read more

FivePoint taps Irvine Company veteran as CEO

FivePoint taps Irvine Company veteran as CEO

CEO of FivePoint, among Cali’s largest homebuilders, stepping down

CEO of FivePoint, among Cali’s largest homebuilders, stepping down