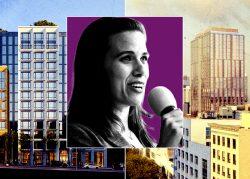

Carmel Partners’ plans for a 218-unit “group housing” development in San Francisco’s SoMa district were approved by the city’s Planning Commission, despite neighbors’ concerns about shadows and “safety and health hazards.”

It now moves to the Board of Supervisors, which has previously turned down group housing projects due to fears they would become “tech dorms.”

The plans approved in a 4-1 Planning Commission vote late last week include additional onsite affordable housing units so that the San Francisco-based multifamily developer can take advantage of a 50% state density bonus. With that, Carmel can demolish an existing 36-foot-high warehouse and build a 75-foot-high 125,000-square-foot building on the site, which was purchased by an LLC tied to a former Mercedes-Benz dealership nearby for $3.5 million for 2013.

Over 100,000 square feet are planned for the 35 affordable and 183 market-rate rentals, as well as shared spaces for everything from coworking to entertaining. There will also be a basement garage for about 20 cars and 200 bikes, and a few small ground-floor retail spaces.

The location is also just blocks from Zynga, Adobe and Patreon offices in the Showplace Square neighborhood.

Pasquali said the under- 400-square-foot units would be attractive to more than just young techies and would even make sense for older workers saving for retirement. In Seattle, where about 6,000 group housing units have been built in the last decade, he said, such units have appealed to a wide range of ages and are 20%-30% less expensive than studios in the same neighborhood.

In San Francisco, supervisors unanimously shot down a group housing project approved by the Planning Commission in the Tenderloin due to fears it would become a “tech dorm” and not the family housing neighborhood groups had requested. That decision is now the subject of lawsuits from SF YIMBY and the project’s developers Forge Development Partners.

The Bryant Street development was endorsed by SF YIMBY, the SF Housing Action Coalition and the Greenbelt Alliance, which worked together to solicit 120 letters of support in advance of the vote. That’s 10 times more than the number of opposition letters, which all came from neighbors on Langton who had “understandable objections to height and shadows,” according to Claire Feeney at the city planning department.

Feeney also said the project’s initial application last year means that it is not subject to legislation passed by the Board of Supervisors in March 2022 that prohibits individual cooking units in most new group housing and requires that more space be set aside for common amenities. That means the approved units may be among the last group housing rentals to have a kitchenette with a small sink, “dorm-size” refrigerator and combination microwave/convection ovens. Each unit will also have a washer-dryer and private bath and some will have private patios. Common open spaces include a 6,200-square-foot roof deck and 1,000 square feet of basement patio space.

Pasquali said in the meeting that neighbors’ opposition to the group housing elements and height of the project had been clear since planning began last year. They wanted a three-story condo development, he said, not seven stories of “workforce-targeted” rentals. Designers at BAR Architects pulled the building back slightly from the property line to allow for more green elements and a wider sidewalk and repositioned a mechanical tower on the roof, but Carmel could not feasibly move ahead with a shorter building, he said.

““I understand it’s not much but economically this project does not work if it’s less than seven stories tall,” he said.

Across the city, housing applications were down to record lows this spring, according to Planning Department figures, and even developers with entitled plans have been stalled by higher building and labor costs amid softer sales and still recovering rents.

Read more