It’s unofficial. SKS Real Estate Partners will pay up to $67.5 million to buy the office tower at 350 California Street in a fire sale that could reset office prices across San Francisco.

The San Francisco-based firm teamed up with a South Korean investor to pay between $200 and $225 per square foot for the 297,600-square-foot building in the Financial District, the San Francisco Business Times reported, citing unidentified sources.

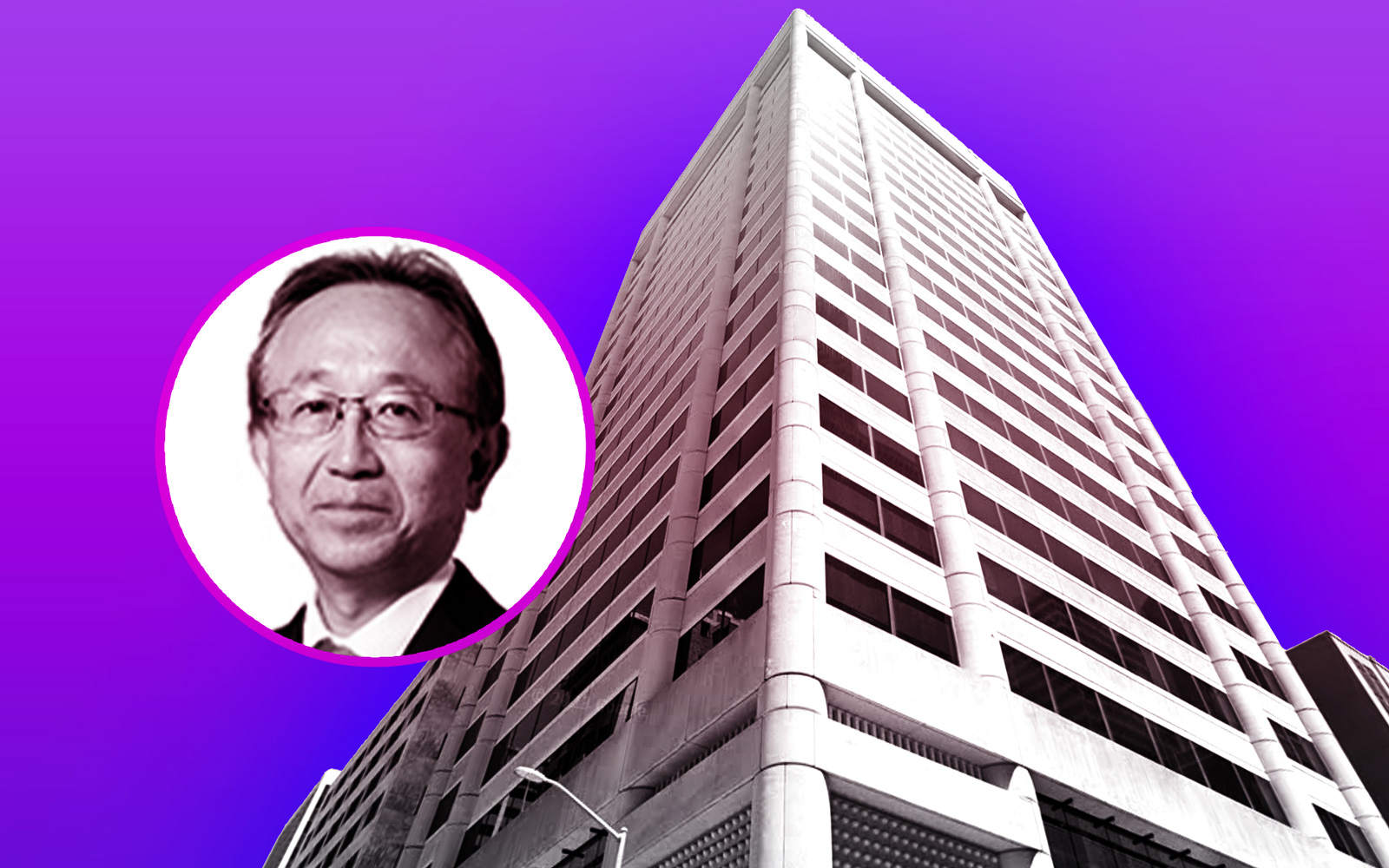

The seller of the 22-story glass-and-stone tower was Mitsubishi UFJ Financial Group, based in Tokyo.

The deal comes out to $60 million to $67.5 million — or around 75 percent below the $250 million sought when the building hit the market in 2020.

Before the pandemic, California Street was home to some of the world’s most valuable commercial real estate. Now, in the era of remote work, the city’s office vacancy has jumped to a record 32.7 percent, compared to 4 percent before the contagion.

Some of the city’s most noted corporate tenants, from Salesforce to Meta Platforms, have sublet offices, flooding the market with square footage.

The plunge in office workers has slammed the Financial District, leading restaurants, stores and other small businesses to lay off employees or close up shop.

The sale of 350 California may establish a new office benchmark.

The tower, built in 1976, is now 75 percent vacant because the primary tenant, Union Bank, has mostly moved out.

Union Bank, previously owned by Mitsubishi UFJ, once occupied the entire building. Mitsubishi UFJ sold Union Bank to U.S. Bancorp in December.

Brokers Kyle Kovac and Mike Taquino of CBRE represented the seller in the building sale.

Commercial real estate experts say it could be the bottom of the city’s office market. SKS has a history of buying properties in distress, then investing in them.

“It’s a potential boost of confidence for other market participants who have been waiting on the sidelines. This market is going to provide more opportunity than anyone has seen in 40-plus years,” Derek Daniels, research director for Colliers International in San Francisco, told the Business Times.

“If it is SKS, this is an even more positive sign for San Francisco considering a local, established owner is choosing to recommit to San Francisco.”

— Dana Bartholomew

Read more