Swift Real Estate Partners has defaulted on a $62.3 million loan tied to an 111-year-old office building in San Francisco’s South of Market.

The San Francisco-based investor has fallen behind on its loan tied to the eight-story building at 55 New Montgomery Street, the San Francisco Business Times reported.

The lender, Boston-based CrossHarbor Capital Partners, recorded a notice of default on the property late last week.

Swift, which has purchased distressed properties and fixed them up, bought the 100,200-square foot building in 2018 for $64.25 million, or $641 per square foot.

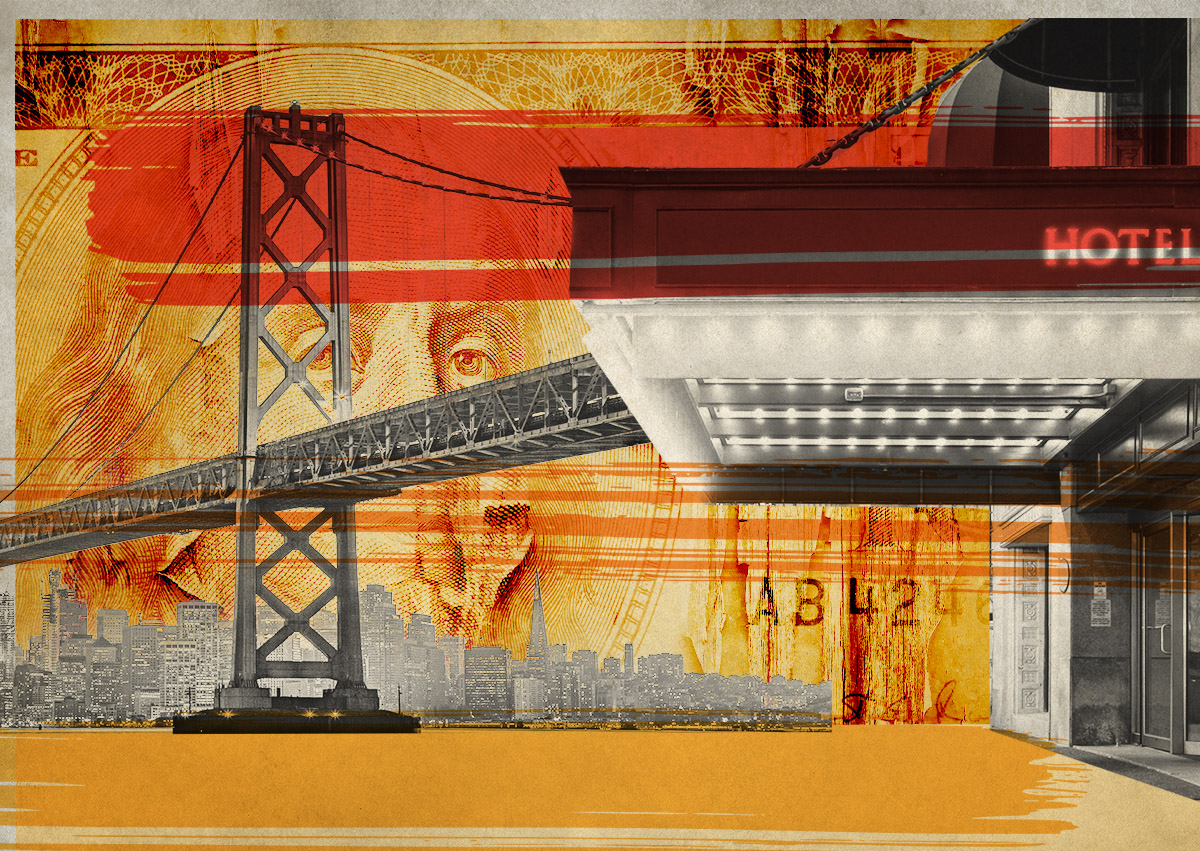

The office market in San Francisco, where nearly a third of the offices are empty, has been hammered during the era of remote work and higher interest rates.

A Swift spokesman disputed that the default would impact plans for the property, once known as the Sharon Building, which now sits vacant five years after its purchase.

“The company is in active discussions with the various parties regarding potential for resolutions,” Sam Singer, a spokesman for Swift, told the Business Times. “Swift’s goal remains to complete, lease and operate the project at 55 New Montgomery Street.”

Swift bills the Beaux-Arts building at New Montgomery and Stevenson streets as a historic “creative office” property with ground-floor retail, a block from the Montgomery Street BART/Muni Station and across the street from the Palace Hotel, not far from Moscone Convention Center and Yerba Buena Gardens.

Notices of default — which signal a lender’s ability to commence foreclosure — have been popping up across town at office buildings, hotels, retail properties and apartment complexes.

New York-based Columbia Property Trust defaulted on a $1.7 billion loan backed by a seven-building portfolio, including two office buildings at 650 California Street and 201 California Street.

San Francisco-based Veritas Investments, the biggest residential landlord in San Francisco, has $1 billion in delinquent loans tied to 95 apartment complexes, a third of its portfolio. It has placed a bid on its own debt. The firm also defaulted on a $448 million loan tied to 62 buildings.

Park Hotels & Resorts said it will hand the keys to two of the city’s largest hotels to the lender, as will the French owner of the Westfield San Francisco Centre, the city’s largest mall.

Nearly $2 billion in loans are coming due this year for office buildings in the city, followed by nearly another $2 billion next year, signaling other possible defaults, according to Trepp.

In February 2022, Swift Real Estate Partners bought two buildings in Los Angeles under redevelopment into entertainment production studios for $92.5 million.

In August 2021, Swift bought a 24-story, 565,900-square-foot office tower in Downtown Oakland for $327 million, betting on a recovery in the office market. The city’s office vacancy rate stood at 32.1 percent in the first quarter of this year, according to CBRE.

Read more

— Dana Bartholomew