A pair of Bay Area hospitality investors have filed for Chapter 11 bankruptcy on a Pacific Heights mansion, according to filings with the U.S. Bankruptcy Court for the Northern District of California. The filing comes a year after the pair’s investment group also filed for bankruptcy on three Bay Area hotels.

The home was purchased under the entity AV Residence LLC, of which Hitesh Patel owns 50 percent of and Bhavesh Patel has 25 percent. The remaining 25 percent is owned by another individual named Renna Patel.

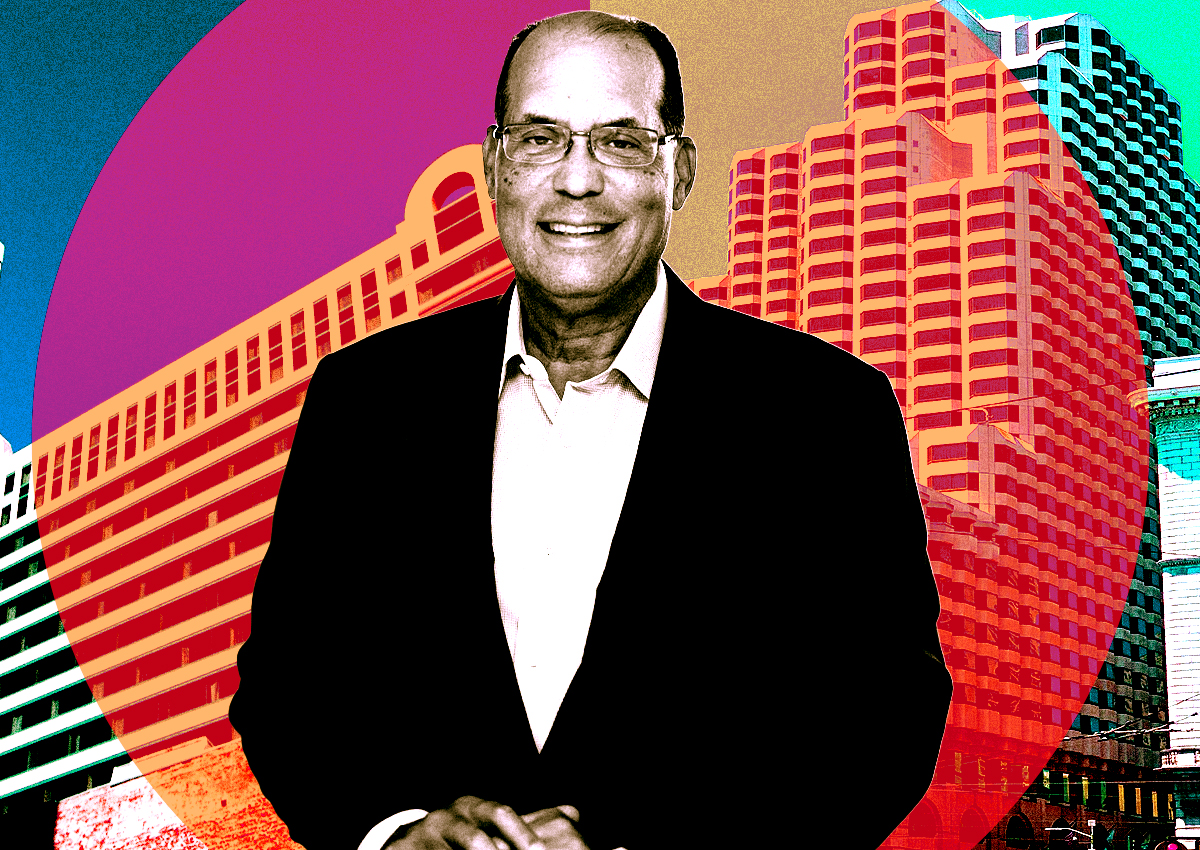

Hitesh Patel, one of the heads (along with Bhavesh) of San Francisco-based Golden State Hospitality Group, submitted the filings for a home located at 2741 Vallejo Street in San Francisco. The home was last sold for $9.5 million in 2020 and is currently valued at $9.8 million, according to property records.

The home was built 124 years ago, totals 4,600 square feet, and has five bedrooms and six bathrooms. The Pacific Heights home is four levels and was remodeled recently to include “top-of-line” fixtures and fittings, according to a former listing on Redfin. The exterior of the home features a large deck and a garden.

The Patels did not respond to requests for comment.

The investors have also filed for bankruptcy on a number of their investment properties. In June of last year, they submitted filings for three of at least 15 properties they own. Bankruptcy filings signed by Hitesh Patel last year are for affiliates of a Quality Inn & Suites in Santa Rosa and a La Quinta Inn & Suites in Fairfield which indicated assets of more than $10 million and liabilities of more than $10 million and of about $8.3 million, respectively.

Another filing was for a Holiday Inn Express in Santa Rosa, with declared assets of just more than $33 million and liabilities of about $30.5 million. Golden State Hospitality owns more than a dozen hotels across the state from Merced to Elk Grove, including Quality Inn, Super 8 and Holiday Inn franchises around the Bay Area.

The Bay Area hospitality market is experiencing distress as property owners struggle to make their debt payments. According to a report by Trepp, 89 percent of lodging CMBS loans in the city have debt service coverage ratios of less than 1.25, meaning the hotels are barely making enough to cover their monthly loan payments.

In one high-profile example, Park Hotels and Resorts announced this week that it will cease making payments on Hilton Union Square and Parc 55 this month and the $725 million loan will become delinquent in July.

Current economic conditions are more unstable than when a lot of these properties’ loans were first made.

“You have an interest rate environment now that is significantly higher than when these were taken out,” David Putro, head of commercial real estate analytics at Morningstar, said. “If you have a loan that originated in 2013 and matures in 2023, you’re probably looking at a couple hundred basis points difference in interest rates.”

Read more