Owners of two Bay Area Hiltons may be attempting to modify their loans rather than give up their distressed properties.

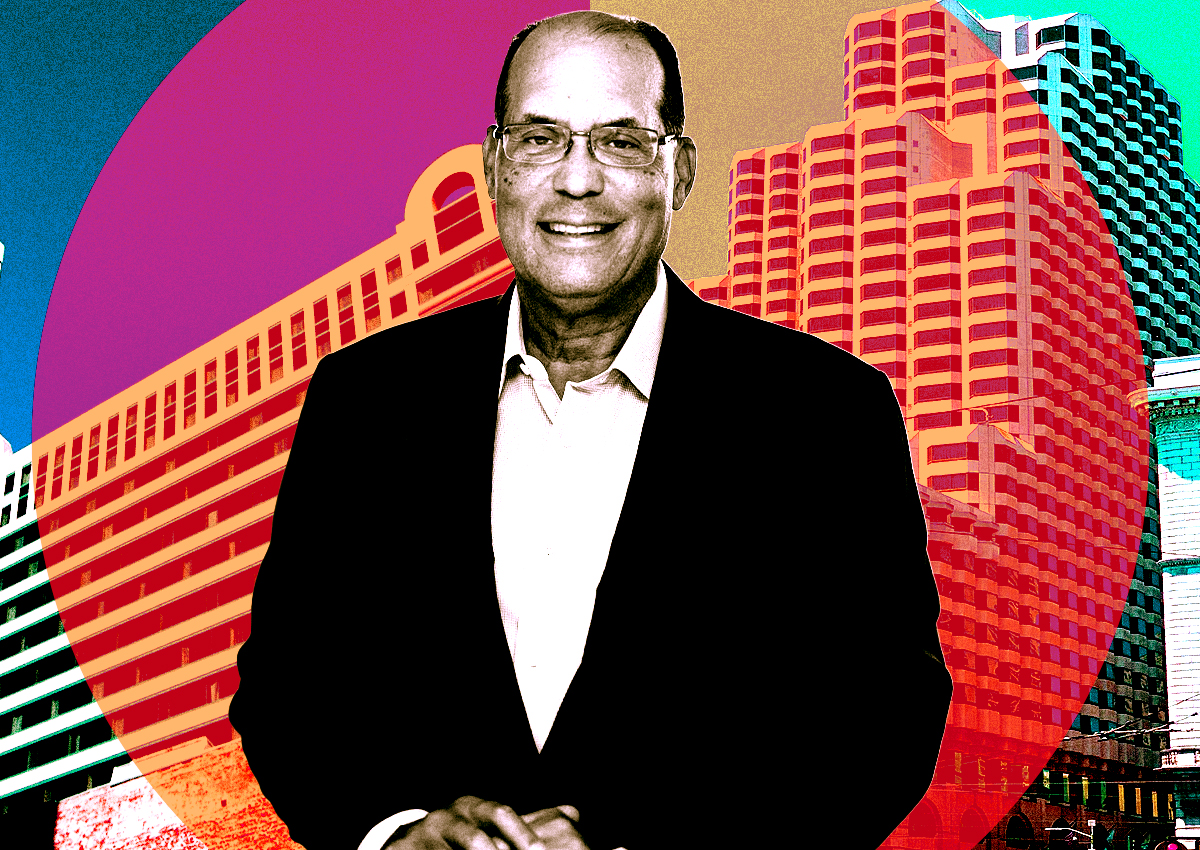

Recent special servicer notes on the Hilton San Francisco Financial District at 750 Kearny Street show that owner Portsmouth Square is working with lenders on a 12-month extension for $86 million in CMBS loans on the 543-room hotel that defaulted at maturity in January, according to analytics firm Trepp.

There’s not much information available about how the borrower is attempting to get the extension, though servicer comments note the loan is now managed on a hard cash basis.

Jennifer Spillane at Trepp said that a loan paydown or some other form of capital contribution from the borrower, a subsidiary of L.A.-based The Intergroup Corporation, may be required as part of the modification.

She called the one-year extension “a bit brief” but said in several modifications recently there have been additional extension options negotiated into the modification, if the loan hits certain performance standards. She also noted that there is $20 million in mezzanine debt on the property, and thus far there’s no information on how that would factor into any prospective modification.

Another Bay Area Hilton, the 165-key Hilton Garden Inn Cupertino, is in imminent monetary default on its $32 million CMBS debt, according to credit rating agency Morningstar. But that doesn’t mean that owner Cupertino Hospitality Associates is handing over the keys, according to Morningstar’s David Putro.

Cupertino Hospitality may be trying to figure out an extension or modification, he said, since the most recent debt service coverage ratio on the property is an adequate 1.27 and the loan doesn’t mature until the end of the year.

“This may be a move by the borrower to get ahead of the maturity in December,” he said, adding that the loan first went into special servicing for a COVID relief request that was ultimately withdrawn in December 2022.

Essentially, the property at 10741 North Wolfe Road appears to perform well enough to keep going with its current 4 percent interest rate, even with some extra capital put into the workout. But a refinance at 7 percent wouldn’t make sense for the borrowers or new lenders, he said, especially when it was underwritten in 2014 at $3.9 million of net cash flow and the recent reporting indicates about $1.7 million.

“The math doesn’t work to refinance the loan,” Putro said.

Trepp’s Spillane said we could see more extensions for lodging loans in the San Francisco market this year as there are a few more with 2024 maturity dates whose financials are trending similar to the Hilton Financial District and Hilton Garden Inn Cupertino loans. The extensions are both a sign of the continued difficulties faced by hotels in the San Francisco Bay Area as well as a positive indicator if it means more borrowers are willing to put money into their properties, she said, rather than walking away like Park Hotels & Resorts did on $725 million in debt backed by Hilton Union Square and Parc 55 last year.

“Special servicers are requiring borrowers to commit additional capital for most modifications that are getting done these days, so for modifications to continue tells me that borrowers are not exiting the San Francisco market in droves,” she said.

Read more