Nate Paul transferred $11.5M same month the FBI raided his office and home

Nate Paul transferred $11.5M same month the FBI raided his office and home

Trending

Who is Nate Paul? A look at the developer at the center of Texas’ impeachment scandal

He's already warring on multiple fronts over his real estate portfolio. Here comes an even bigger problem

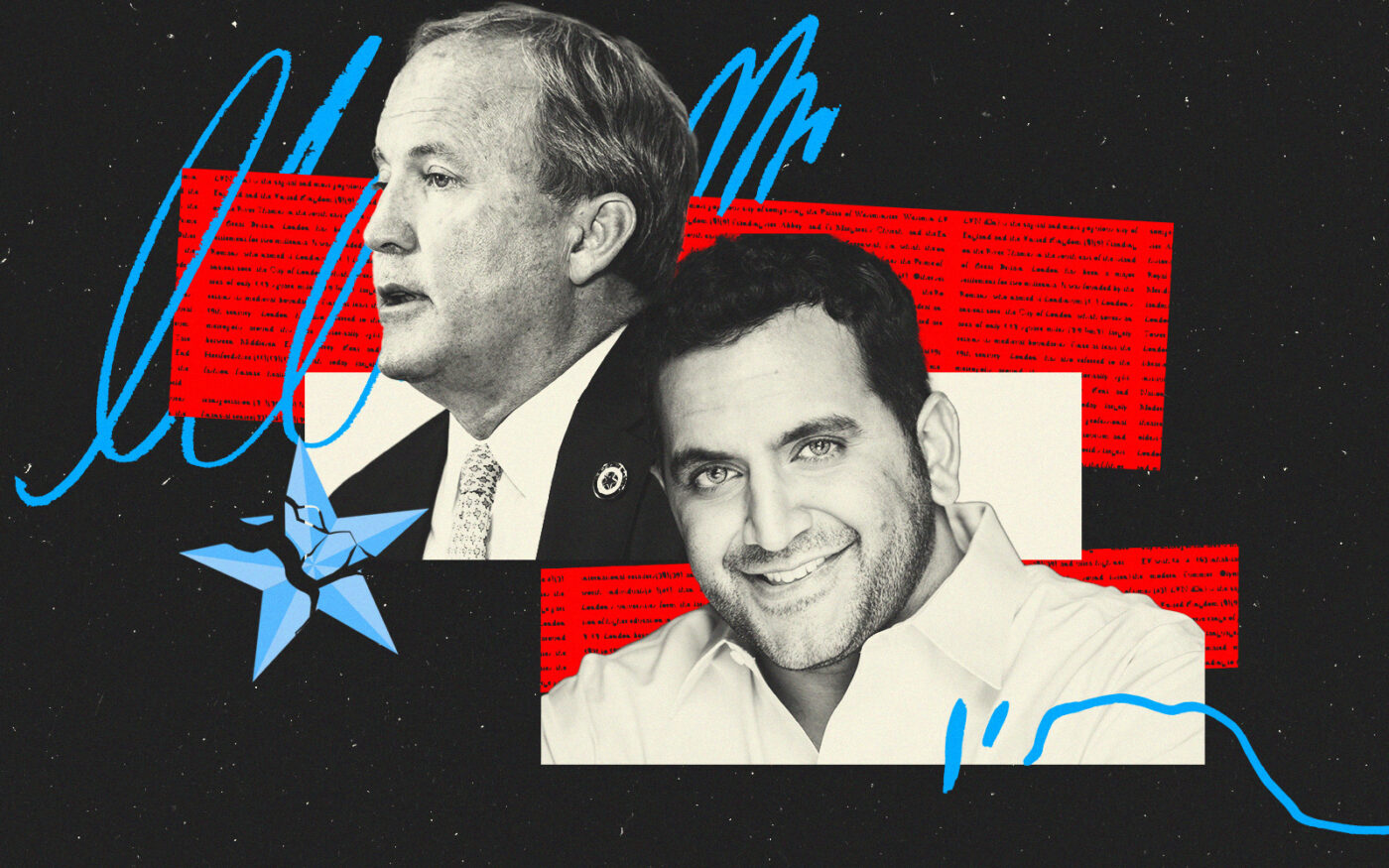

Texas Attorney General Ken Paxton and World Class Holdings’ Nate Paul (Getty)

A report detailing new corruption allegations against Texas Attorney General Ken Paxton rippled around Austin Thursday. A house committee recommended that Paxton be impeached, and in the 20-count bill of particulars, one name familiar to just about everyone in Austin real estate came up again and again: Nate Paul.

Paul, the founder and CEO of World Class Holdings, was mentioned in at least seven of the 20 articles of impeachment introduced against Paxton. The charges included bribery, misappropriation of public resources and disregard of official duty.

According to the House report, Paul renovated Paxton’s Austin home and hired Paxton’s mistress. In exchange, Paul allegedly received favors from the attorney general while his real estate empire was being hit with a wave of foreclosure cases.

“Paul received favorable legal assistance from, or specialized access to, the office of the attorney general,” reads the ninth article of impeachment filed by Rep. Andrew Murr, a Republican from Junction, who led the House investigation.

Rumors of an inappropriate relationship between Paul and Paxton have swirled since at least 2020, when whistleblowers in Paxton’s office told federal authorities they believed Paxton had misused his office to benefit Paul. Paul and Paxton have denied the allegations.

Up until Thursday, the rumors were just that: rumors. But the Texas House report and impeachment resolution are the clearest official allegations yet that Paul received improper benefits from the state attorney general, the most potent sign of real estate-related corruption in Texas politics in years.

Who is Nate Paul?

In 2015, Nate Paul was on top of the city — literally.

Sitting in his penthouse office atop the Frost Bank Tower, Austin’s premier office building, the 28-year-old real estate investor had yet to develop anything significant, but he had the city’s attention. Black posters bearing the logo of his company, World Class Capital, hung from trophy buildings he had acquired across the city like championship pennants.

In a profile titled “Is this guy for real?” the Austin Business Journal pointed out that Paul’s name was the site’s most-searched term the previous year. Everyone in real estate was “in a tizzy” trying to figure out who Paul was and how he had amassed a 9 million-square-foot portfolio.

According to Paul, owning the skyline was no longer enough — it was time to start shaping it. He outlined plans to build a 38-story apartment tower at 99 Trinity Street, his first ground-up build.

But even then, at his apex, before the dozens of bankruptcies, foreclosures and tough press, there was an undercurrent of skepticism toward Paul.

“He may fit into one of two categories,” David Armbrust, a veteran real estate attorney at Armbrust & Brown, told the publication. “Either a rising star or a shooting star. Only time will tell.”

Read more

Nate Paul transferred $11.5M same month the FBI raided his office and home

Nate Paul transferred $11.5M same month the FBI raided his office and home

Revealed: The lenders wrapped up in Nate Paul’s grand jury indictment

Revealed: The lenders wrapped up in Nate Paul’s grand jury indictment

Inside Nate Paul’s bankruptcy jiu-jitsu at Braker Business Park

Inside Nate Paul’s bankruptcy jiu-jitsu at Braker Business Park

And what a time it’s been.

Paul was born in 1987 in Victoria, Texas, a small city between Houston and San Antonio. He is one of three children of Dr. Love Paul, a physician, and Pearl Paul, a real estate agent. Love came to America from India in the 1970s with $8 and a medical degree, Nate wrote years ago on LinkedIn.

The family moved to Austin, where Nate attended St. Michael’s Academy and showed a knack for business early. At 17, a local paper profiled his various side hustles selling custom-branded water bottles and wristbands. Walking down the hallways of St. Michael’s with a laptop, a PDA and a cell phone, Paul told the paper his six companies netted him $20,000 that year.

In 2005, Paul was a finalist for a youth entrepreneurship award from Texas Christian University.

“Nate has the potential to be the next Michael Dell or Bill Gates, if he continues on this course,” his college counselor said at the time.

He went to University of Texas at Austin to study business. In 2007, at 20 years old, Paul founded World Class Capital Group, the company he still owns to this day, and that became the subject of the Paxton allegations. His first deal came that year, when he bought a 13-unit apartment building in south Austin for $1.1 million and flipped it 90 days later for $1.6 million, Paul told Forbes.

He was active across the city, but focused much of his energy on West Campus. He was able to pick up properties on the cheap as the market turned, with once-prized assets going into foreclosure. In 2008, he made a prescient move into self-storage facilities, forming an entity, Great Value Storage, that he sold last year for $588 million.

As Paul became a bonafide player on the Austin real estate scene, his youth drew media attention. He had early success landing institutional investors, raising $25 million from the Austin Police Retirement Fund in 2009.

“My biggest concern with him was the kid was 22 years old,” Art Alfaro, Austin’s city treasurer, later told Forbes.

Other investors included the Texas Medical Liability Trust, and a group led by Harvey Bookstein, an accountant, which poured $100 million into six of Paul’s deals. Around that time, he and Rob Gandy, co-founder of Cielo Property Group, tried to buy Colorado Valley Bank, but the deal fell through.

Paul’s sister left prestigious law firm Skadden Arps in 2013 to establish a New York office for World Class. The firm nabbed office space in one of the city’s most prestigious addresses, the GM Building.

By 2017, Forbes, while anointing him a “Top 30 under 30,” pegged his net worth at $800 million. The publication tabulated that World Class held $1.2 billion in assets: 120 properties in 17 states and 10 million square feet of commercial space.

His holdings included the KPMG Centre in Downtown Dallas, Spaghetti Warehouse in downtown Austin and 3M’s 158-acre campus near Lake Travis. He also controlled some of the city’s most valuable development sites in the chamber and thousands of self-storage units and apartments. He was a fixture in the deal journals. He popped bottles at Leonardo DiCaprio’s birthday. He bid $800 million for the Plaza Hotel portfolio. Then came the raid.

Severely compromised

In August 2019, FBI agents raided Paul’s home and office. The unwanted media attention from that incident left his business “severely compromised,” Paul later told a Texas court.

Paul sued the FBI, alleging that the raid had violated his civil rights under the Fourth and Fifth Amendments and damaged his firm’s reputation. The court dismissed Paul’s claims in 2022, although an appeal is still active.

In any case, the raid set off an era in which Paul found himself spending more and more time in the courtroom. He has shown the same grinding determination in dozens of bankruptcy cases across his portfolio as he battles to maintain control over the properties he spent a decade amassing.

The first major foreclosure case targeted five World Class properties: 900, 904 and 905 Cesar Chavez Street, 504 East 5th Street and 7400 South Congress. Paul had spent nearly $25 million acquiring the properties, according to a deposition from the case, and would not let them go easily.

The case dragged on as Paul put the property ownership entities into bankruptcy, delaying a foreclosure auction that was already complicated by pandemic restrictions on mass gatherings.

“Like every case involving Nate Paul and the many bankrupt affiliates of World Class Capital, this case has a long and tortured history,” reads a 2021 motion for judgment filed against Paul in one of those cases, years after the initial foreclosure filing.

To give a sense of just how drawn-out the saga is: When the desk clerk at the Travis County Courthouse was asked to print a copy of a particularly comprehensive motion from the case, her eyes widened in disbelief at its 1,355 pages. (At the court’s printing rate of $1 per page, a PDF on the court computer was the better option.)

In other foreclosure cases, Paul has lost prime parcels, including a six-acre South Congress assemblage and the prized 3M campus.

Paul has pledged to make a comeback and maintained in court filings that he still has lenders willing to extend him debt for deals. Plus, his profits from the self-storage portfolio sale gave him access to plenty of capital to start rebuilding. But the court troubles will have to be dealt with first.

A recent contempt ruling threatened to land him behind bars. In delivering the ruling, which was stayed, the judge wrote that his “lies to the Court while under oath were pervasive and inexcusable.”

Those property disputes, damaging though they are, are still just real estate stuff. If the allegations about Paul and Paxton are proven out, however, the developer would become a poster child for political corruption.

And that’s a much bigger problem to deal with.