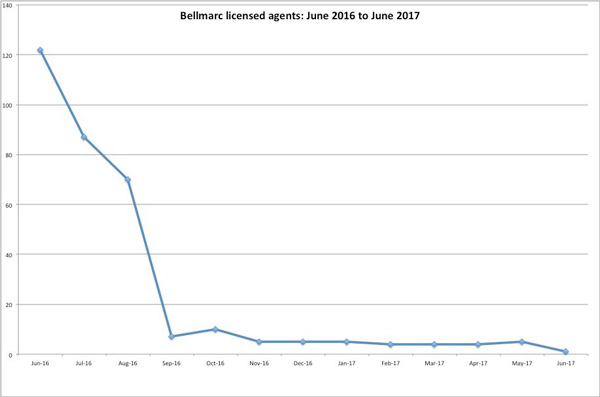

In June 2013, approximately 550 agents worked for Bellmarc Realty across five offices. Today, only one licensed broker is associated with the firm: company founder Neil Binder.

It’s a spectacular downfall for the veteran brokerage chief, who in 2013 inked a lucrative franchise deal with national firm Coldwell Banker and a year earlier acquired brokerage AC Lawrence. Bellmarc seemed primed to be a major force in sales and rentals. But by March 2015, the Coldwell Banker agreement had been ripped up, dozens of lawsuits flooded in and about 200 agents had jumped ship. A year later, remaining brokers were issued IOUs on commissions, eviction notices were slipped under the door, and Bellmarc, founded in 1979, was forced to shutter its last office.

Using data from the New York Department of State’s licensed real estate agent portal, The Real Deal set out to track down the former brokers of Bellmarc.

TRD’s analysis of the DOS data shows that ex-Bellmarc agents are now hanging their hats at the likes of Douglas Elliman, the Corcoran Group, Citi Habitats, City Connections, Keller Williams and Halstead Property.

Interestingly, more than a quarter of the 122 agents whose licenses were registered to Binder’s firm in June 2016 found their way to Bond New York.

Bond’s co-founder Bruno Ricciotti said that Bellmarc agents were drawn to his firm in part because a former Bellmarc sales manager was already working there. He estimates that Bond has picked up around 100 Bellmarc agents since 2015, with the biggest wave coming in when Binder’s brokerage collapsed last year.

“Most of the [former Bellmarc] agents that I spoke to personally were attracted to Bond for the large-firm resources without the corporate bureaucracy,” Ricciotti said.

Approximately eight former Bellmarc agents found jobs at the brokerage Mdrn. “The writing was on the wall for 12 months,” said Mdrn’s CEO Zach Ehrlich, who said many Bellmarc agents delayed leaving even though the troubles were obvious.

“Unfortunately, sometimes the mentality with agents is that they are afraid to change,” he said. “They waited until the very last moment that they could.”

A number of agents also went to Weichert Realtors, which shut down its Midtown office last July because of tough competition and a soft rental market.

Some Bellmarc alumni have also struck out on their own. Larry Friedman and Frank Sanchez, who co-founded AC Lawrence and left Bellmarc in 2014 following legal disputes with Binder, started their own investment firm, SDF Capital LLC, which specializes in single-family flips in the Hudson Valley.

Bellmarc, founded by Binder and Marc Broxmeyer nearly 40 years ago, closed its Flatiron District office last year after the landlord sued for nonpayment. Last June, Binder began issuing IOUs to agents who were demanding their commissions. The DOS launched an investigation into both Binder and the firm.

“Everybody that I interviewed or met with was owed money by Neil Binder,” said Ehrlich. “Literally every person.”

Binder told TRD last year that he planned to revive Bellmarc with an infusion of cash from new investors. He also said he would be focusing on the launch of a patented real estate search engine called Homepik. Messages left on his cell phone and at several email addresses were not returned.

As of February, three agents remained alongside Binder: Ralph Lowenstein, Piter Guttman and Chandra Tyler. They remained licensed to Bellmarc in March, April and May. And in May, a new agent, Carlos Ramos, was licensed with the firm. On May 18, all four agents were still licensed with the company. But on May 30, only Binder was.