TD Bank beat out a slew of competitors in late 2015 to lease roughly 2,000 square feet on a prime retail corner on the Upper East Side — right in front of the 6 train. The publicly traded financial firm inked a 20-year lease brokered by Cushman & Wakefield’s Joanne Podell in a deal that carried an asking price of about $350 per square foot.

TD Bank beat out a slew of competitors in late 2015 to lease roughly 2,000 square feet on a prime retail corner on the Upper East Side — right in front of the 6 train. The publicly traded financial firm inked a 20-year lease brokered by Cushman & Wakefield’s Joanne Podell in a deal that carried an asking price of about $350 per square foot.

But today, the retail space at the corner of Lexington Avenue and 77th Street sits empty, awaiting another tenant. “After careful consideration, we’ve decided to sublease the location,” Andrew Bregenzer, the bank’s regional president for the New York metro area, told The Real Deal in an email response to questions. He would not elaborate on the reasons for the sublease, but noted that TD Bank is committed to growing its presence in New York City and tailoring its retail strategy “in response to what customers want today.”

Friedland Properties, the space’s landlord, declined to comment, and Podell could not be reached.

The vacant space underscores the second thoughts many regional, national and global banks are having about their branch locations in the age of online banking, mobile payment apps and digital currencies. And while the broader NYC retail market is grappling with the ongoing disruption brought on by e-commerce and millennial consumer habits, it seems retail banking — which has always been more of a chore than an experience — is set for a major shakeup in particular.

It’s a clear reversal from years past, when banks were aggressively grabbing prime real estate locations, and landlords could count on them to pay above-market rates for the best locations.

“Five years ago, I would have said it’s a feeding frenzy,” noted Madison International Realty’s Ronald Dickerman, a major New York retail landlord. “JPMorgan was going to rent a corner so that TD Bank wouldn’t. There were bidding wars. I don’t think you’re going to see that going forward.”

The digital disruption

To be sure, banks aren’t abandoning their highly trafficked corners en masse. But many are rethinking their retail strategies in the digital age — whether by downsizing from 10,000-square-foot megabranches and focusing more on ATM locations or moving off prime corners to more cost-efficient spaces.

But real estate players said they expect the consolidation to escalate once current leases start expiring. “They just don’t need [as much] space anymore,” said Richard Hodos, a commercial broker at CBRE. “They don’t need as many tellers or loan officers to sit at a desk on the banking floor. They can do that in back offices or on the phone or the internet in some cases.”

But real estate players said they expect the consolidation to escalate once current leases start expiring. “They just don’t need [as much] space anymore,” said Richard Hodos, a commercial broker at CBRE. “They don’t need as many tellers or loan officers to sit at a desk on the banking floor. They can do that in back offices or on the phone or the internet in some cases.”

There were 680 bank branch locations in Manhattan as of June 30, just nine fewer than a year earlier, according to the Federal Deposit Insurance Corporation. That’s a reduction of about 3 percent from 2014, when the number of Manhattan bank branches hit an all-time high of 702 (tied with 2010).

And while the number of branches today is below the 10-year average of 690, there are still far more than in the early 2000s, as Manhattan began to gentrify more rapidly. At that time, there were fewer than 500 retail bank locations on the island.

Meanwhile, financial firms from Capital One to Bank of America are still inking retail deals at a steady clip. Banks signed 18 leases through the first nine months of the year, compared to 20 deals for all of 2016, according to CBRE.

But as banks alter their real estate strategies, industry sources said the days of counting on a branch to pay top dollar are gone.

“I wouldn’t automatically say on a potential acquisition … that if the market’s $250 per square foot then I’m going to get $400 for a bank,” said Steve Gonzalez, TF Cornerstone’s retail leasing director.

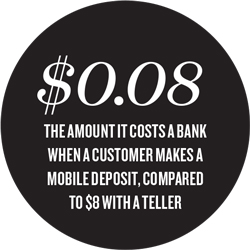

One of the core reasons banks are looking for smaller retail spaces and spending less per square foot is the steady rise of online and mobile banking. It typically costs a bank $0.08 when a customer makes a deposit using a mobile device, compared to $0.80 at an ATM and a whopping $8 with a teller, according to a JLL report on banking that the commercial brokerage published in April.

Sol Gindi, chief administrative officer for JPMorgan Chase’s consumer banking, told TRD that more than 80 percent of customer transactions nationwide are done through digital channels, including mobile apps and ATMs, up 14 percent from last year.

Chase — which has the largest bank branch network in Manhattan — shuttered a net total of three locations between July 2016 through June 2017, bringing its branch count in the borough to 149. But while the bank is considering different formats, including digital branches and ATM kiosks, it has no broad-based plans to make a major shift in its retail strategy, Gindi said.

“We continue to open new branches where it makes sense, especially in high-growth areas where new homes are being added and the neighborhood needs a new bank close by, and consolidate in branches with less foot traffic,” he said.

The millennial twist

Coinciding with the rise of digital banking, millennials — defined as those born between 1981 and 1997 — pose their own threats. Many of those shoppers are inclined toward “experiential retail,” a tricky business model for banks.

“Seventy-one percent of millennials would rather go to the dentist than listen to a bank commercial,” said Morley Winograd, a senior fellow at the University of Southern California’s Annenberg School for Communication and Journalism and a thought leader on the age group.

Winograd said millennials still harbor animosity toward big banks stemming from the 2008 financial crisis, while tech companies are actively targeting them with the same kinds of services. One such company is the online personal finance firm Social Finance, commonly known as SoFi, he noted.

“There isn’t a question that going to some place where you stand in line and talk to somebody behind a divider is completely weird for them,” he said. “Maybe a government office is the only place they would run into that kind of retail process.”

Gindi acknowledged that millennials come into Chase’s branches less often than older customers. While two-thirds of all Chase customers visit their branch an average of four times a month, he noted, millennials only do so three times a month.

Some banks have tried to make their locations more welcoming to a younger crowd by offering additional products and services — a move similar to what chain pharmacies began doing in the late 1990s and early 2000s.

Capital One, for example, launched a new concept in 2015 when it signed a 10-year lease for 15,000 square feet that included a work lounge and Peet’s Coffee shop at the Feil Organization’s 853 Broadway in Union Square.

TD Bank’s predecessor, Commerce Bank, was one of the first companies to bring the “retailtainment” concept to banking in the 1990s with a focus on giving customers additional incentives to visit their local branches.

Greg Braca, TD Bank’s president and CEO, told Bloomberg News in October that the company is now trying to figure out how to shift those experiential strategies online. “We used to, 15 years ago, talk about dog biscuits in stores, and that was a convenience point and people loved it,” he said. “What’s the digital version of that biscuit?”

Bregenzer noted in his email to TRD that “while in-store interactions are trending downward, physical presence is still important.”

But some real estate players are skeptical that banks can reverse the latest trends and drive up foot traffic.

“At the end of the day, I think for most people it’s still a transaction,” said Walter Bialas, one of the authors of the JLL banking report and a former research director at PNC Bank. “I don’t know that many people who are going to hang out at the bank just because it’s a cool place to hang out.”