It’s been about a decade since The Real Deal began ranking Manhattan’s top residential agents. But this year, the ranking looks a little different.

That’s because rather than evaluating agents based on the dollar volume of their listings, this year our beefed-up research team created a methodology to evaluate brokers based on what they actually sold. And in a market where inventory is up and buyers are swimming in choices, particularly on the high end, closing deals is no small feat.

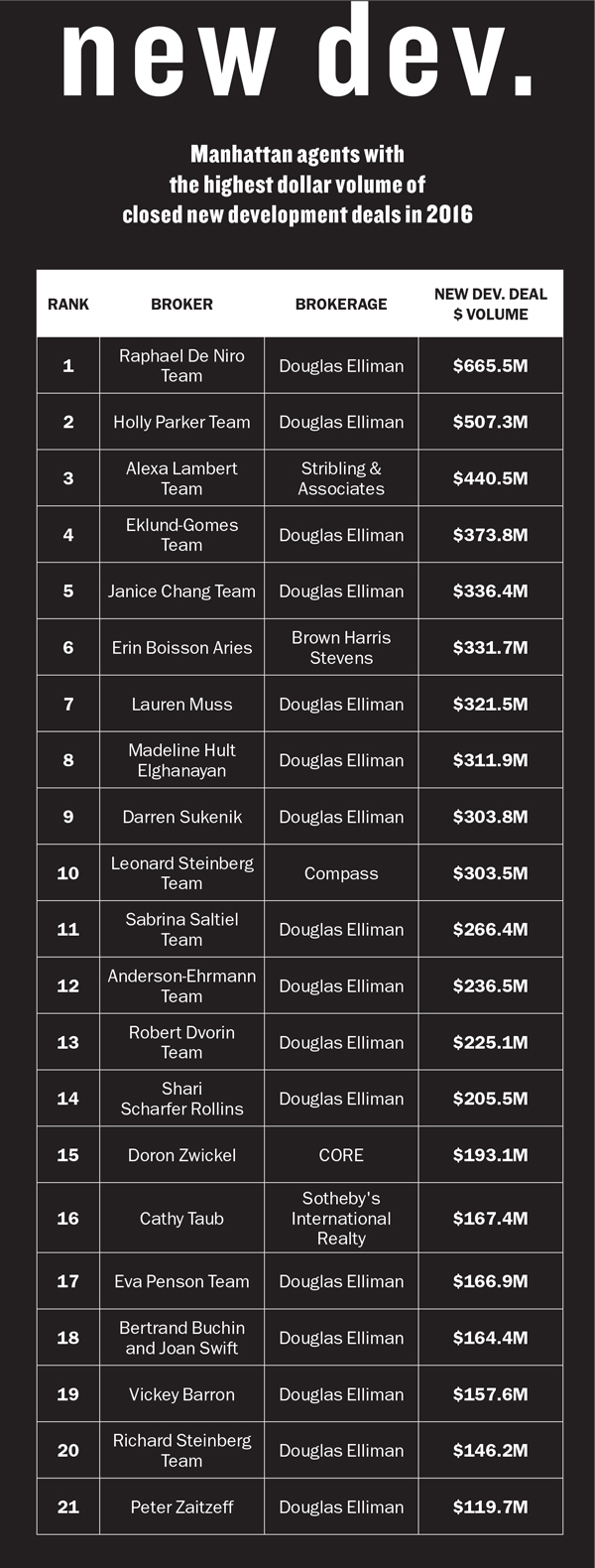

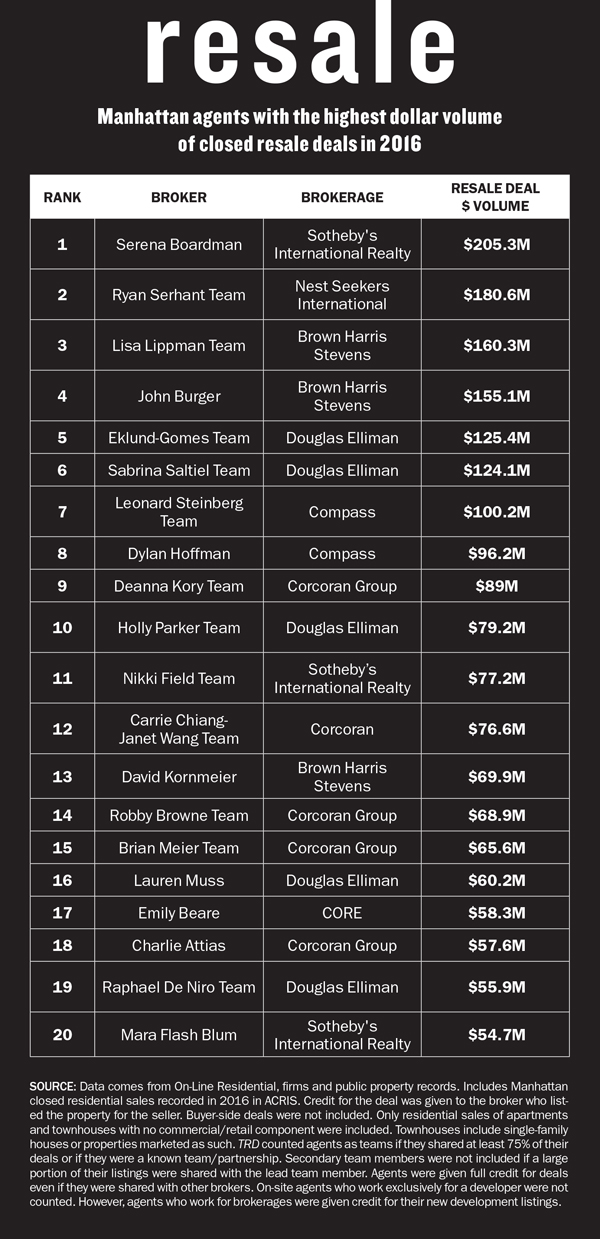

While TRD’s methodology has changed, one key thing that hasn’t is that the brokers who worked on new development projects trounced their resale counterparts. But to get a clear sense of which agents dominated in both areas, we compiled two separate rankings. The undertaking was not easy. We sifted through thousands of condo, co-op and townhouse listings and cross-referenced them with sales that hit public records last year.

The final rankings — which include only sell-side transactions — are based on deals that closed between January 1 and December 31, 2016, and that the agent had as a listing. Oh, and agents had to have at least $50 million in deal volume to make the cut.

Related: The top brokers are joining forces — and sharing paychecks

— at NYC’s biggest new developments

As a group, the top 20 agents, regardless of which list they landed on, closed $6.8 billion worth of sell-side deals in 2016. The vast majority of that — a massive $5.9 billion — came from new development sales, according to TRD’s analysis. That was more than six times the $858.7 million worth of resale listings that closed during the same time.

Interestingly, brokers are juggling an even higher dollar volume of listings, highlighting how hard it is to close sales in this market.

Douglas Elliman’s Raphael De Niro closed more than any other broker in 2016. His team — which came in at No. 15 on last year’s “listing” ranking — closed a mammoth $721.4 million in deals overall, including $665.5 million in new development units at buildings like 100 Barclay, 150 Charles and 135 West 52nd.

He was followed by Elliman’s Holly Parker (whose team closed $586.5 million in both new development and resale deals); Elliman’s Fredrik Eklund– and John Gomes-led team (with $499.2 million); Stribling & Associates’ Alexa Lambert (who closed $460.5 million); Compass’ Leonard Steinberg (with $403.7 million); and Elliman’s Sabrina Saltiel and Lauren Muss (with $390.5 million and $381.7 million, respectively).

While all of those agents were carried by their new development business, many of their deals went into contract two or three years ago, before the market began softening. Given the uncertainty today surrounding new developments — which skew toward the shaky luxury market — a number of top agents have since made further efforts to diversify into resales. For example, Saltiel, one of the agents selling Harry Macklowe’s ultraluxe 432 Park Avenue, racked up $266.4 million in new development sales. But she also closed $124.1 million in sell-side resales.

“With new development, you can work on something for three or four years and get paid two years later. You’ve got to balance it out,” said Compass’ Steinberg.

“With new development, you can work on something for three or four years and get paid two years later. You’ve got to balance it out,” said Compass’ Steinberg.

“I’ve never looked at real estate as a month-by-month or year-by-year thing,” he added. “Those with patience are rewarded handsomely.”

An opaque market

There’s no denying the sex appeal of the new condos that hit the market this real estate cycle. They have, after all, spawned a coterie of starchitects, celebrity brokers and record-breaking prices.

And agents in the new development space saw their closed deals soar in 2016.

Those closings impacted Manhattan sales prices last year, pushing the median price for new condos to $2.96 million, up 44 percent from the prior year, according to real estate appraisal firm Miller Samuel. That was even as the median price for resales dropped 6.3 percent to $900,000.

But even De Niro, who leads a team of eight, noted that many of his new development closings stemmed from deals struck in 2014 and 2015 — a delay he said can create a false depiction of the market.

“The market can be opaque in some ways. The deals are not recognized until they close,” said the agent, who has a Rolodex of celebrity clients. “It can be difficult for buyers and sellers to get their arms around what’s happening in real time.”

De Niro, who shuns the limelight (and rarely mentions his famous dad, though they’re partners in the Greenwich Hotel), said buyers and sellers were in a “stalemate” last year as they adjusted to a more sober, steady market. “Things are looking much better than they were this time a year ago,” he said.

On the whole, the new development ranking skewed heavily toward Elliman, where resale agents often team up to sell new development projects.

Elliman’s Parker came in at No. 2 with $507.3 million in new development closings. The bulk of her deals came from 10 Madison Square West, the former International Toy Center that Witkoff Group converted into a 16-story luxury condo.

She was followed by Stribling’s Lambert, who racked up $440.5 million in new development sales, including deals at the Naftali Group’s 210 West 77th Street, a 25-unit condo designed by Thomas Juul-Hansen.

But the next couple of agents — Eklund and Gomes and Janice Chang — came from Elliman, as did others in the top 10, including Muss, Madeline Hult Elghanayan and Darren Sukenik.

Brown Harris Stevens’ Erin Boisson Aires clocked in at No. 6 with $331.7 million in new development sales at 551 West 21st Street, the 44-unit condo designed by Foster + Partners.

Sukenik and Elghanayan both saw their deal volume aided by closings at 150 Charles and 10 Madison Square West, while the Eklund-Gomes duo — who in 2015 nabbed the top spot in TRD’s listings-based ranking — reaped the rewards of deals at buildings including 11 North Moore, 215 Sullivan and 5 Beekman.

It should be noted, however, that while Elliman had a strong showing in the ranking, the Corcoran Group has a very different business model, funneling nearly all of its new development projects to its sister firm Corcoran Sunshine Marketing Group. (Corcoran Sunshine is dominant in that space, but it was not included in the ranking once again this year because it focuses exclusively on new development. Still, that firm’s on-site agents inked $5.6 billion in contracts in 2015, the latest year for which sales figures were available.)

But Sukenik said Elliman’s strategy of assigning agents to new development buildings has paid off.

“It’s not like they put people’s names in a hat and keep their fingers crossed. There’s a methodology,” he said. “They put brokers who are neighborhood specialists on those particular products, so they’re not just selling the building, but they truly understand the product, the buyer and how to sell it.”

“It’s not like they put people’s names in a hat and keep their fingers crossed. There’s a methodology,” he said. “They put brokers who are neighborhood specialists on those particular products, so they’re not just selling the building, but they truly understand the product, the buyer and how to sell it.”

Regardless, many top brokers said new development is seeing a price correction.

Elliman’s Muss said while many developers are willing to work with buyers on price, they often need to get their investors and partners on the same page.

“I try to convince sellers that sometimes you need to hear what the market is telling you, and if no one is calling or coming, it is due to price,” she said.

Fellow Elliman broker Richard Steinberg, who’s on the 432 Park team, said at TRD’s annual Showcase & Forum last month that “anyone that tells you they’re not making concessions, I think, is not being fully transparent.”

He said while 432 is not “giving away units,” the marketing team there is negotiating on deals.

Meanwhile, CORE’s Doron Zwickel — who closed $193.1 million in new development listings — said the bulk of his deals were at moderately priced buildings such as the Flynn at 155 West 18th Street and 15 Renwick, which stalled during the financial crisis but launched sales (with a new developer) in 2014. Zwickel said both projects did well with “conservative” prices, around $2,100 per square foot and $2,250 to $2,300 per square foot, respectively.

Parker said in today’s market, listings need to be perfect — or to undercut the market. “Buyers want to be blown away,” she said. “It either has to be beautiful — like, ‘You had me at hello’ — or it needs to be an incredible opportunity in price, and a lot of times it needs to be both.”

Who rules in resale?

On the resale side, Sotheby’s International Realty’s Serena Boardman — a perennial top agent in TRD’s past rankings — showed that she doesn’t only list major properties, she also closes them.

Boardman, who is famously press-shy and declined to comment, led the resale pack with $205.3 million in sell-side deals. She has a stronghold in the well-heeled world of exclusive, Uptown co-ops; one of Boardman’s top deals last year was a prewar, five-bedroom spread at 101 Central Park West, which traded for $35.3 million.

She was followed by Nest Seekers International’s Ryan Serhant. Despite his well-publicized foray into new development, $180.6 million of his $258 million total closed listings came from resales. That included a $15.9 million unit at 1185 Park Avenue, a 1920s co-op with a grand courtyard and six lobbies.

The reality TV star — who is on “Million Dollar Listing New York” and recently landed a solo show on Bravo called “Employee of the Month” — and his massive team of nearly 60 people closed 128 of his listings in 2016. He said he’s recently made a push into brokering deals at lower price points, where the market is moving faster, and he’s expanded in Brooklyn. “My goal is to do deals wherever people are transacting. That’s where I want to be,” he said.

Coming in at No. 3 in the resale ranking was Brown Harris Stevens’ Lisa Lippman with $160.3 million in closed sell-side deals, including a co-op at the famed San Remo on the Upper West Side owned by Goldman Sachs’ David Solomon that sold for $21.5 million.

She was followed by BHS’ John Burger, another regular top agent, and Elliman’s Eklund and Gomes.

While commissions on the resale side are more financially favorable to agents (see below), the volume of resale deals paled in comparison to sold new development listings. “People want new. They want amenities that are over the top. That’s the way of the world,” said Corcoran’s Robby Browne.

Browne nonetheless ranked No. 14 on the resale list with $68.9 million in closings, including a three-bedroom condo at 25 Central Park West that he sold for $9.4 million — but only after cutting the price from $10.85 million.

Brokers said properties priced at $10 million and up — and certainly anything above $20 million — faced serious pushback from buyers in 2016. “On the very high end, it’s not a buy that you have to have, it’s a buy that you want to have,” said Sotheby’s Mara Flash Blum, who took the No. 20 spot in the resale ranking.

That lack of confidence at the high end shook the rest of the market.

But, Blum said, after the market adjusted to Donald Trump’s election, both luxury and lower-priced properties began trading again.

“When the high end starts to move, the buyers in the lower end see it moving, and it gives them the confidence level to buy,” she said.

Corcoran’s Deanna Kory — who saw $89 million of her $115 million in total closings come from resales — said she, too, saw the market pick up in late 2016 as Wall Street stabilized after the election. “Whenever you’re in an election year, people are in a tentative, wait-and-see situation. Last year was pretty much that way,” she said.

Residential agents — as they often do — stressed that realistic pricing is key to transacting in this market. And sellers, it seems, are getting realistic.

Sotheby’s Nikki Field, whose team was No. 11 on the resale list with $77.2 million in deals, said local buyers are poised to call the shots going forward.

“They’re finally off the sidelines,” she said. “They see real value and price adjustments.”

Commission inequality

While the stakes may be high for selling new condos — with billions of dollars on the line for top New York developers and hundreds of units to unload — it’s a volume game. That’s because new development agents generally earn a fraction of the commissions that resale agents get.

On resale deals, brokers typically earn a standard 6 percent, which is evenly split between the buyer’s and seller’s agents. For new development sales, however, the buyer’s broker typically gets 3 percent, while the on-site team walks away with 1.5 percent to 2 percent. But those commissions need to be divvied up among a lot of players: The on-site team usually includes a sales director, along with several agents and assistants. “If you’re on-site and you get a piece of everything, you’re working for less than 1 percent,” said one top agent.

Complicating matters is that some agents work on large teams — where all deals fall under their banner — while others go it alone. For example, Elliman’s Muss works with just one associate, while Serhant has one of the largest teams in the industry and as a result has more overhead. (Elliman caps teams at 10 brokers.)

A back-of-the-napkin estimate by TRD of commissions earned in 2016 by resale and new development brokers reflects the earnings gap.

Assuming standard commissions on all deals —meaning no commission discounts or increases were agreed to — new development agents likely took home $118 million for closing $5.9 billion in sales. By comparison, resale agents likely pocketed $25.7 million for a far lower $858.7 million worth of closed deals in 2016.

On a per-agent basis, it’s a “minuscule amount,” said Sotheby’s Field. For that reason, she added, “Strong agents want to be out reselling, because the income is 10 times larger.”

Top agents said that to be successful in new development requires selling a significant amount of product. Stribling’s Sean Murphy Turner said new developments are a heavy lift that requires many sets of hands.

Corcoran CEO Pam Liebman made that same point last month. “New development: It’s not so easy,” she told a packed house at TRD’s forum. “What do you think, that you just show up and they give you a big check?”

Correction: An earlier version of this story inadvertently excluded Brown Harris Stevens’ Erin Boisson Aires from the new development ranking. She ranked No. 6 with $331.7 million in deals. The original story also omitted one of Nikki Field’s deals. The addition moved her up to No. 11 on the resale ranking. The new development ranking also mistakenly excluded Elliman’s Bertrand Buchin, who shared Joan Swift’s closed new development deals. Buchin also had one additional $9.4M closed new development deal.