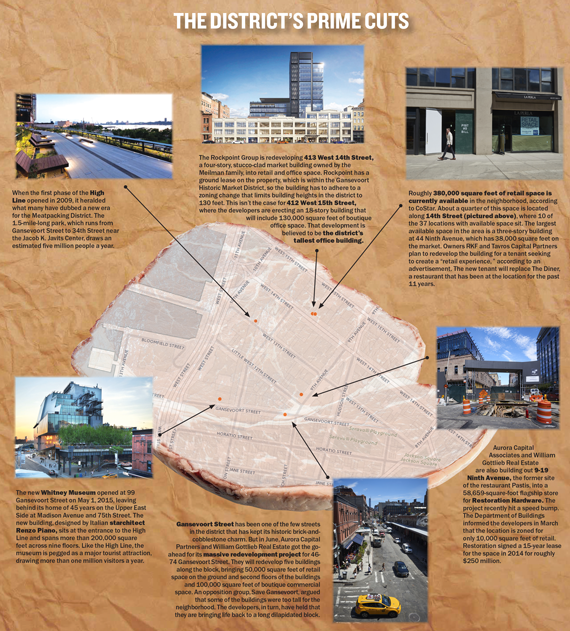

The Meatpacking District has always been a study in contrasts, but never more so than today. The neighborhood teems with tourists climbing on and off the High Line, and below there are clusters of people waiting outside the Whitney Museum. Elsewhere, there are massive renovations taking place. On the district’s historic Gansevoort Street, Aurora Capital Associates [TRDataCustom] and William Gottlieb Real Estate are partnering in the redevelopment of five stone market buildings, which will bring 50,000 square feet of retail space on the ground and second floors of the buildings, plus 100,000 square feet of boutique commercial space. Not far from that project, the Rockpoint Group is planning to build an 18-story office tower at 412 West 15th Street.

At the same time, there are worrying signs on the retail front. Stretches of stores along 14th Street and Washington Street sit vacant, while high-end boutiques look sleepy at best. Despite a longstanding effort to remake the neighborhood into a retail destination — beginning with high-fashion boutiques and later upscale stores with mass appeal — the retail availabilty rate is still on the rise. Cushman & Wakefield reported the neighborhood’s availability rate at 22.2 percent during the second quarter of 2016 — a 3.9 percentage point increase from the same time last year and a 5.2 percentage point increase from 2013.

All told, Meatpacking has the fourth highest availability rate — tied with Times Square and behind Soho, Herald Square and Fifth Avenue — among the 12 Manhattan submarkets studied by the brokerage. Fifth Avenue, between 42nd and 49th streets, had the highest rate at 27.6 percent.

“The current reality is that it’s really dead,” Elaine Young, a local community activist who has opposed Aurora’s project on Gansevoort. “Nobody is in those stores. They are just billboards.”

Hogs and Heifers, an iconic biker bar on Washington Street, closed last August, citing climbing costs, while Jean-Georges Vongerichten’s Spice Market is leaving its home of nearly 13 years this month as landlord Midtown Equities seeks to reposition the building. And high-end clothing boutique Scoop NYC closed all of its locations — including two on Washington Street — earlier this year.

Rising rents continue to be a trend. Within Manhattan, the district had the highest year-over-year asking rental increase at $394 per square foot. Louis Puopolo, who co-heads Douglas Elliman’s commercial operations, said that in some cases, landlords are intentionally keeping spaces vacant as they wait for new ones willing to pay more money for large amounts of space.

Driving the rent increases has been a series of transformations. The district lost all but a few traces of its namesake industry long ago, turning into a hipper-than- thou clubbing and luxury shopping mecca in the 1990s. With the arrival of the High Line in 2009, the area began attracting more mainstream stores like Patagonia, UGG and Lululemon. And last year’s relocation of the Whitney Museum only further cemented the neighborhood’s status as a tourist destination.

Now, brokers and developers are banking on the district’s transformation into a hub for “experiential” stores, which invite customers to come in and play with various tech gadgets. Samsung opened its flagship office at 837 Washington Street, a six-story building developed and owned by Taconic Investment Partners and Thor Equities. The tech company rented the entire building and, according to the Wall Street Journal, paid about $500 a square foot for the ground floor and slightly more than $120 a square foot in rent for the floors above. The Samsung “store” — visitors can’t actually buy any Samsung products there — has three floors of interactive stations where people can watch videos on a three-story screen and try out virtual-reality gear. Next year, Lexus will open a similar concept, Intersect by Lexus, at 412 West 14th Street, which is also owned by Thor. In addition to a showroom, it will include a restaurant, boutique and art gallery.

Some observers are skeptical about this type of retail being a sustainable driving force for the neighborhood’s next phase. “I think it’s more of a branding opportunity,” said Jeffrey Nissani, an investment sales broker at Eastern Consolidated. “But at the end of the day, if you have 30 stores on the strip and no one’s making money, those will be the first stores to go.” He added: “I don’t see the area becoming this technology alley where people just want to go to the Meatpacking District to test out this new ‘experiential’ technology.”

Still, other brokers believe the neighborhood’s high level of availability is merely a growing pain. Construction, which includes the city’s redesign of Ninth Avenue, has been a pedestrian nuisance and traffic nightmare. “This is going to be like nirvana for retail, but not today,” Puopolo said, adding that he sees the retail district coming together in three years. By then, work on Ninth Avenue should be complete, and the Gansevoort development and the 15th Street tower should be well underway.

Among the retail expected to open within the next few years is a 58,659-square-foot flagship store for Restoration Hardware at 9-19 Ninth Avenue, which is currently under construction by developer Aurora Capital Associates. The California-based furniture store company is also planning to open a boutique hotel and restaurant around the corner as part of a new hospitality concept. Meanwhile, Starbucks announced in April that it would establish a roastery in a 20,000-square-foot space at 61 Ninth Avenue, which sits on the border of the Meatpacking District and Chelsea. The store would be the biggest Starbucks in the world.

Jared Epstein, vice president of Aurora Capital Associates, said that while the amount of available retail space in the neighborhood is significant, he feels that it’s merely a prelude to a boom. He’s confident that these spaces will fill up with more “experiential” retail. Samsung has inspired other landlords, like Midtown Equities, to seek out an “experiential-style” flagship for its 29 Ninth Avenue, the soon-to-be-former home of Spice Market.

“Samsung hit the nail on the head,” Epstein said. “You walk in there, you’re not in a store. You’re in a fairy tale.”

Correction: An earlier version of this story misstated the name of Aurora Capital Associates.