The sun was shining and the air was crisp when 30 real estate pros from CIM Group [TRDataCustom], Kushner Real Estate Group, Criterion Group and Mitsui Fudosan boarded a bus idling on Park Avenue bound for the Bronx. The field trip, organized by white-shoe law firm Herrick Feinstein, promised a tour of the borough’s rapidly changing neighborhoods — including the much-buzzed-about South Bronx — which is how the group of developers found themselves hurtling over the Third Avenue bridge one afternoon in the middle of last month. Clutching swag bags with granola bars, mints and maps, the group filed onto a red trolley at the Bronx Courthouse and for the next 90 minutes, traversed the borough, craning their necks to catch glimpses of a burgeoning development landscape.

The sun was shining and the air was crisp when 30 real estate pros from CIM Group [TRDataCustom], Kushner Real Estate Group, Criterion Group and Mitsui Fudosan boarded a bus idling on Park Avenue bound for the Bronx. The field trip, organized by white-shoe law firm Herrick Feinstein, promised a tour of the borough’s rapidly changing neighborhoods — including the much-buzzed-about South Bronx — which is how the group of developers found themselves hurtling over the Third Avenue bridge one afternoon in the middle of last month. Clutching swag bags with granola bars, mints and maps, the group filed onto a red trolley at the Bronx Courthouse and for the next 90 minutes, traversed the borough, craning their necks to catch glimpses of a burgeoning development landscape.

“We make shidduchs, that’s what we do,” said Herrick partner Jonathan Adelsberg, chair of the commercial leasing department, invoking the Hebrew term for matchmaking.

“You can’t be a great real estate lawyer until you understand the market. We do what we can to expose opportunities to our clients,” he noted over pasta and eggplant Parmesan at Pasquale Rigoletto, the Arthur Avenue eatery where the tour concluded.

The Bronx, which has long fought its image of a borough besotted by arson, poverty and urban decay, is now a hot commodity among the same investors and developers who overlooked it for years. In 2014, it saw an influx of $1.2 billion worth of real estate investment, a 26 percent jump from the prior year, according to data from Bronx Borough President Ruben Diaz Jr.’s office.

Some of the key commercial and retail projects reshaping the Bronx include the redevelopment by Youngwoo & Associates of the Bronx General Post Office into an open-air food market, the conversion of the Kingsbridge Armory into an ice-skating complex with nine rinks and the construction of new Bronx headquarters for Fresh Direct, which is moving from Long Island City.

But residential projects are the darling of developers, who pumped $788 million of the $1.2 billion into the Bronx last year. This year, the borough is on track to see a record 8,000 new residential units hit the market, up from 3,697 a year ago, according to Diaz’s office.

Rising land prices in other boroughs, coupled with the Bronx’s proximity to Manhattan, a strong transit system and available development sites, are fueling the feeding frenzy. Developers who’ve already planted their flags see the Bronx as the last bastion for development, while those who haven’t done so already are eager to gain a foothold. Residential rents, while far lower than elsewhere in the five boroughs, are also creeping up, boosting the confidence of market-rate developers who see tremendous upside in the Bronx.

Rising land prices in other boroughs, coupled with the Bronx’s proximity to Manhattan, a strong transit system and available development sites, are fueling the feeding frenzy. Developers who’ve already planted their flags see the Bronx as the last bastion for development, while those who haven’t done so already are eager to gain a foothold. Residential rents, while far lower than elsewhere in the five boroughs, are also creeping up, boosting the confidence of market-rate developers who see tremendous upside in the Bronx.

“The frontier is always the best investment because we are in an extraordinary supply-demand imbalance. Wherever you can buy land the cheapest will have the highest appreciation,” said Nancy Packes, founder of the eponymous new development-marketing firm. “The Bronx right now [is] a seething hotbed of people buying land.”

Indeed, the number of development sites trading hands this year seems to back Packes up. More than 75 development sites sold through Sept. 30, in deals valued at $146.3 million, up from just 45 similar sales worth $43.1 million in all of 2013, according to Cushman & Wakefield.

Early innings

For investors priced out of Manhattan and Brooklyn, the Bronx is one of the last relatively affordable markets in New York City.

And sources say they believe the rest of the city is further along in the economic cycle.

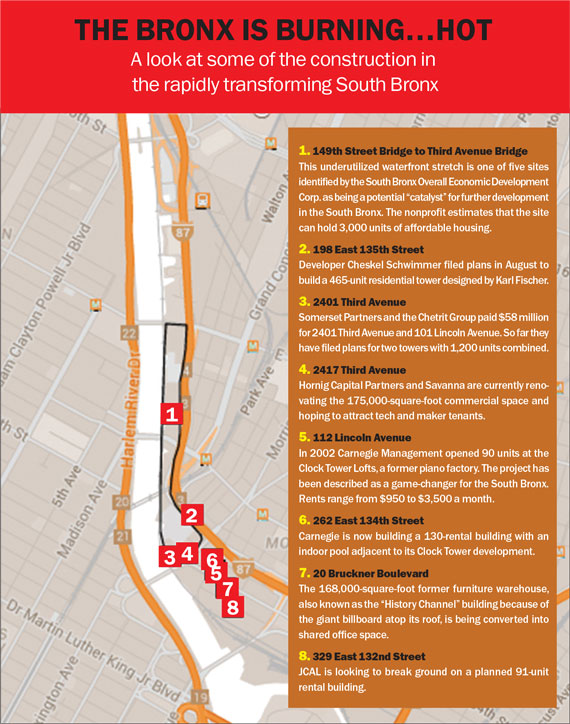

“It’s [only] in the first or second inning,” said Daren Hornig, managing principal of Hornig Capital, which is converting a 170,000-square-foot warehouse at 2417 Third Avenue in Mott Haven into office space for tech and maker tenants.

“This cycle, the theoretical balloon is being squeezed [as tenants are priced out of other locations]. We’re finding a lot of commercial tenants from Manhattan are knocking on our doors and want to relocate,” he added.

“This cycle, the theoretical balloon is being squeezed [as tenants are priced out of other locations]. We’re finding a lot of commercial tenants from Manhattan are knocking on our doors and want to relocate,” he added.

For many, the growth of deep outer-borough neighborhoods like Bay Ridge and Bedford-Stuyvesant gave investors the push they needed to gaze north. “The contagion in Brooklyn let people have the leap of faith to go to the Bronx,” said Packes.

Land costs hover around a modest $50 per foot, compared with $638 in Manhattan, according to Ariel Property Advisors, which is active in the Bronx. For comparison, the average land price is $233 per foot in Brooklyn and $168 in Queens.

The housing stock in the Bronx is also appreciating rapidly.

The average value of a multifamily unit there is nearly $127,800, according to Ariel Property, up from almost $108,600 last year and just under $93,800 in 2013.

“There are definitely a new list of buyers in the Bronx that see potential in the market and are priced out of areas in Upper Manhattan and other markets,” said Westwood Realty Associates’ Steven Vegh, who brokered several Bronx deals this year.

Bronx cap rates remains high — 5.93 percent compared with 3.72 percent in Manhattan and 4.84 percent in Brooklyn, according to Cushman & Wakefield — and investors who bought two years ago are already seeing big returns.

For example, Azure Partners bought a 274-unit rental building at 1749 Grand Concourse for $35 million in 2012 and recently sold the property for $50 million to Brooklyn-based landlord Paradise Management.

With a low basis, investors are able to pencil out market-rate rentals in the Bronx, unlike in Manhattan where land prices necessitate pricey condos. “It’s a bargain in comparison,” said Cushman & Wakefield’s David Simone. Earlier this year, Simone represented Cheskel Schwimmer, who paid $15.47 million for a site at 198 East 135th Street in the South Bronx. “He invested in waterfront properties in Brooklyn and saw that people were being priced out of Brooklyn,” Simone said.

Video created by Uldis Dirnens

Amassing assemblages

While affordable housing developers are often first to see a neighborhood’s potential, largely because of land prices, smaller developers are now proving that certain Bronx neighborhoods can support market-rate housing.

“People are taking the first steps into the pool without the Floaties,” said Eli Weiss, managing director of Joy Construction, referring to government subsidies that historically facilitated affordable housing development.

JCAL Development Group, an active affordable housing developer in the Bronx for more than a decade, turned a vacant lot at 55 Bruckner Boulevard into four market-rate rental units in 2012. More recently, JCAL principals Josh Weissman, Neil Weissman and William Bollinger bought 135 and 136 Alexander Avenue, which are under construction and will have 18 units and 20 units, respectively. JCAL is also looking to break ground at 329 East 132nd Street, where plans call for 91 market-rate rental units.

According to Packes, ambitious developers often start piecing together large assemblages once they see smaller projects take off.

From left: William Bollinger and Joshua Weissman, both of JCAL Development Group

“They will start picking up pieces, knowing they can always trade off to someone [else],” said Packes.

According to an analysis of deeds and transfer records by Packes’ firm for The Real Deal that is what’s happening in parts of the Bronx right now. By her tally, nine assemblages — defined as four or more lots — totaling more than 5 million square feet have been cobbled together since 2011.

During that time, for example, Simon Bergson’s Manhattan Beer Distributors purchased several parcels totaling 3.3 million square feet at a site on East 149th Street. Controversial Greenpoint developers Joshua and Jack Guttman, the father-son duo who developed the Brooklyn Expo Center, have also pieced together a 487,000-square-foot assemblage in Hunts Point, comprised of seven parcels at 1155-1165 Randall Avenue, 611 Truxton Avenue and 620-636 Truxton. Meanwhile, Enclave Equities, which has developed townhouses in Brooklyn and properties in Massachusetts, has amassed 172,471 square feet on 4643 Furman Avenue, 4644 White Plains Road and 700-714 East 241st Street in Wakefield.

Big money moves in

Institutional and other big-money players have also recently jumped into the Bronx fray — or are seeking opportunities to do so. Related Companies, the driving force behind Hudson Yards, has deployed its $300 million equity fund to acquire workforce housing in the borough. Last year, the firm paid $66 million for a 355-unit rental building at 2001-2045 Story Avenue, and in 2013 the developer bought up 35 rental buildings for $270 million.

Meanwhile, Scott Rechler’s RXR Realty, which paid $1.2 billion for 230 Park Avenue this year, is actively hunting for opportunities in the South Bronx. And Savanna, the private equity fund that was early to invest in Midtown South and Downtown, is partnering with Hornig at 2417 Third Avenue.

“Many sources of private and institutional capital are reaching out to us to better understand investment opportunities in the Bronx,” said Daniel Parker, a senior vice president at Hodges Ward Elliott and former Related executive. “We are showing new investors that the Bronx multifamily investment metrics look appealing… Investors compare those same metrics to Upper Manhattan, Brooklyn or Queens and on a relative basis the Bronx looks very attractive.”

On a recent afternoon, as sun streamed through 11-foot windows at 2417 Third, Hornig noted that in the wake of the financial crisis, he made a conscious decision to focus on the outer boroughs. Hornig said he’s doing five projects in the Bronx — though some of those he declined to disclose exact addresses on, including one he described as a 220,000-square-foot market-rate residential development in the South Bronx.

“The Bronx has always been the redheaded stepchild of the five boroughs from a development standpoint,” he said, adding that the perception is changing in part because of “unjustifiable” prices in other parts of the city.

“It’s pretty much a herd mentality,” Hornig said, describing the current rush to invest in the Bronx. “As people report more deals happening … people are looking for that next frontier.”

Even developer Gary Barnett, who sold a $100 million penthouse at One57, his ultra-luxury tower on Billionaire’s Row, appears to be bullish on the Bronx.

Last month, Extell Development Company scooped up the former Whitestone Multiplex Cinemas at 2505 Bruckner Boulevard for $41 million from David Lichtenstein’s Lightstone Group, which paid $30 million for the site in 2012.

And on the other side of the borough, along the Grand Concourse, the Bronx’s main thoroughfare, landlords are swapping buildings at breakneck speed, upping the price tag with each trade.

Last year, longtime Bronx landlord Marc Goldfarb paid $27.8 million for 1770 Grand Concourse from the Bronx-Lebanon Hospital Center, up from $6.2 million in 2004. Goldfarb Properties renovated the building into 185 rental units, with one-bedrooms going for more than $1,700 and two-bedrooms asking almost $2,000.

Nearby, Eli Bleeman’s New Jersey-based Asden Properties bought 1777 Grand Concourse (170 units) for $25.6 million — a $10 million-plus markup over its 2012 sales price.

Who’s selling?

There are 51 development sites for sale in the Bronx, ranging from privately owned buildings to air rights and underutilized lots. One such site, a large parcel currently filled with a massive pile of dirt, sits just south of the 149th Street Bridge that connects Manhattan and the Bronx. “[That site is] a big problem for us. People coming to the Bronx, it’s the first thing they see,” said Wilhelm Ronda, director of planning and development for the borough president’s office, as the trolley drove by the unsightly parcel.

From left: Loew’s Paradise Theatre on Grand Concourse and former furniture warehouse known as the History Channel building

In many parts of the borough, including the South Bronx, properties belonging to business owners haven’t changed hands in decades. But those owners are growing increasingly eager to sell to the developers knocking on their doors.

“Business owners and investors who have the properties rented out to different tenants have seen the values spike,” said Eastern Consolidated’s Simone, who noted that monthly residential rents (around $35 per foot) outweigh retail rents ($25 to $35 per foot).

He said there are many parking lots and one-story industrial buildings where the highest and best use is for development.

In some cases, businesses are partnering with developers to reap the rewards of residential development. For example, Yates Restoration, a family-owned firm that repairs building facades, owned a small lot at 131-133 Alexander Avenue, adjacent to a parcel at No. 15 that JCAL owned. The neighbors formed a joint venture to develop a single residential building on the two plots.

Although there’s no evidence of widespread land speculation, several property owners who invested in the Bronx in recent years are now cashing in on their investment.

This spring, JPMorgan Chase and Continental Properties put their 13-building residential portfolio on the market with an asking price of $90 million, a significant premium over the $56.7 million they paid for the 612-unit portfolio eight years ago.

Similiarly, Galil Management, formerly E&M Associates, nearly tripled its money at 975 Watson, which sits on the Soundview waterfront. The Brooklyn-based landlord sold a rental building there for $31 million, after paying roughly $11 million in 2010.

South Bronx surge

Situated on the Harlem River a single subway stop past Manhattan, the South Bronx looks a lot like Williamsburg, Red Hook and other industrial waterfront neighborhoods that became magnets for investment. Past the bodegas and auto repair shops, Bruckner Boulevard is at the heart of a neighborhood in transition, and today, vibrant murals cover concrete walls. It’s hard to walk more than two blocks without bumping into a construction site or “coming soon” sign.

In March, Keith Rubenstein’s Somerset Partners and Joseph Chetrit’s Chetrit Group shelled out $58 million for two waterfront sites, 2401 Third Avenue and 101 Lincoln Avenue, where they are planning 1.2 million square feet of development and up to six 25-story residential towers.

That deal jump-started more investment.

“That was the barometer for everyone else who might not have had this on their radar screen,” said JCAL’s Bollinger. “Everyone looking for the next hot area —all of a sudden, their eyes opened.”

Those searching for sites should have plenty to choose from.

As many as 8,500 units could be developed along the Harlem River waterfront by 2040, representing more than $3 billion worth of investment, according to a forthcoming study by SoBRO, a nonprofit that’s working to spur development in the South Bronx. The report, set to be released in late November, also identifies five “catalyst sites,” which could be key to bringing additional development to the area, including 101 Lincoln, part of Somerset and Chetrit’s assemblage.

During a recent walk through that Mott Haven site, Rubenstein said his office at 450 Park Avenue faces north and he often gazed toward the Bronx from his Midtown perch. In 2013, he walked around the neighborhood and instantly saw potential.

“When I came across the two sites, I said to myself, ‘This is the next great place to live and I don’t want to be the developer who said I could have bought this 10 years ago,’” he recalled. “I had a vision right away for what it could become.”

Sitting on the Harlem River, Mott Haven — which is bounded by 149th Street to the north, Willis Avenue to the west and St. Ann’s Avenue to the east — has become a development hub.

Within a 20-block radius, low-slung warehouses and vacant lots are giving way to new construction. Around the corner from Somerset and Chetrit’s project, Schwimmer has plans to build a 25-story, market-rate residential building with 465 units at 198 East 135th Street. In addition, Carnegie Management, which in 2002 converted a former piano factory into Clock Tower Lofts at 112 Lincoln, is looking to break ground this winter on a second building with 130 units at the corner of Alexander Avenue and 134th Street. Currently, an 800-foot one-bedroom at the original Clock Tower building rents for $1,950 a month.

In addition to their residential development, Somerset and Chetrit have five additional sites tied up, some under contract, some leased, where they plan to bring in five restaurants, two art galleries and a sports bar.

Eastdil Secured’s Doug Harmon, who was involved in the deals, said land values have tripled in the South Bronx since Somerset and Chetrit stepped in. The area, he said, is like a “diamond in the rough.”

“It just took someone to put a big flag down there,” Harmon said. “This is such a low basis that even if you held it and incubated it, you’d sell for five times what it’s worth in five years.”