The first big flip in recent memory seemed too good to be true.

Russell Weiner, the billionaire founder of Rockstar Energy Drink, sold two North Palm Beach homes for more than $48 million — $15 million, or 45 percent more than he paid to acquire the properties from Swedish model Elin Nordegren just one month earlier.

That was the fall of 2020.

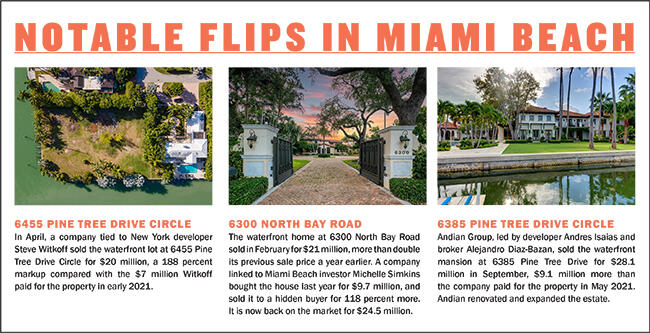

Since then, buyers of multimillion-dollar properties across South Florida have fielded offers from brokers and their clients to make a quick profit and walk away from their homes. Some do it intentionally, like billionaire casino magnate Steve Wynn, while others stumble into major windfalls.

The result: flipping fever is spreading across South Florida’s luxury market. Yet, after astronomical sale prices in the waterfront market, buyers may be becoming less eager to overpay.

“We definitely see pricing hitting its peak,” said Milla Russo, an agent with Illustrated Properties in Palm Beach County. “It depends on the location and the supply and demand.”

The biggest deals are for properties in Palm Beach and Miami Beach, but flips are occurring almost everywhere. What was previously seen as risky is now considered a safe investment strategy, as prices continue their upward climb and sales volume soars, brokers say.

A proliferation of off-market sales of luxury single-family homes has helped fuel that, said Jay Parker, CEO of Douglas Elliman Florida.

“There is this cachet in the market with off-market because the buyer thinks at least there’s some more juice in the deal,” Parker said. In other words, the buyer thinks they got a good price, and can turn it around for a good return.

In many cases, buyers are paying cash. And luxury buyers “don’t really look at the prices,” said Russo of Illustrated Properties. She is seeing new-to-market buyers who are end-users, and investors who are looking to make a quick buck.

“They don’t rely on appraisals. They are [making] cash offers,” Russo said.

“We’ve had a few clients who come from up north looking for real value. They move in and decide that’s not where they want to live,” she said. “They bought it sight unseen, and they turn around and sell it.”

Flipper’s market

Spec home developer Todd Michael Glaser has flipped more than a handful of properties over the past year.

Todd Michael Glaser (Photo by Sonya Revell)

Glaser and his partners paid $12.6 million for the oceanfront home at 870 South Ocean Boulevard in Palm Beach in early 2021, and sold it while it was under construction. Before the expansion of the four-bedroom, 6,124-square-foot house into a six-bedroom, 7,589-square-foot home, a buyer approached him to pay $28.5 million for the property, Glaser said. The deal closed in July.

Glaser also flipped a Palm Beach estate that he planned to keep as his “forever home” for nearly $32 million to cardiologist Dr. Robert Fishel in February. Glaser paid $23.8 million for the mansion at 210 Via Del Mar in May of last year.

“There’s people everywhere flipping shit,” Glaser said, pointing to Wynn, developer Steve Witkoff and others.

As former President Donald Trump told a crowd of more than 3,500 attendees at a Grant Cardone conference in March, Wynn flips as a hobby. The billionaire mogul’s recent sales include a waterfront Palm Beach home for $32 million, one year after paying $24 million for the house and completing some renovations, including a new kitchen and bathrooms.

“He will buy a house, fix it up a little and sell it. He doesn’t need to do it, but he likes it,” Trump said.

In March, Tommy Hilfiger and his wife, Dee Ocleppo Hilfiger, sold the non-waterfront home at 244 Fairview Road in Palm Beach to Fox News host and political correspondent Bret Baier for $12 million, $3 million — or 33 percent — more than the Hilfigers paid for the property a year earlier.

Palm Beach has become a foolproof market. The median price of single-family homes on the small island jumped 51 percent to about $10 million in the first quarter, according to the Elliman reports, prompting some to ask if pricing has peaked.

“No, nothing is too high,” Glaser said. “At this point, the market has legs. It has a good foundation. People buying into it are very wealthy people.”

Glaser even managed to flip the property previously owned by the late convicted sex offender and financier Jeffrey Epstein. After paying $18.5 million for the estate at 360 El Brillo Way in Palm Beach in March 2021, Glaser demolished the house and sold the waterfront lot to venture capitalist David Skok for $25.8 million seven months later.

In Miami Beach, Glaser partnered with broker Nelson Gonzalez to buy the Palm Island home that once belonged to the late mobster Al Capone for $10.8 million in August. They planned to demolish the house, but after a public outcry over the demolition of the circa 1922 home, they were able to flip it within a month for $15.5 million, an increase of over 40 percent.

And Gonzalez recently represented Anatomy Fitness owner Chris Paciello in the flip of a waterfront Sunset Islands home on the Sunset Islands. Paciello paid $9.3 million for the property in March, and sold it one month later for $14 million, records show.

From single-family homes to condos

In October 2020, Miami Beach investor and developer Greg Mirmelli declared the city “the hottest place in the whole world” when he sold a waterfront home on the Sunset Islands for $18 million, following a bidding war. The buyer was David Lindsey, founder and CEO of a security systems company that ADT bought in 2020. (Mirmelli paid $5.7 million for the home in 2007.)

It would get hotter.

In March of this year, Lindsey sold that house at 2120 Bay Avenue for $33 million. That’s $15 million or 80 percent more than he paid less than two years earlier.

“Someone comes along and they offer these really aggressive offers, and you’re sort of like, how do you not entertain these offers?” said Parker of Elliman, referring to the overall market.

Waterfront single-family homes have gotten so expensive that buyers are looking at dry properties and condos, brokers say.

In Miami-Dade County, luxury single-family home sales fell about 4 percent in the first quarter to 667 sales, compared with the first quarter of 2021, according to the Keyes/Illustrated Luxury Report. Luxury condo sales, meanwhile, increased 43 percent to 837 closings.

“Buyers were a little bit more open to meeting a seller’s request in the last 18 months,” said Dina Goldentayer, a top agent at Douglas Elliman, regarding waterfront single-family homes. “Now some of the sellers, their pricing requirements are so absurd it’s not easy to convince the buyer to meet that number. Buyers are OK to wait.”

Escalating demand for condos caught some by surprise, including One Sotheby’s International Realty agent Eddy Martinez. Martinez and his partner Roland Ortiz’s clients, Jeff Herzog and his wife Jill, paid $8.4 million for unit 1201/1202 in the south tower of the Continuum in South Beach in October. The Herzogs decided it wasn’t the right fit and listed the unit for sale.

“He thought he would be lucky to break even,” Martinez said of Herzog. It was listed in February for $10 million, then the price increased to $10.5 million.

“Demand was so high, we were really able to push the envelope. We did not think that that would happen,” Martinez added. Related Group Development CEO Steve Patterson ended up buying the unit for $10 million, a 19 percent increase from the Herzogs’ purchase price.

That deal created a new record in that tower, prompting another client of Martinez’s to buy a unit in the north tower for $6.3 million at the end of March. That buyer now has it under contract to flip for $8.8 million, or 40 percent more, in just over a month. The sale is expected to close in early May.

“When we saw it happen with [unit] 1201, I guided the investor to this unit in the north tower that no one wanted to buy, and told him ‘I think you can trade this successfully around the $7.5 million range,’” Martinez said. “Once he closed I started showing it. Sure enough as soon as I raised it to $8.9 million, someone paid $8.8 million.”

Non-waterfront homes are also increasingly setting records. Compass agent Angel Nicolas was involved in the off-market, $7 million sale of a property in the Ponce Davis neighborhood, near Coral Gables. It then flipped for the full asking price of $7.9 million within six months.

Another non-waterfront house in Coral Gables that sold for $3 million in 2020 traded in April for $8.9 million. He represented the seller, who only changed the flooring.

Said Nicolas: “Nothing surprises me in this market anymore.”