One day in 2018, McConnell Dorce discovered that the Brooklyn building he’d owned for four decades was no longer his. The city had transferred it to a company some time ago.

Dorce had bought the four-unit rental building on Rockaway Parkway in 1977. It was a source of pride for the Haitian immigrant. He knew he was behind on water and sewer bills, but believed he was on an installment plan to pay them off.

“He went to pay his bills in 2018, and they wouldn’t take his money. He didn’t understand why,” said Yolande Nicholson, an attorney representing him.

Dorce and two other property owners have sued. They are seeking class-action status to challenge New York City’s third-party transfer program, which seizes distressed properties with overdue taxes or fees and hands them to developers.

The program was created in 1996 to relieve the city from managing abandoned buildings. Later, complaints mounted that it disproportionately affects communities of color and allows the city to seize property worth far more than the delinquency.

To critics, it seemed cruel and ironic that people who had overcome decades of discriminatory policies to become homeowners would find themselves back in the rental market and their equity gone.

The program is not simply a giveaway to developers. They are handed a money-making asset, but with strings attached. They must renovate an occupied building, often with tenants who are not cooperative. The upside is minimal because once repairs are complete, rents are limited by New York’s rent stabilization law, and as units become vacant, they are reserved for low- to moderate-income tenants.

Third-party transfer is at a crossroads. Proponents consider the program a critical housing preservation tool that motivates property owners to pay their bills. Detractors believe the city is wrongfully seizing property without just compensation. While the city contemplates its future, the program is on hold.

Recommendations to reform it, released nearly two years ago, have gathered dust. The last round of property transfers was in 2018, and given the criticism, Dorce’s lawsuit and a recent U.S. Supreme Court decision, the program is likely to be overhauled before it is revived. The Department of Housing Preservation and Development, which administers third-party transfer, said it looks forward to working with the City Council in the “near future” to review the recommendations.

Meanwhile, the city is fighting the lawsuit. “The city is looking at the third-party transfer program to see where reforms might be made to ensure the program advances the goal of helping New Yorkers access safe, high-quality, affordable housing,” a spokesperson for the Law Department said.

Government seizure of property has been controversial since it began, and not infrequently attracts the attention of the U.S. Supreme Court. In May, the high court ruled that the government must pay owners the difference between the value of the condemned property and what was owed on it. Dorce’s lawsuit and others have argued that the city must also compensate owners for the equity in their properties.

The third-party transfer program is at the center of several debates in the city about how to preserve deteriorating housing stock and what companies can be entrusted with such work.

Properties, owners in distress

One family nearly lost its Crown Heights brownstone over a $4,000 water bill — that it had paid.

The Dean Street property, owned by Marlene Saunders, was not distressed. But it was pulled into the third-party transfer program in 2018 because of another property on the block.

When city officials found a property in distress and with a high enough tax delinquency, they sometimes seized non-distressed buildings on the same block if they also had unpaid taxes. That made rehabilitation and conversion to affordable housing more efficient than doing one small property at a time.

But it made no sense to the Saunders family.

“We were just confused, hurt. How could this property be taken from us?” said Brian Saunders, whose mother, a retired nurse, had bought the building in 1984.

Elected officials eventually intervened and HPD reversed course, saying a clerical error had occurred, PoliticsNY reported at the time.

But Saunders said the experience took a toll on his mother’s health and has made him more wary that the city could wipe away hard-earned, generational wealth.

“Just to know that your mom and dad worked to just achieve some kind of wealth and foundation,” he said. “It still gives me chills.”

The Saunders property was among 420 the city identified as eligible for third-party transfer in 2015, in the 10th round of the program. Only 65 of those were ultimately transferred. The City Council, which has the final say on transfers, in 2018 voted down at least 20, many of which were instead awarded a tax break known as Article XI to pay for renovations. Others paid off their arrears in time to escape the program.

“You can’t reform something that is fundamentally unconstitutional.”

Round 10 drew a lot of criticism and inspired the formation of a working group to redesign the program. Building owners said the city failed to adequately notify owners facing foreclosure and concentrated the seizures in neighborhoods of color. Of the 420 properties, half were in 11 neighborhoods and the highest number was in Bushwick and Crown Heights, a City Council committee found.

Opponents of the program say many of the buildings it targeted were in rapidly gentrifying neighborhoods, meaning that owners stood to lose properties just as their values were soaring.

A property is considered distressed if it has a tax lien worth 15 percent or more of its value and either it averages five or more hazardous violations per unit or HPD has paid at least $1,000 for emergency repairs.

Nondistressed properties on the same block can be sucked into the program if they have owed $1,000 or more for one year, or three years for condos and co-ops. HPD appears ready to scrap that feature, but not the entire program.

“The block pickup has not performed in a manner that supports the goals of the program, and as the working group recommended, we should consider new selection criteria that index financial and physical conditions,” Kim Darga, a deputy commissioner at HPD, said in a statement.

Soon after becoming commissioner of the agency in 2019, Louise Carroll acknowledged that the agency was willing to revisit how properties are selected.

“I think it needs to strike the balance between ownership rights of property owners and tax collection,” Carroll, a lawyer now in private practice, said in a recent interview.

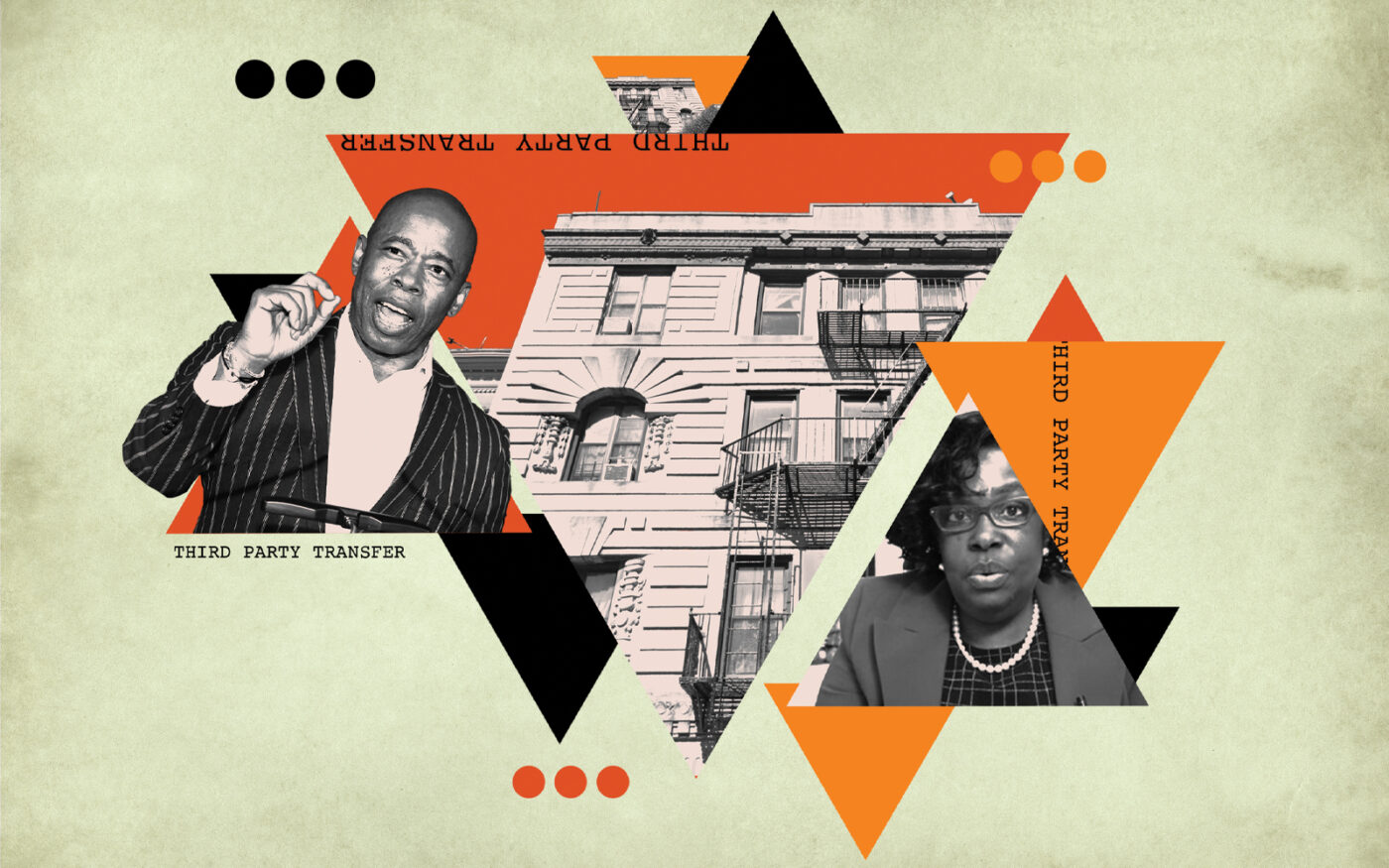

When he was Brooklyn borough president, Mayor Eric Adams was critical of the program and its effect on working-class families — calling it “racist” and demanding an investigation. He had Dorce speak about his experience with third-party transfer at a press conference in 2018.

“What they’re doing to Black and brown property owners is malfeasance at best,” he said at a press conference the following year, Bkylner reported. “There is a clear conspiracy to remove homes from Black and brown people, and we need to call it the way it is and not try to sugarcoat it.”

But the program has its defenders. They see it as an essential preservation tool.

“It actually focuses on a population of properties that need intervention,” said Salvatore D’Avola, executive director of Neighborhood Restore, a nonprofit that has shepherded 594 buildings through the program since 2001. “I think there are buildings and there are landlords who are not providing services to their tenants. They are milking those buildings.”

He said that most often, the buildings are in distress. Some have hundreds of violations.

Neighborhood Restore acts as an intermediary for the city, stabilizing properties and addressing immediate needs, such as broken windows or heating systems, before the new owner takes control. Properties are initially transferred to Neighborhood Restore, then turned over to a developer that has financing in hand for renovations.

“This is a program of last resort,” D’Avola said. “It is not one that people go into willingly. The city does not want to foreclose on owners.”

No pot of gold

Developers are handed their properties sight unseen, which can present unexpected challenges. In one instance, a developer found a woman with Alzheimer’s struggling to grapple with relocation and helped pack her belongings.

One developer in Brooklyn had to deal with an occupant who would not leave. They eventually worked things out, and the occupant was able to return to a rehabilitated apartment.

Developers don’t do third-party transfer for the money, according to those who spoke with The Real Deal. Projects are funded through low-interest loans and city subsidies, so developers make something but don’t get rich off this program, one said.

“I don’t think anyone makes a lot of money off of third-party transfer projects,” noted Bernell Grier, executive director of IMPACCT Brooklyn.

Larry Hirschfield, head of ELH Mgmt., said that his company enjoyed providing affordable housing to city tenants and restoring neighborhoods as well as once-beautiful architectural gems.

“We’re here to help,” Grier said. “It’s definitely not a project where you’re getting huge developer fees, and so it is very much mission-driven.”

There isn’t a formal bidding process for the program; instead, HPD handpicks pre-qualified developers from a list. It doesn’t hurt to be seen by the agency as trustworthy and devoted to maintaining affordable housing.

Developers receive not just fees but rent, and come into possession of a finite asset: New York City buildings. Rent stabilization limits profits, though.

Scott Short described the program as a “mission-centric activity” for the nonprofit he runs, Brooklyn-based RiseBoro Community Partnership. “We’ve got to remember that at the root of this are tenants who are suffering through really bad conditions,” he said.

“We were just confused, hurt. How could this property be taken from us?”

Nevertheless, Short said, higher developer fees would help recognize the immense labor that goes into the rehab projects, which can take three or four years. Elimination of the block-pickup rule, in contrast, would erode developers’ bottom lines because many of the buildings selected for third-party transfer are small and do not offer economies of scale.

“The smaller the clusters are, the less developer fee you earn because it’s based on total development costs or total units that you are redeveloping,” Short said, adding that cluster sizes are trending downward.

Fees for nonprofits using the Participation Loan Program, typical of third-party transfer projects, are capped at $10,000 per unit.

Another downside for developers is the perception that the program is racially discriminatory and unfairly takes properties that are sometimes the owners’ main source of wealth. Developers also often encounter tenants who have not been told what is happening.

“If there was a way to directly communicate with the residents in the building … it would be more helpful,” Grier said.

The communication gap is especially pronounced in some Housing Development Fund Corporation cooperatives, which accounted for 27 of the 65 foreclosures in the last round of third-party transfers. The co-op boards are supposed to relay messages from the city to shareholders and tenants, but that doesn’t always happen.

John McBride, a member of the HDFC Coalition, said that many of these buildings, offloaded by the city decades ago, were “in extreme disrepair” when residents took control. He said most HDFC co-ops that succeeded only did so through “tremendous determination and sweat equity.”

“Why weren’t the funds for rehabbing buildings made available to the co-ops? Doesn’t the city want to preserve and expand home ownership?” McBride said in an email. “Taking homes away from people doesn’t further that objective, and in fact causes destabilization of neighborhoods and communities.”

Courts weigh in

In 2019, a state judge vacated foreclosures of six properties in the third-party transfer program. The judge found some owners targeted by the block-pickup rule were not given adequate notice.

The judge found the city improperly foreclosed on 25 MacDonough Street, a 19-family, rent-stabilized building in Brooklyn’s Bedford-Stuyvesant neighborhood, as the owners were paying off $120,749 in overdue property taxes under an agreement with the Department of Finance.

The arrears were “minuscule” compared with the estimated $3 million value of the property, the judge wrote, adding that such examples were not isolated but rather a “widespread occurrence being experienced by many property owners, who are being inequitably stripped of their valuable property rights.”

The judge also noted that the owners lacked the opportunity to recoup their equity.

That issue was at the heart of the Supreme Court case, Tyler v. Hennepin County. The court ruled that the Minnesota county had wrongfully pocketed all $40,000 from the sale of 94-year-old Geraldine Tyler’s condo unit, which had been seized for a $15,000 debt.

It is unclear whether the decision will influence any reform of New York City’s transfer program. The city does not receive payment for the properties it seizes and has held that it provides ample notice and opportunity for owners to keep their assets.

In response to the Hennepin case, New York state’s legislature this spring passed a bill temporarily barring jurisdictions from foreclosing on properties for delinquent taxes, unless they already have a system in place to return surplus funds to owners. Attorneys in Dorce’s lawsuit believe the Supreme Court decision bolsters their case.

The MacDonough Street property, however, also demonstrates why third-party transfer has fans. Two years after the judge spared the apartment building from foreclosure, tenants sued the owners, alleging “shoddy” electrical wiring, unclean hallways and pest infestations. This March, the owners were hit with a $2 million judgment for unresolved hazardous violations. And HPD filed a complaint in July alleging the building lacked hot water.

ELH’s Hirschfield pointed out another rationale for third-party transfer: If a property went through a traditional foreclosure instead, there would be no affordable housing requirement.

Looking to the future

Despite the controversies, people involved in the program still see a future for it.

Robert Cornegy, an ardent critic of the program during his tenure as a City Council member, said he had seen tenants benefit from the program and called its intent “laudable.”

Cornegy suggested increasing the unit threshold for buildings to qualify for the program and giving local politicians more time to intervene.

Grier, of IMPACCT Brooklyn, suggested using a racial equity lens to evaluate the program and its effects on communities of color.

The city has not released its plans for the program, but it may be guided by the 2021 recommendations from the working group, which Cornegy led. They included adjusting payment plans for owners, increasing outreach before foreclosure initiations and creating a hub to provide owners with financial and technical support.

The group also recommended allowing transferred properties to become community land trusts and permitting HDFC co-ops to remain co-ops, rather than be converted to rentals.

But attorneys in the proposed class action assert that the program is not salvageable.

“You can’t reform something that is fundamentally unconstitutional,” Nicholson said. “The city needs to come to terms with the fact that it is untenable.”

The city has also paused its other program that deals with financially delinquent properties — an annual tax lien sale — for similar reasons, but has indicated that it will change and restore it sometime this year.

That is probably third-party transfer’s destiny as well. Just because the program has problems doesn’t mean it needs to be scrapped, Cornegy argued.

“You don’t throw out the baby with the bathwater,” he said.

Read more