Over the past decade, Craig Robins’ Dacra and his well-heeled partners have spearheaded the transformation of the once-gritty Miami Design District into a luxury shopping destination and cultural hub.

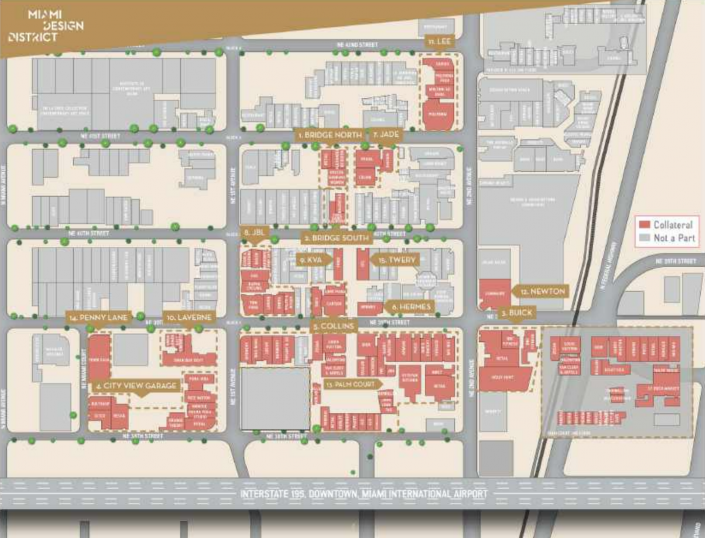

Last February, the ownership group achieved a major milestone when it secured a 10-year, $500 million refinancing from Bank of America for a 15-building, 497,000-square-foot portion of the Miami Design District known as Oak Plaza. But just weeks later, the coronavirus pandemic changed everything.

The properties were closed from mid-March to mid-May due to coronavirus restrictions, and again for 10 days in June “due to civil unrest,” although no damage occurred, according to loan documents. The landlord provided millions of dollars in rent abatements to tenants, and also secured loan modifications to defer three months of debt service.

While the pandemic has put other projects in the Miami Design District under severe financial pressure, observers expect the Oak Plaza properties to come back strong.

“Oak Plaza is well positioned to return to its strong pre-pandemic performance given the high-quality, luxury nature of the retail tenancy and targeted clientele coupled with experienced long-term institutional sponsorship,” a recent DBRS Morningstar report observed. “However, the property is likely to continue to experience stress in the short and medium term until the pandemic fully abates, the economy recovers and international travel resumes.”

Miami-based Dacra began aggregating land for redevelopment of the Miami Design District in the 1990s, and in 2010 partnered with L Catterton Real Estate for phase one of the project, which was completed in 2012 according to the loan prospectus.

General Growth Properties and Ashkenazy Acquisition joined the partnership in 2014. GGP bought out Ashkenazy’s stake in 2018, and was itself bought out by Brookfield Property Partners soon after. Currently, Dacra and L Catterton each have a 38.75 percent stake in the partnership, while Brookfield has 22 percent.

Starting last month, pieces of the $500 million financing have been included in a number of CMBS transactions. Documents associated with these securitizations provide an inside look at the property’s finances — and how it has responded to the pandemic.

As of September, the Oak Plaza properties were 88.5 percent occupied by 86 tenants. Overall, tenants have an average underwritten annual rent of $78 per square foot, with retailers typically paying triple digits while showroom tenants pay somewhat less.

By total rent paid, Hermès is the top tenant in the portfolio, paying $113 per square foot for a 13,500-square-foot building on Northeast 39th Street, in the heart of the district. The second-priciest lease goes to jeweler Harry Winston, which pays $209 per square foot for 7,200 square feet in the Palm Court building across the street from Hermès.

By square footage, the largest leases are for luxury furniture retailers Holly Hunt and Fendi Casa/Luxury Living, each paying about $50 per square foot for more than 20,000 square feet in showroom space.

Thirteen of the tenants, including Christian Dior (11,000 square feet), Fendi, Louis Vuitton (10,000 square feet), and Tiffany & Co. (5,000 square feet), are considered affiliates of the landlord because their parent company, French conglomerate LVMH Moët Hennessy Louis Vuitton, owns a stake in the partnership via the investment firm L Catterton.

Read more

In 2019, the properties generated more than $231 million in sales, or more than $1,000 per square foot, among tenants reporting sales. Since the start of the pandemic, the landlord has provided $4.7 million worth of rent deferrals to 35 tenants and $4.9 million in rent abatements to 27 tenants, according to DBRS Morningstar. Eight tenants totaling nearly 30,000 square feet have moved out since March.

Elsewhere in the Miami Design District, Thor Equities is seeking to evict luxury retailer Stefano Ricci over a rent dispute. Private equity firm JZ Capital Partners has written down the value of its investment in a Design District portfolio to zero.

The Oak Plaza properties were redeveloped between 2014 and 2019 from former warehouse, showroom and industrial space. The landlord owns a total of about 20 acres in the Design District, 7.4 acres of which are occupied by Oak Plaza. According to the loan terms, Dacra and partners need lender approval to engage in any future development or leasing activity that could impact the collateral.