The investment sales market went into a slump during the first half of the year, which means one thing for commercial real estate brokers

“We make less money,” said Woody Heller, who heads the capital transactions group at Savills Studley and has seen his share of down cycles in his 30-plus years of brokering property deals.

Citywide, estimated commissions fell more than 22 percent year-over year in the first six months of 2016, according to a new analysis by The Real Deal.

That’s about $370 million worth of commissions on $32.8 billion worth of closed deals in the first half of the year, compared to $476.13 million in commissions earned on $37.9 billion in transactions through the first two quarters of 2015.

Brokers love to talk about their deals, but rarely discuss commissions. TRD calculated them by applying a rate on a sliding scale to the dollar volumes of closed deals in different price ranges. Deals for billion-dollar trophy towers, for example, fetch lower commission percentages than more modestly-sized deals.

Seasoned brokers told TRD that preparing for the days when buyers and sellers are answering fewer calls is as important as preparing for the next big pitch. They know that the party doesn’t last forever.

Still, when the market is down, just about everybody feels the pinch.

“I’ve definitely started working on Plan B, because if transactions fall completely down, there’s not much to do,” said one broker who asked not to be named. “You can do all the dinners in the world, but it’s just sort of laying the seeds for when the market comes back.”

Breaking down the boroughs

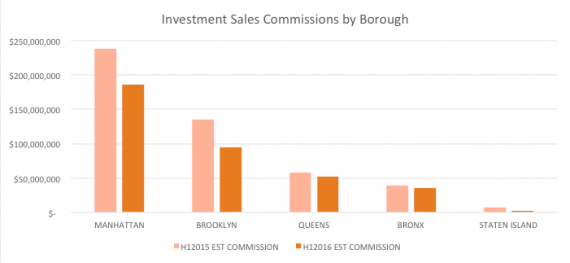

Excluding the relatively small market of Staten Island, commissions took the biggest hit in Brooklyn, where they fell slightly more than 30 percent year-over-year to a total of $94.25 million. That hit especially hard because last year Brooklyn saw record investment sales activity, and most of the city’s major brokerages made a big push into the borough. Manhattan, too, was hit hard, with commissions falling by 21.95 percent to $185.4 million from $237.6 million in the first half of 2015.

How much brokers are exposed depends in part on the asset classes they specialize in. The market for cash-flowing multifamily properties, for instance, appears to still be going strong, while development sites and hotels generally see less action when the market starts to turn downward.

And of course, different brokers will charge different fees.

“I think it’s more about the client than broker,” said Marcus & Millichap’s [TRDataCustom] Nat Rockett. “Institutional clients have one view of what fees are, as opposed to private clients who may be on unfamiliar ground.”

“I think the market’s pretty efficient as far as fees go,” he added.

In Queens and the Bronx, the landscape didn’t look as bad. Each borough saw commissions drop less than 10 percent year-over-year, down to $52.62 million in commissions in Queens and $35.1 million in the Bronx.

And even as deal and dollar volumes start to fall, the slow sales market could be squeezing commissions in another way. Although they are loathe to do it, some brokers will negotiate down the fee they charge on a deal in order to get it across the finish line.

No professional wants to be seen as the “commodity broker” in the market, but when times are tough, it’s sometimes the difference between getting paid and watching a deal wither.

“I think it’s an equal opportunity hardship, in that brokers are sometimes making concessions and owners themselves are making concessions,” said CPEX Real Estate co-founder Tim King. “Reasonable people should be able to.”

Idle days

August is always a slow period, both in good times and bad. But if the market continues to trend downward in the fall and into next year, offices could remain relatively quiet.

There’s the overhead of keeping the lights in the building on, expenses paid on boozy lunches and pricey dinners to woo clients as well as support staff and junior brokers who assist the big dealmakers.

Eastern Consolidated’s Adelaide Polsinelli said compensation for junior brokers varies. It could be a cut of a deal, a percentage of the senior broker’s income or salary.

“It depends on what they bring to the table,” she said, adding that those who show their worth by pitching in when times are slow are often the ones who are still around when the market comes back. “There are positions to take if you’re humble enough to know it’s not always going to be an up market.”

And while things like fees might be up for negotiation, the split between the salesperson and the brokerage are usually not as malleable.

“Splits generally do not get changed,” said Michael Weiser, president of GFI Realty Services. “That’s not to say if someone’s really got their back against a wall, we can’t work a deal out. The top producers generally invested in other things to keep them afloat.”

Maintaining a lifestyle and growing one, he added, are two very different things. If nothing else, when commissions dry up, brokers realize the value of prudent personal finance. Those who learned the lesson when the market was ascending may be around to cash in on the next up cycle. Those who didn’t, on the other hand, might be back to selling insurance in the coming months.

“Income and personal lifestyle was one of the first lessons I learned as a broker, taught to me by folks I still consider my mentors,” said David Schechtman of Meridian Investment Sales. “Live well, well, well within your means – especially during boom times.”

(Research by Eda Kouch for The Real Deal)