(Paydirt is a new weekly column that riffs on the biggest NYC real estate news of the moment, providing analysis and historical context on the deals and players that make this town tick.)

That’s Shvo business: New York real estate is a magnet for dreamers with chutzpah, but even among them Michael Shvo stood out. He moved from Israel with $3,000 and no plan and ended up pioneering a showmanship-heavy approach to selling that helped him break records as a broker. As a developer, he went right for the big fish: splashy condo projects with brand-name architects. Along the way, his signature traits — the custom suits, the swagger, the ruthlessness, the endless swigs of Diet Coke — became part of industry folklore, and Shvo became the guy the industry loves to hate. “In my 20 years in this business,” the Corcoran Group’s Pam Liebman told New York Magazine in 2005, “I have never seen one man inspire such across-the-board loathing.”

So when news broke last week of his indictment on tax evasion charges broke, many reacted with glee. The DA has accused him of skipping out on paying more than $1 million in taxes on his extensive art collection by deliberately misleading auction houses. Shvo [TRDataCustom] plead not guilty to the allegations, and will have his first appearance in court Oct. 19.

We sell for less: How the mighty have fallen. At One57, a seller, Escape from New York LLC, is poised to take at least a $7 million loss on an apartment purchased for more than $7,000 a foot. It’s another instance of an investment gone wrong at the glitzy building: In January, Gloomberg 57, LLC, sold its pad there for $17.75 million, after purchasing it for $20.37 million. (Side note: Buyers at One57 are notorious for their creative aliases, including Platinum Hideaway and Hebrews 3:4).

Though the past few months have seen sellers and sponsors slash asking prices on trophy pads, this is much more telling: If sellers are willing to actually lose money on a deal, it could be a sign that they believe values are going to tank even more.

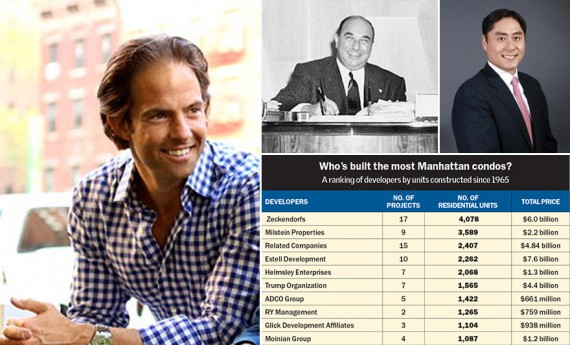

Who built New York?: Developing a great project, the late Bill Zeckendorf once said, “is a bit like building a road through mountain country; around every bend there is a surprise, and a great part of the excitement and interest in a development, aside from its conception, lies in the challenge of finding new ways around the many difficulties that crop up.” Zeckendorf certainly faced his share of challenges, including multiple bankruptcies, but the legacy he created helped his family firm become New York City’s most prolific condo developer of the last 50 years, according to a first-ever ranking by TRD. Since 1965, the Zeckendorfs have brought more than 4,000 Manhattan condo units to market.

Many of the developers who made the cut, including the Trump Organization, are largely out of the condo game today. Others, such as Related and Extell, continue to make big bets.

Chung nears deal for Brooklyn’s tallest office tower: After 15 years at the Carlyle Group, Andrew Chung struck out on his own to form Innovo Property Group last January. He’s been busy, partnering with several different firms on major acquisitions. Last August, Chung and Artemis Real Estate Partners paid $44 million for a Chinatown retail condo. In March, he teamed up with Westbrook Partners to buy a Long Island City warehouse for $195 million. And now, in partnership with San Francisco-based fund DivcoWest, he’s making a play for SL Green Realty’s 16 Court Street, Brooklyn’s tallest office tower.

(Read more from Paydirt here)