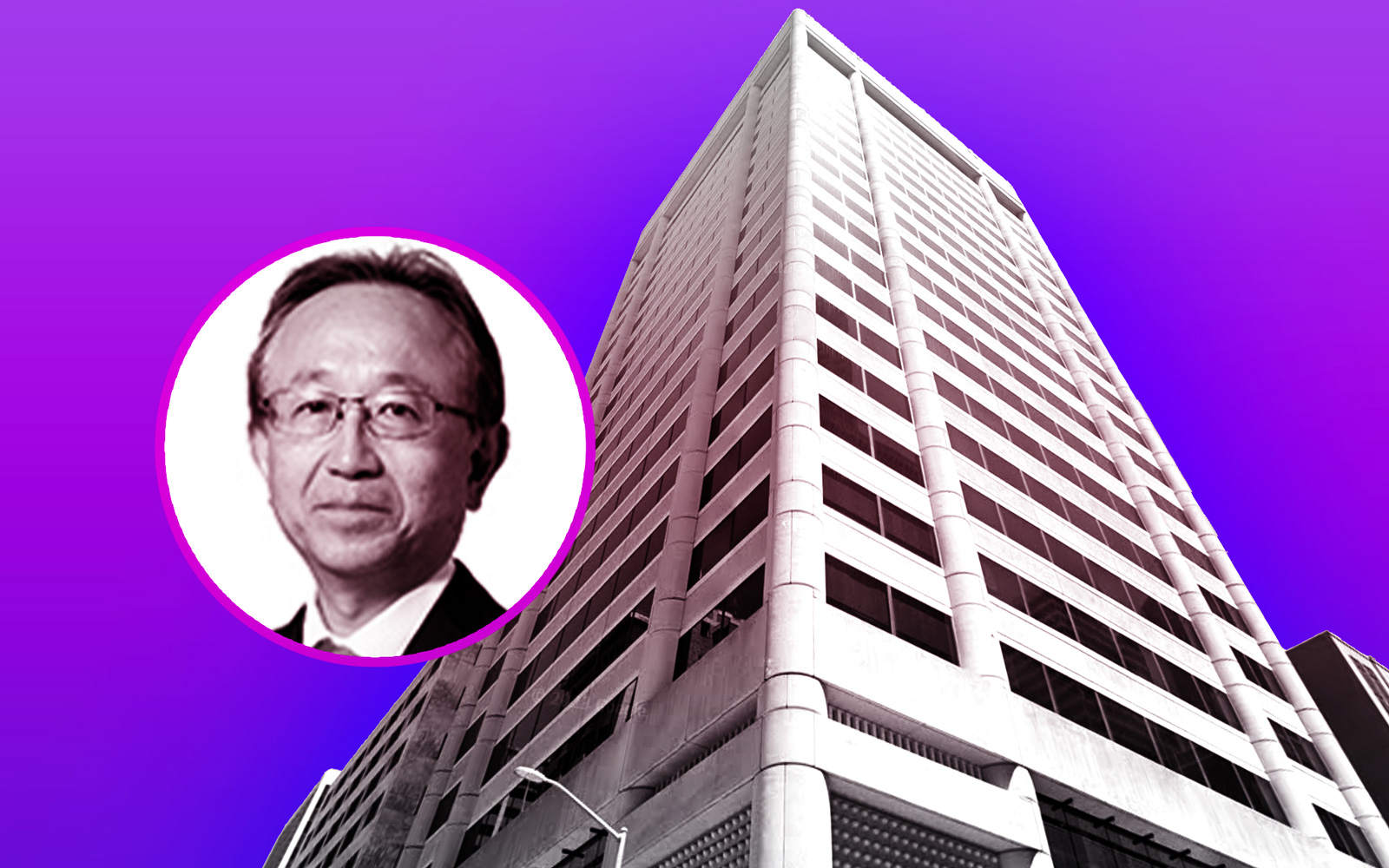

SKS Real Estate Partners has bought a 22-story glass-and-stone office tower in San Francisco’s Financial District for $61 million — 76 percent less than its asking price in 2020.

The San Francisco-based firm teamed up with The Swig Company, also based in San Francisco, to purchase the 297,600-square-foot building at 350 California Street, the San Francisco Business Times reported, citing unidentified sources.

The seller was Mitsubishi UFJ Financial Group, based in Tokyo. The sale price works out to $205 per square foot.

The pending deal, announced in May, initially disclosed that the building would sell for between $200 and $225 per square foot, or up to $67.5 million. A South Korean equity partner, first involved in the contract negotiations, was replaced by Swig.

The purchase “reflects the certainty that The Swig Company and SKS Partners have in San Francisco’s continued role as a center of business and innovation,” Paul Stein, co-founder of SKS, told the Business Times. “We are confident in our city’s future.”

The $61 million sale was 75.6 percent less than the $250 million Mitsubishi sought when the building hit the market in 2020.

Brokers Kyle Kovac, Mike Taquino and Giancarlo Sangiacomo of CBRE represented the seller.

The tower, built in 1976, is now 75 percent vacant because the primary tenant, Union Bank, has mostly moved out. Union Bank, previously owned by Mitsubishi UFJ, once occupied the entire building. Mitsubishi UFJ sold Union Bank to U.S. Bancorp in December.

Union Bank has agreed to a “minimal short-term leaseback” of some of the offices at 350 California, unidentified sources told the Business Times.

Before the pandemic, California Street was home to some of the world’s most valuable commercial real estate. Now, in the era of remote work, the city’s office vacancy has jumped to a record 32.7 percent, compared to 4 percent before the contagion.

The plunge in office workers has slammed the Financial District, leading restaurants, stores and other small businesses to lay off employees or close up shop.

The sale of 350 California and an 11-story office tower at 60 Spear Street early last month may establish a new office benchmark in San Francisco. Presidio Bay Ventures bought the 157,000-square-foot property for $41 million, or $260 per square foot — a third of its 2014 price.

The sales highlight purchases by local investors, rather than the institutional players that bought into the market before the pandemic.

“This is an example of local, established ownership groups with proven track records taking advantage of unprecedented opportunity provided in today’s office market,” Derek Daniels, research director for Colliers International in San Francisco, told the Business Times.

— Dana Bartholomew

Read more