Trending

Rockpoint, Highgate look to sell Meatpacking office development for $350M

Partners own the leasehold interest on record-setting tower

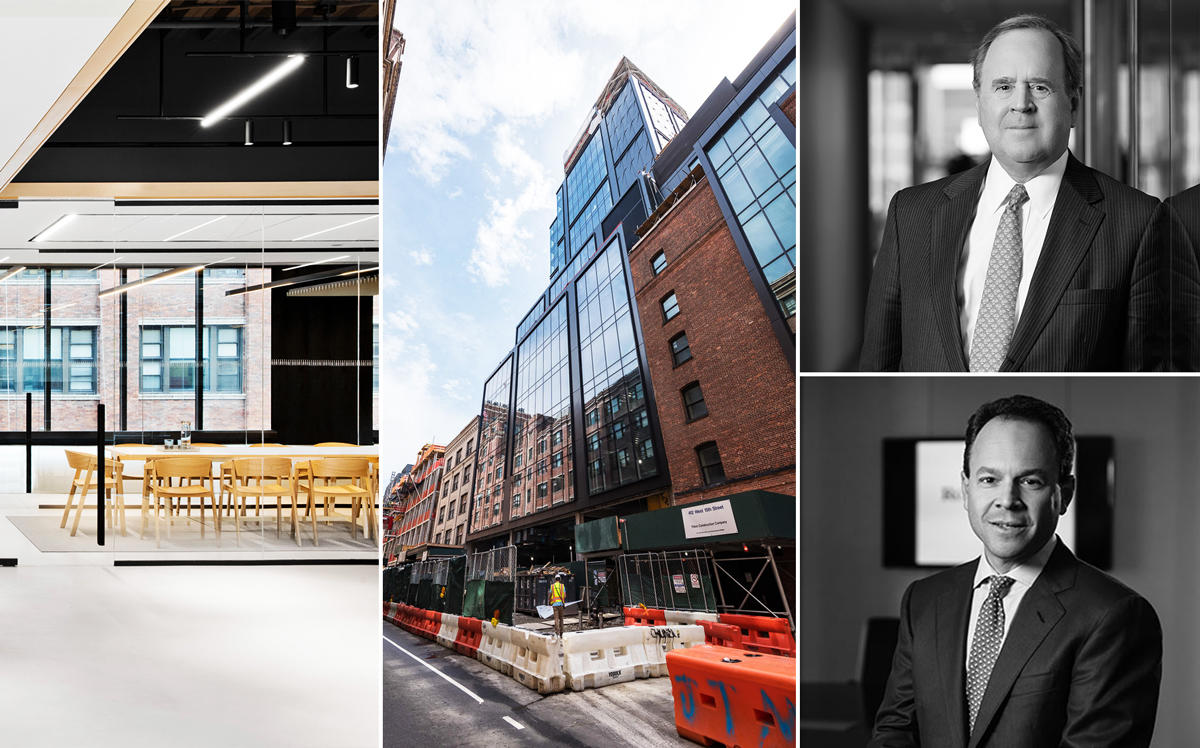

Rockpoint Group and Highgate Hotels are looking to sell their record-setting office development in the Meatpacking District for $350 million, sources told The Real Deal.

The co-developers own a leasehold interest on the buildings at 412 West 15th Street and 413-421 West 14th Street, which combined span roughly 256,000 square feet. The two buildings are nearly 60 percent leased, according to marketing materials.

The pricing works out to $1,367 per square foot.

Rockpoint and Highgate could not be immediately reached for comment. The Cushman & Wakefield team of Doug Harmon, Adam Spies and Kevin Donner has the listing.

Real Estate Alert first reported that the office development was on the market.

Highgate’s Mahmood Khimji (left) and Mehdi Khimji (Credit: Kelly Taub/BFA.com)

Longtime property owner Meilman Family Real Estate owns the ground underneath the development. The Meilmans originally teamed up with Highgate and had planned to build a hotel on the site. But as the Meatpacking District started showing signs of evolving from a tourist destination to an office market, Rockpoint signed a 99-year lease with the Meilmans in 2014 to take over the property.

The developers earlier this year signed Paris-based asset manager Tikehau Capital to a 10,000-square-foot lease at the top of 412 West 15th Street at a record rent of $195 per square foot for the neighborhood.

Argo Insurance is the largest tenant at the development, occupying roughly 46,500 square feet.

The neighborhood is now a sought-after destination for office tenants, and deals like Google’s $2.4 billion purchase of the Chelsea Market building nearby at 75 Ninth Avenue have boosted investor sentiment in the area.

In July, Invesco Real Estate bought the leasehold interest on TH Real Estate’s office building nearby at 430 West 15th Street for $158.5 million.

Pricing on that deal was $1,617 per square foot.