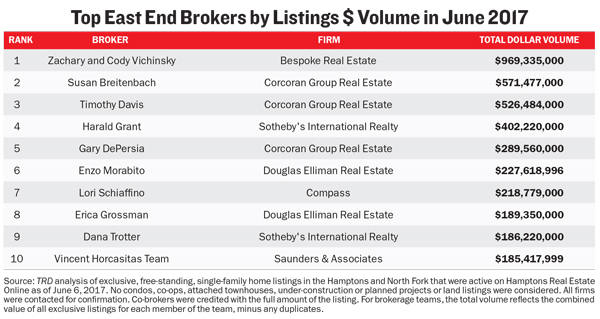

Zachary and Cody Vichinsky, the upstart duo that three years ago launched Bespoke Real Estate, grabbed the No. 1 spot this year in The Real Deal’s ranking of top East End brokers with nearly $1 billion in exclusive listings, nearly doubling the volume of the runner-up.

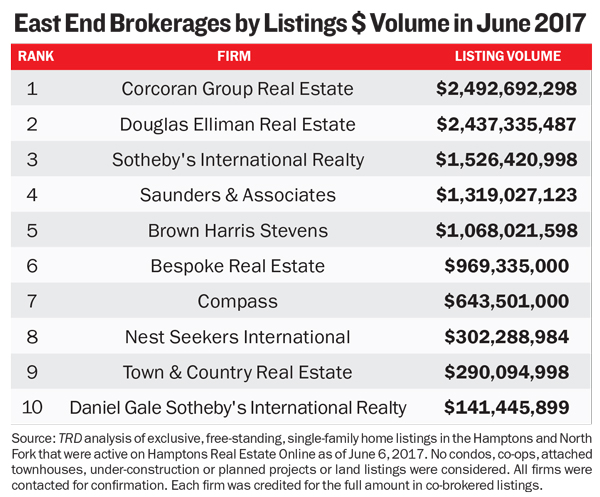

It doesn’t hurt that the two brothers have their sights trained exclusively on the priciest properties, with 36 listings accounting for a total of just over $969 million as of early June. Their brokerage — which clocks the same listings dollar volume as the siblings, since they are involved in all the firm’s deals — took the No. 6 spot on TRD’s ranking of East End brokerages. “We have a myopic focus on the high end of the market,” said Zachary Vichinsky. “Our business model is strictly related to the high end, $10 million and up.”

By mid-June, Bespoke had done its 15th deal over $10 million this year, according to Zachary. He said that even Villa Maria, the 28-room former nunnery on Mecox Bay in Water Mill that has been on and off the market for nearly 10 years, is starting to see some interest. On the market for $72 million since last year — down from $100 million in 2008 — the 15-acre estate has gone through several price adjustments. “At this point, it’s a value property,” Zachary said.

Zachary and Cody Vichinsky

The prevalent theme among the top brokers TRD spoke to was that the year got off to a slow start, but come June, buyers came a-knocking and the market started rocking — or if not rocking, picking up a substantial amount of steam, albeit at lower price points. The spring’s cold, wet weather and a creeping shift in the sales season, which brokers say now starts in late June and July instead of Memorial Day, all contributed to the slower start.

While average prices in the first quarter lagged behind those of the year-ago quarter by 8.9 percent, the overall number of sales was up 8 percent, the result in part, brokers said, of a reluctance to buy last year due to the uncertainty surrounding the election. The decline in the luxury segment — the top 10 percent of the market — was most defined in the first quarter, with the average sales price down a steep 24.1 percent to $6.7 million and the number of sales dropping by 6.7 percent year over year. Jonathan Miller, president of Miller Samuel real estate appraisers and consultants, said there was a lot less activity in the $5 million-and-up range but that high-end sales were starting to recover in the second quarter. “Going into the spring, we’re seeing more of those sales occur, and therefore the market feels better than it did in the last couple of quarters,” he said.

Part of the uptick in activity could be attributed to the fact that high-end property listings saw average discounts of 16.2 percent in the first quarter, nearly double the rate of discounting in the year-ago quarter.

“They have to make it attractive,” said Sotheby’s International Realty’s Harald Grant, who took fourth place in the rankings this year with $402 million in exclusive listings. “For the average 2-acre property in Southampton that is asking $12 million, $9.5 million is perceived as good value.”

Doing particularly well, brokers said, are properties in the lower and middle parts of the market, $1 million to $5 million.

“Properties at $2 million to $3 million in Bridgehampton and Water Mill, I could sell all day long,” said Christopher Burnside, a broker with Brown Harris Stevens, which came in fifth in TRD’s ranking of East End brokerage firms. “New construction in the $3 million-to-$4 million range is also very busy.”

Another segment that did well in the first quarter was the condo market, which saw the average sales price climb by 52.2 percent versus last year and more than double compared to the fourth quarter, according to Douglas Elliman. Brokers say that condos are an increasingly important part of the market as empty nesters unload big houses and move into smaller, more manageable dwellings. (The TRD analysis of top brokers and brokerages does not include condos or spec homes, which in some cases represent a large portion of a broker’s business.)

“The condo phenomenon over the past couple of years has become much more visible to participants in the market,” said Miller. “It’s a niche market that I believe has room to expand.”

Despite the softness at the top during the first quarter, brokers remain upbeat, saying that they are getting busier as Wall Street has strengthened and that the downward pressure on prices is helping to generate sales as buyers search for value.

“People are looking for a deal,” said Susan Breitenbach of the Corcoran Group, who nabbed second place this year with close to $571.5 million in exclusive listings. “I’m seeing [clients from] billionaires to $1 million buyers all wanting value.”

In late June, Breitenbach had eight listings over $20 million, including Lasata, the East Hampton estate where Jacqueline Kennedy Onassis spent her childhood summers. It was put on the market last year by the current owner, fashion designer Reed Krakoff. Breitenbach’s priciest listing is a $50 million, 3-acre, oceanfront property in Sagaponack with a pool and tennis court. “It’s getting a lot of activity,” she said.

Like the Vichinskys and Breitenbach, most of the other top brokers on TRD’s list are making repeat appearances, members of an exclusive, always-on-top club of earners on the East End.

Like the Vichinskys and Breitenbach, most of the other top brokers on TRD’s list are making repeat appearances, members of an exclusive, always-on-top club of earners on the East End.

“Like any good broker out here, you work every day,” said Corcoran’s Gary DePersia, who ranked fifth this year with about $289.6 million in listings across 48 properties. “You keep your cellphones on, you have your laptop and your iPad with you. You’re answering phones all the time.”

DePersia agreed that price drops are starting to stir the market. “All of a sudden, things are selling,” he said. “Part of it is prices coming down.”

DePersia’s top-priced property is Twin Peaks in Southampton by developer John Kean, a brand-new, fully furnished 15,500-square-foot estate that went on the market for $45 million two years ago and is now asking $39.5 million.

Occupying third place is Tim Davis, also of the Corcoran Group, with 23 exclusive listings priced at a total of $526.5 million as of early June. Bucking the larger trend, Davis said he had a good first quarter with $150 million in sales, and in mid-June had three deals in the works, each over $10 million.

Among his listings: Tick Hall, the 7,000-square-foot Montauk home of former talk show host Dick Cavett, which went on the market in early June for $62 million. Designed in the 1880s by McKim Mead & White, it has 20 acres of land and 1,000 feet of private beachfront and abuts 170 acres of parkland. Cavett has owned it for 50 years, said Davis, who predicted that the estate would sell by the end of the year.

Sotheby’s Grant can take credit for the priciest property on the market and the second most expensive ever in the Hamptons: La Dune, a $145 million, 22-bedroom estate on Gin Lane in the Village of Southampton owned by Canadian art publisher Louise Blouin of Panama Papers fame. With 4 acres, two houses, a pool and tennis court, it’s been on the market for a year. It was rented for $1 million last season. “It’s had a few looks,” Grant said.

For Enzo Morabito of Douglas Elliman, in sixth place this year, it’s all about being attuned to the market.

High-end properties, he said, are taking years to sell. Last year, a property priced at $60 million in Water Mill eventually sold in the mid-$20 millions. Another of his listings, on Georgica Lane in East Hampton, sold for $5 million, down from $7 million. Like others, he said the year started slow but is now picking up; he’s had 10 closings in the past four weeks.

“You’ve got to get to market value,” he said. “That’s the beauty of the Hamptons. There’s always someone waiting, and if [a property] is at market value, they will buy it.”

Morabito said he’s also seeing a shift in location, with activity brewing in more affordable areas such as Remsenburg, Westhampton, Hampton Bays and Quogue.

“I’m seeing that people who would never even consider coming west of the canal are looking and buying,” said Morabito. “You can pick up an interior lot with 1 or 2 acres for just under $3 million.”

Burnside of Brown Harris Stevens said Two Trees Estates, a 12-home development by the Walentas family in Water Mill for which he is the exclusive broker, has sold all but two houses and one lot. Most sold, he said, in the $8 million-to-$9.5 million range.

Burnside is known for showing properties from a Cessna, but he said he now thinks the tactic is too distracting. He still takes clients out in the plane, but “it’s more like, ‘Do you want to go somewhere for lunch?’”

Rounding out the list of top 10 East End brokers are Compass’s Lori Schiaffino in the No. 7 spot with $218.8 million in exclusives, including a $75 million property on Lily Pond Lane in East Hampton; Douglas Elliman’s Erica Grossman, in eighth place with $189.4 million in listings; Dana Trotter of Sotheby’s International Realty, in the ninth spot with $186 million; and the Vincent Horcasitas Team from Saunders & Associates, with $185 million of exclusives for the 10th spot.

As for the intense poaching of brokers that raised hackles last year, most say it has quieted down. “We don’t have new agencies on the market,” said Corcoran’s Davis. “When you have a new brokerage come into marketplace and [make] offers to agents, it causes everyone to think, ‘Am I in the right place, am I being compensated properly?’”

While there were no new kids on the block to contend with, old rivalries still ruled the day. Corcoran and Elliman were neck and neck in TRD’s ranking of East End brokerages, with Corcoran barely inching ahead with $2.49 billion in listings to Elliman’s $2.44 billion.

—Harunobu Coryne and Gina Moreno provided research for this article