When the average Manhattan pad costs $2 million, it’s a good time to be in the brokerage business.

Soaring prices and relief from the inventory crunch of the last few years have translated into more business for the borough’s largest residential firms.

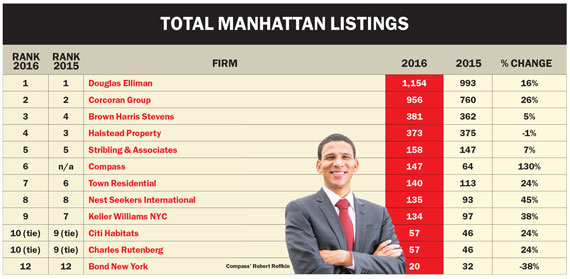

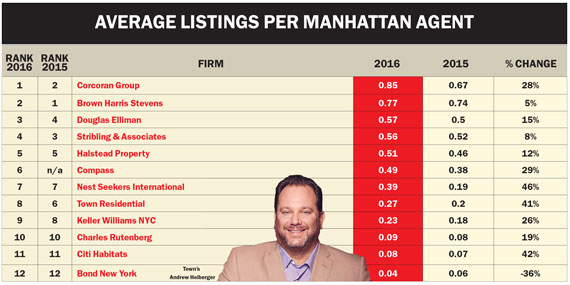

The Real Deal’s annual ranking of top companies — which is based on agent count and is tallied from a one-day snapshot of data from On-Line Residential on March 27 — shows that many of Manhattan’s largest residential firms grew in size in 2016. The ranking also saw the cumulative dollar value of sales listings climb, as both median and average sale prices ticked higher.

Still, there are headwinds. The market is in transition, and brokerages are recalibrating to deal with global economic volatility, a softening über-luxury market and increasing leverage on the part of buyers.

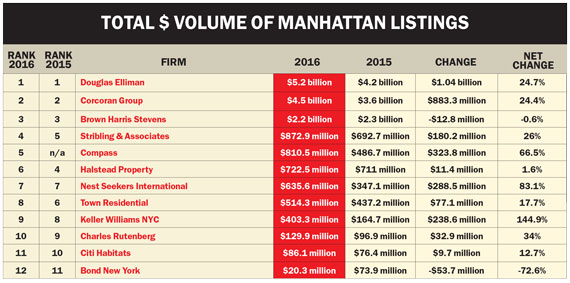

Continuing its dominant streak, Douglas Elliman clocked in at No. 1 with the highest number of agents, number of listings and listing dollar volume. The firm, headed by Dottie Herman and Howard Lorber, amassed an impressive $5.2 billion worth of exclusives, up roughly 25 percent from $4.2 billion a year ago. Meanwhile, its main rival, the Corcoran Group, which is headed by Pamela Liebman, took the No. 2 spot in all three of those categories and logged $4.5 billion in listings, up 24 percent from $3.6 billion last year.

Halstead Property, Citi Habitats and Charles Rutenberg rounded out the top five largest firms by agent count, while Brown Harris Stevens, Stribling & Associates and upstart Compass did so for dollar volume, with $2.2 billion, $872.9 million and $810.5 million in exclusives, respectively.

Collectively, the biggest 12 firms had 3,712 listings as of March 27 — a 19 percent jump from 2015. The value of those listings jumped nearly 30 percent to $16.2 billion from $12.5 billion last year.

Despite the softening at the very top of the market, Citi Habitats President Gary Malin, whose firm had 671 agents, said there is “plenty of demand out there.”

“The market is moving fast at certain price points,” he said. “It’s fluid.”

The expansion race

Two firms — Bellmarc Group and venture-backed Compass — shook up the top firms list, but for very different reasons.

Bellmarc, which is tangled in financial and legal problems, slipped off the list after hemorrhaging brokers and shuttering offices in a struggle to survive.

Meanwhile, Compass, which launched only three years ago, graduated from our mid-sized ranking by adding 132 agents for a total headcount of 300.

Compass CEO Robert Reffkin said the firm’s national network has been a key recruiting tool in New York City, where agents want a referral community in sister markets, including Los Angeles, the Hamptons and Miami.

“This time last year, we were in two cities with three offices and now we’re in eight cities with 22 offices,” he said.

Compass has, of course, taken heat for being too aggressive and poaching top talent from competitors — a claim Reffkin dismissed as sour grapes. (Last year, the firm settled lawsuits with both Corcoran and Citi Habitats — brands that fall under the umbrella of corporate real estate conglomerate Realogy — after those firms accused it of stealing proprietary information. Another suit, brought by Brown Harris Stevens against former Hamptons manager Ed Reale, a Compass recruit, is ongoing.)

While Compass is staffing up as it attempts to compete with industry giants, more established firms are also growing, albeit at a slower pace.

Elliman, for example, increased its headcount to 2,010 from 1,977.

Like Reffkin, Lorber touted his firm’s network outside of New York — which includes offices in South Florida, Los Angeles, Connecticut and Aspen — for helping to lure new agents.

“We’re in all the best markets,” he said after posing for photos last month for TRD’s cover shoot.

In addition, he said, while the firm is large, it is not mired in bureaucracy.

“Although we’re a big company, we operate in an entrepreneurial way,” he said.

Liebman also touted Corcoran’s ability to operate in a nimble fashion more in line with a small operation. She cited the introduction of mobile access to listings to show how tech-savvy the firms is. “We are connecting with clients in new ways,” said Liebman, who recently started up an Instagram account.

Keller Williams NYC, meanwhile, grew its agent headcount by more than 10 percent to 593 agents, as it added 58 new brokers in the past year. The firm is scheduled to open a second office in Tribeca this month.

And Charles Rutenberg — which has a 100 percent commission model — also increased its ranks by about 10 percent to 599 agents.

Rutenberg President Stefani Markowitz said that agents are joining her firm since they can earn more commission.

“Agents want to run their own businesses. They’re already branded,” she said. “They want to have the freedom and flexibility to truly be independent contractors.”

Shrinking, but not violets

Still, not all firms added to their ranks.

Citi Habitats, for example, shrunk to 671 agents from last year’s 745. Malin said that the firm has been “heavily recruiting” amid a multi-year “rebuilding” process. The firm acquired Brooklyn-based Aptsandlofts.com last year for an undisclosed sum.

And Malin continues to hunt for firms to acquire. “Because of what we’ve built,” he said, “it’s silly to not jump into the water and see what opportunities exist.”

The rebuilding effort has also included a new website, back-end systems, offices and investments in marketing and training. “Our business model is scalable now,” Malin said.

Still, while the firm, which primarily focuses on rentals in Manhattan, grew its dollar volume by 13 percent since last year — it had $86 million in exclusive sales listings in the borough — that was a drop in the bucket compared to many firms on the list. Its Aptsandlofts.com acquisition was, however, designed to give it a presence in Brooklyn, which is not tallied in this ranking.

For its part, Halstead saw its Manhattan agent count drop to 724 from 814.

While company CEO Diane Ramirez said she encourages agents who aren’t succeeding at Halstead to “ease themselves out” of the firm or the business, she dismissed the idea that the brokerage is shrinking. “As far as agents we want to keep — excellent, productive agents — our loss factor is near zero,” she said.

She also underscored the firm’s growth in Brooklyn, the Bronx and, as of last year, Queens —which are not tallied into TRD’s ranking.

“We do feel that if you really are committed to being able to help people find a home at all price points, you need to be out in the boroughs,” she said.

Brown Harris Stevens CEO Hall Willkie said the competition for recruiting top agent talent is as fierce as ever but that firms are being more careful in the wake of a round of high-profile poaching-related lawsuits last year. Last year, he said, firms “hired managers who had contracts that addressed solicitation and non-competes.”

“That’s calmed down,” he said. “Everyone got their hands slapped a bit.”

More inventory, more sales

The inventory crunch of the last few years has finally let up a bit for Manhattan’s biggest brokerages.

Indeed, 10 out of the 12 firms saw a spike in their listing counts and the same number saw a rise in the value of their listings since 2015.

Driving those increases, of course, is more product and higher prices. At the end of the first quarter, there were 5,506 Manhattan properties for sale, up 5 percent year over year, according to real estate appraisal firm Miller Samuel.

Still, not all segments of the market are acting the same.

As the ultra-luxury market softened, new condo inventory plummeted 44 percent during the first quarter, to 753 listings, as developers held units back to avoid saturating the market.

For several firms — Keller Williams, Nest Seekers International and Compass to name a few — a shifting market has translated into big gains.

Of the Big 12, Keller Williams saw the biggest growth in listing dollar volume with a 145 percent increase over last year, bringing its total book of listings to $403.2 million.

Lezley Dawn Schad, CEO of Keller Williams’ Midtown office, said fast-moving segments of the market — such as properties under $2 million — have boosted her firm’s book of business.

Nest Seekers, meanwhile, saw listings jump more than 83 percent to $635.5 million, with star agent Ryan Serhant leading the way with mega listings like a duplex at 146 West 57th Street that’s asking roughly $15 million and a condo at 200 Chambers Street listed for roughly $13 million. And Compass’ listing dollar volume shot up nearly 67 percent, as it racked up $810.5 million in listings.

In addition, Stribling’s jacked up its listing volume by roughly 26 percent to nearly $873 million from almost $693 million. The firm’s priciest listing is a penthouse at the Naftali Group’s condo the Shephard, at 275 West 10th Street, asking $29.5 million. “We pack a powerful punch in the market,” said Elizabeth Ann Stribling-Kivlan, who noted that her firm’s new development team has 20 buildings in its pipeline. “Our portfolio and pipeline is very strong.”

On the flip side, two firms — Bond and Brown Harris Stevens — saw dollar volume of exclusives drop.

Bond’s exclusives fell a massive 73 percent to $20.3 million. But that firm can hardly be described in the same breath as heavy hitters like Brown Harris Stevens, which saw a slight 1 percent decline in total listings, to $2.2 billion from $2.3 billion.

BHS’s Willkie explained the firm’s drop by pointing to market realities.

“There are fewer big resale listings on the market and that’s where we dominate,” he told TRD. “I think we’re going through a price correction in the market, which is a healthy thing.”

He added that buyers at the high end have become particularly price sensitive. “Many asking prices are super overpriced and the market is saying, ‘We’re not interested,’” he said.

Prices keep rising

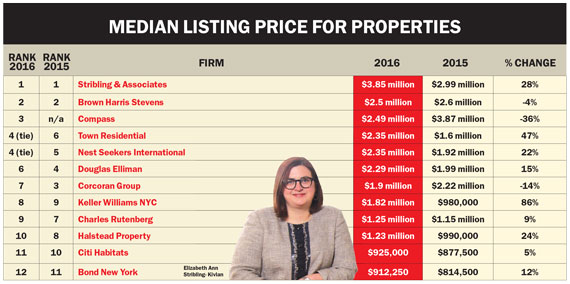

Despite the fact that buyers are becoming leery of overpaying, most of the top firms saw the value of individual listings rise.

Stribling added a feather to its cap with a $3.85 million median listing price — the highest among the Big 12. Rounding out the top three for highest median listing price this year were BHS, with $2.5 million, and Compass, with $2.49 million.

Manhattan’s median sale price topped $1 million for the first time during 2015’s fourth quarter, according to Miller Samuel. The average price hit a record $2 million during the first quarter of this year.

Still, those numbers were impacted by big-ticket new development condos that may have gone into contract 12 to 18 months ago, according to Jonathan Miller, president of Miller Samuel.

Since those heady days, the market has ratcheted down. While brokers often tout the importance of accurate pricing, it’s become something of a rallying cry in the last six months.

“What went on the last few years was not normal,” Lorber said, referring to eye-popping price increases in the residential market.

“It’s the wrong time to be aspirational with pricing,” he added.

BHS’s Willkie said whereas there are few mega listings, properties under $5 million are selling quickly when they’re well priced.

“There’s more activity in that market than ever,” he said.