Those who grew up in the 1980s will no doubt remember the catchy jingle about the Milford Plaza Hotel — aka the Lullaby of Broadway.

But in 2009, there was very little singing and dancing at the Eighth Avenue institution. Instead, 350 workers were laid off, a planned renovation was scrapped, and Philip Milstein‘s Ogden Cap Properties put the 1,331-key Midtown property on the market.

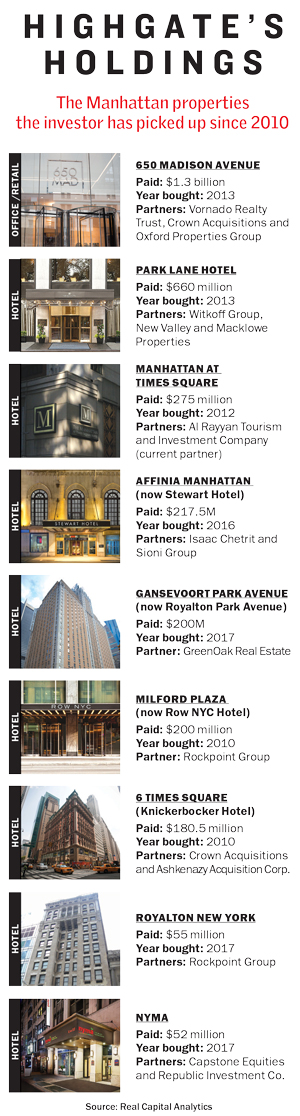

The following year, with the hotel sector still reeling from the financial crisis, the hotel sold for $200 million to Highgate Hotels and its private-equity backer Rockpoint Group, which pumped $140 million into fixing it up and renamed it the Row NYC Hotel.

The move was a power play for the privately held firm and one that signaled its arrival in the big leagues on the New York hotel scene.

“When they went into the market and bought a massive hotel on Eighth Avenue, that said something,” said Jonathan “Jay” Morrow of Hodges Ward Elliott, which has brokered deals involving Highgate.

Almost a decade later, Highgate is again something of a lone wolf in the turbulent New York hotel market.

Brothers Mahmood and Mehdi Khimji — the company’s founders — have made $500 million-plus NYC hotel acquisitions in the past year with a rotating cast of partners. According to real estate data firm Real Capital Analytics, the company dropped about $1 billion nationally on hotel acquisitions during that same time.

Between December 2016 and December 2017 alone, the firm bought the 600-plus-room Affinia Manhattan on Seventh Avenue in the 30s, the Royalton New York on West 44th Street, the Nyma on West 32nd and the Gansevoort Park Avenue.

The under-the-radar company is indisputably the most active hotel buyer in Manhattan today.

In 2017, high-profile players like Richard LeFrak, Joseph Sitt and Hong Kong-based investor Gaw Capital Partners all made hotel buys. But nobody threw down as much money as Highgate, and none of them bought more than one hotel.

“People think Highgate is crazy because they don’t feel the same way about the market [as other players],” said a hotel-investor source. “The performance isn’t there.”

Finding low cash flow

Given current market conditions, the big question is: Why is Highgate buying when most big investors are sitting on the sidelines?

Hotel-centric real estate investment trusts, for example, are fleeing the market.

The Texas-based FelCor Lodging Trust, for one, took a big loss last year on the Morgans Hotel and the Royalton, selling them for a combined $96 million after paying $140 million for them in 2011. (The REIT was sold to RLJ Lodging Trust in September).

The Texas-based FelCor Lodging Trust, for one, took a big loss last year on the Morgans Hotel and the Royalton, selling them for a combined $96 million after paying $140 million for them in 2011. (The REIT was sold to RLJ Lodging Trust in September).

While the Khimji brothers declined to comment — a spokesperson said only that the company “evaluates every opportunity on its merits” — sources said their bullishness is tied to their company’s unique business model.

Not only does the firm buy hotels, it also manages them. It fact, it claims to be Manhattan’s largest independent hotel manager, operating nearly 12 percent of the borough’s total inventory.

That role, sources said, gives Highgate more data to mine on hotel profitability, which it then uses to determine what to buy.

“They probably have [a more] unique perspective on lodging than any other company because they get a ton of data from managing all of these hotels,” said the abovementioned hotel investor.

And the company — which the brothers run with Neil Luthra and Vann Avedisian — seems to have put a bull’s-eye on struggling hotels.

“When the hotel’s cash flow is off 60 to 70 percent and approaching zero, that’s when Highgate buys,” said Eastdil Secured’s Adam Etra, who has worked with the firm.

And once it does buy, it typically cuts costs, upgrades the property and flips most (or all) of its equity stake while retaining a management role.

On the management front — where it usually does not have equity in its projects — the company has tony assets such as the Quin Hotel on West 57th Street, the Michelangelo Hotel on West 51st Street and the Park Central Hotel near Central Park. It was also recently hired by Thor Equities to run the James New York hotel in Soho.

In all, it currently either owns or manages about 30,000 existing or under-construction hotel rooms and owns at least eight NYC hotels, according to an analysis of RCA data. The firm also occasionally invests in office buildings, 650 Madison Avenue being one of them.

These days, there is an abundance of other beleaguered properties for the firm to pick off.

NYC room prices are in a downward spiral, and revenue per room dropped 1.3 percent to about $234 through the first nine months of 2017, according to third-quarter 2017 data from hotel research firm STR and from PwC.

Joshua Zamir of Capstone Equities, Highgate’s partner in the Nyma, said the firm has “clearly demonstrated a level of conviction in the long-term potential for New York hotel real estate.”

That, he said, is “despite recent market headwinds.”

The double down

Highgate’s dominance in the New York hotel market may seem sudden, but the company has been around for decades.

The Khimji brothers founded Highgate in 1988. Mahmood — who attended the University of Houston and Columbia Law School — spent two years at the white-shoe Paul, Weiss, Rifkind, Wharton & Garrison before leaving to launch the firm.

While little is known about the brothers’ personal lives, sources said both primarily live in New York and travel frequently.

In 2015, Mahmood bought a limestone townhouse on East 69th Street for $22.5 million.

But it wasn’t until the early aughts that Highgate began making big New York purchases.

Between 2004 and 2005, it dropped $215 million on the 934-key Park Central, $58 million on the Days Inn on Eighth Avenue and $34 million on the leasehold for the Crowne Plaza United Nations, which it bought with the Carlyle Group. (It rebranded the Days Inn as the city’s first Hilton Garden Inn. There are now 13 of them in the city.)

In 2007, before the market started to tank, Highgate went on a selling spree, flipping four Manhattan hotels for a total of $719 million. It then spent a few years pushing into other markets.

But in 2010, Luthra — a Westbrook Partners alum — jumped to Highgate and steered the company toward more ambitious New York deals.

Then in 2014, when private equity firms were increasingly invading the hotel space, Trilantic Capital Partners acquired an undisclosed stake in the management side of the business. (In 2016, Highgate and Trilantic also invested $5 million in a startup, LodgIQ, that develops software for managing hotel revenues.)

And New York isn’t Highgate’s only stomping ground.

The company — which has offices in New York, Los Angeles, Dallas, Seattle and London — is making its London debut with a ground-up, 200-key Gensler-designed hotel that will be part of the mixed-use One Fairchild complex, slated to open in late 2019. And the firm has also made a big push in Florida, Boston and California. In California, it recently bought the Westin Long Beach and the Pacific Edge in Laguna Beach, while in Boston it’s snapped up the Taj Boston and the Courtyard Boston Cambridge. (Its Key West hotels in Florida were damaged when Hurricane Irma pummeled the island in September, but have since reopened.)

Still, while Highgate is buying up hotels nationwide, it’s doubling down on New York.

“They’re looking to buy everywhere,” Eastdil’s Etra said. “but what’s happening with them in New York is more of a phenomenon.”

Sixth hotel sense

While Highgate might be more bullish than most on the NYC hotel market, it hasn’t been going it completely alone.

In its acquisition deals, it’s teamed up with private equity powerhouses like Rockpoint, Westbrook Partners and GreenOak Real Estate. The company’s equity in those deals often ranges from 5 percent to 15 percent — a minimal amount that mitigates its exposure, sources said.

“Highgate often has a partner that is writing the big check, and it’s usually one they’ve already been successful with,” Etra said.

The company also looks to purchase at a relatively low basis — its bread and butter is between $300,000 and $500,000 per key, according to an analysis of its recent deals.

The nearly $200 million Gansevoort deal — one of 2017’s priciest hotel transactions — was a rare exception. That hotel, which Highgate bought with GreenOak, closed in December and clocked in at close to $800,000 per key.

Still, sources said that before the market started softening, the sellers were considering selling it for $275 million, or around $1.1 million per key.

Highgate has since hired Tao Group to reenvision the hotel’s food and beverage situation, according to sources familiar with the deal.

The company is, indeed, big on branding. It has distanced itself from rivals like Hersha Hospitality Trust and Magna Hospitality Group by exclusively employing union workers — a move that puts it in a category with global hospitality chains such as Hilton and Marriott.

And it’s renamed a bunch of its hotels. The Affinia Manhattan, for example, became the Stewart Hotel, while the Gansevoort became the Royalton Park Avenue.

Despite a slowdown in hotel investment sales — transactions dropped 32 percent in the first half of 2017 year over year, according to data from the Real Estate Board of New York — Highgate is not showing signs of pulling back. It currently has more than $400 million in U.S. acquisitions under contract, sources said.

“They’re seeing something,” said Hodges Ward Elliott’s Morrow. “They are incredibly plugged in with owners, and have a good bead on the market.”

Correction: A previous version of this story misidentified the former owner of the Milford Plaza Hotel. It is Philip Milstein’s Ogden Cap Properties.