Business is booming and competition is at a fever pitch for top retail real estate brokerages as vacancies hit record lows and rents continue to rise while consumer spending has ticked up nearly 18 percent above the previous peak. This dynamic has led to a flurry of activity for brokers as they handle acquisitions for owners eager to cash out of their investments and manage leasing for those who want to remain in the game.

“The markets are healthy with stable fundamentals, so there’s transaction activity,” said Frank Cohen, senior managing director for Manhattan-based investment firm the Blackstone Group. “In a healthy real estate market it is very important to have intermediaries that put the buyers and sellers together.”

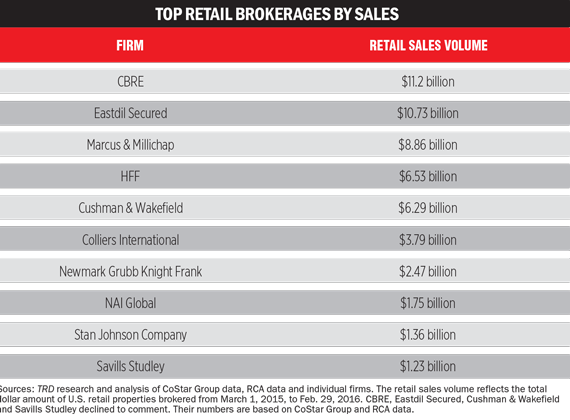

To see which brokerages have been getting the big-ticket listings, The Real Deal crunched retail sales and leasing data for the period from March 1, 2015, to Feb. 29, 2016.

The numbers show that the top five brokerages in retail sales volume handled nearly $44 billion in transactions; the top 10 combined hit more than $54 billion. Leading the pack in sales volume was CBRE, with closed deals worth a combined $11.2 billion. Among the other top firms were Eastdil, Marcus & Millichap, HFF and Cushman & Wakefield.

“It goes without saying the best brokerage firms have the best relationships and the most expertise,” Cohen said. “The ones that consistently rank at the top of the list do so because of those two reasons.”

On the leasing side, Cushman took the No. 1 spot, reporting slightly more than 19 million square feet, followed by Newmark Grubb Knight & Frank with nearly 18 million, CBRE with almost 11 million, the Shopping Center Group with about 10.5 million and Colliers International with about 9.4 million square feet.

Cushman’s top ranking is thanks in part to the amount of business generated by DTZ, the firm it merged with last year. Gene Spiegelman, Cushman’s vice chairman and head of retail services for North America, told The Real Deal one of the key benefits of the firm’s recent merger is having access to the specialized services that DTZ gained from its 2014 acquisition of Cassidy Turley, a Washington, D.C.–based commercial real estate firm. Cassidy connects tenants and landlords with outsourcing providers for janitorial, landscaping, waste management, telecommunications and other property maintenance companies. That massive business came with clients including Edward Jones, H&R Block and Weight Watchers, among others.

Spiegelman said that markets like Chicago, Dallas, Miami, New York, Los Angeles and San Francisco are delivering the most growth for Cushman, noting, “These marketplaces have the benefit of very strong tourism and international trade.” Retail real estate executives for CBRE, Eastdil, HFF, Colliers, SRS and NAI declined to comment for this article.

Cushman’s signature deals included securing a 130,000-square-foot Wegmans supermarket as the anchor tenant for the West Broad Marketplace in Richmond, Virginia; a 86,048-square-foot Century 21 Department Store for Sawgrass Mills Mall in Sunrise, Florida; and a 77,500-square-foot Stone City Kitchen & Bath Design Center at 3053 West Grand Avenue in Chicago.

Among the most notable recent sales handled by Cushman were Kushner Companies’ $296 million November acquisition of the former New York Times headquarters in Manhattan at 229 West 43rd Street (the building had been converted into a condominium with 250,000 square feet of ground-floor retail) and Kuafu Properties’ $300 million purchase of a development site at East 60th Street, where it’s planning a residential tower with as much as 60,000 square feet of ground-floor retail space.

Cushman’s new configuration let the firm compete on a more even playing field with industry giants like CBRE and Eastdil, the latter of which landed some of the most high-profile retail transactions of 2015, including several deals that involved Cohen’s Blackstone.

Eastdil, which ranked second in retail sales volume, is able to tackle some of the largest and most complicated transactions in the country, asserted Blackstone’s Cohen. Its managers “have corporate finance along with equity and debt expertise; they have straight-up broker expertise and they also have debt expertise. They can look at all parts of a transaction and figure out how to get the best result,” he said.

From March of last year to this past February, Eastdil represented Blackstone in three multibillion-dollar transactions. In the first deal, which closed in April 2015, Eastdil represented Blackstone when it sold 26 Northern California real estate assets to Hudson Pacific Properties for $3.5 billion (with roughly half of that in stock). In July Eastdil represented Blackstone when it purchased 204 properties from GE Capital Corp. for $3.3 billion and bought (for $1.8 billion) Excel Trust, the owner of 38 retail properties across the country. Excel’s largest tenants include Dick’s Sporting Goods, Ross Stores and Publix Super Markets.

Other signature transactions that propelled Eastdil’s retail sales business include the $5.9 billion purchase in June by Prologis and Norges Bank Investment Management of KTR Capital Partners (with 70 million square feet of real estate in 25 markets), as well as GIC Real Estate’s $1.2 billion acquisition in November of five U.S. malls from the Macerich Co. In both deals, Eastdil was the listings broker and was responsible for handling the sale of the properties involved in the transactions.

Marcus & Millichap continues to see growth as a result of its multi-tenant shopping center business and stand-alone retail stores, which pay some or all property expenses in addition to rent, said vice president and national retail group director Bill Rose. (This practice is referred to in the industry as “net leasing.”) “Last year, we announced a 20 percent year-over-year increase in production. I think we are going to exceed that this year,” Rose said.

In June, the brokerage handled the $72 million sale of the Promenade at Anaheim, a four-story complex in Los Angeles with 276 residential units and 27,000 square feet devoted to retail. In December, Marcus & Millichap represented the buyer and seller in a $74 million deal for 18 Red Lobster restaurants with net leases.

Rose and his team are seeing more investor interest for shopping centers anchored by grocery stores “mainly because the yield is significantly greater,” he said. “The centers getting the most attention are located in areas that have both job growth and income growth. The Midwest has been very good as of late, as [have been] some sectors in the Southeast.”

Drugstore companies are a concern in the net lease subsector, Rose said. The annual return on equity for drugstores with single-tenant net leases declined from 7 percent in 2014 to between 5 and 6 percent last year; this no longer makes these types of retail stores attractive to institutional investors, he said. At the same time, there’s been a 20 percent increase in the number of Walgreens, CVS and Rite Aid stores on the listings block during the same time period.

Overall, the retail market is offering great opportunity for the top retail brokerages to sell and lease quality properties at record-breaking prices, said Michael Comras, president and CEO of real estate firm Comras Co. in Miami Beach. When Comras sold four retail properties on Lincoln Road to Amancio Ortega, the wealthiest retailer in the world, for a combined $370 million, it relied on HFF to handle the listing and the sale.

Comras said the retail brokerage business remains on firm footing because investors remain bullish on acquiring income-generating properties and tenant demand is at a record high due to a strong economy, low interest rates and consumer growth.

“Assets in good markets will continue to trade at a premium,” Comras said. “You have a lot of money chasing deals. And that always bodes well for the brokers.”