Anbang Insurance Group’s bid for Starwood Hotels & Resorts Worldwide last year dropped like a bomb in the real estate and hospitality worlds. The Beijing-based insurance giant offered $13 billion for the company, seemingly out of nowhere.

The March 2016 bid came as the hotel megachain Marriott International was in the final throes of negotiating to buy Starwood for $12.2 billion. After a counteroffer by Marriott, Anbang upped its bid to $14 billion and seemed poised to be closing in on the priciest acquisition of a U.S. company ever made by a Chinese firm.

But those closely following Anbang [TRDataCustom] had reason to doubt that it would seal the deal.

About a week after Anbang’s offer, news reports in China surfaced that government regulators would likely quash the deal because it would push Anbang’s overseas assets above the allowable 15 percent threshold for an insurance company.

And sure enough, on March 31, Anbang withdrew its bid without explanation. Starwood ultimately sold to Marriott as originally planned.

At the time, the failed deal seemed — at least to those not familiar with Chinese domestic policy — to be a case of an unpredictable investor stretching beyond its means. But in hindsight, it seems more like a foreshadowing of something bigger and more economically ominous: a regulatory crackdown by Beijing on capital leaving China. And that crackdown is now threatening the flow of cash into New York’s real estate market, among other U.S. industries and cities.

Since the end of 2016, Chinese regulators have rolled out a series of capital controls and other directives to help stabilize the country’s weakening currency and promote investment within China.

Those regulations have lowered the ceiling on how much money Chinese individuals and corporations can invest abroad.

The latest of those controls, which took effect in late 2016 and at the beginning of 2017, have had a quiet but significant ripple effect across the NYC market.

Residential brokers interviewed by The Real Deal said that in the last few months, some Chinese buyers have been unable to access their own cash — making it difficult for them to close deals. Meanwhile, commercial executives in New York said they’ve seen fewer Chinese institutions bid for trophy properties, while fund managers told TRD they’ve had difficulties raising money in major Chinese cities such as Shanghai and Beijing.

For New York, all of this amounts to some very unpleasant withdrawal symptoms.

Not only has the industry become heavily dependent on Chinese investment, but the real estate market here is at a less than optimal point. Projects throughout the city are already feeling the squeeze, and both the residential and commercial sectors are softening.

Wendy Cai-Lee, a former executive at East West Bank who recently left to start her own debt and equity fund Oenus Capital, said the impact that the latest capital controls have had on cash flow to real estate deals in the U.S. is “very real.”

“There are larger deals that were effectively halted and a few deals that got killed,” she said.

That doesn’t mean that big deals involving Chinese players have come to a complete standstill.

In March, the Chinese conglomerate HNA Group went into contract to buy the high-profile office tower at 245 Park Avenue for $2.21 billion. And last month the company bought art heir David Wildenstein’s townhouse on the Upper East Side for $79.5 million — marking the priciest New York townhouse ever sold. Sources say the company, which is traded in Hong Kong, likely had its money out of the country before the latest controls took effect.

In March, the Chinese conglomerate HNA Group went into contract to buy the high-profile office tower at 245 Park Avenue for $2.21 billion. And last month the company bought art heir David Wildenstein’s townhouse on the Upper East Side for $79.5 million — marking the priciest New York townhouse ever sold. Sources say the company, which is traded in Hong Kong, likely had its money out of the country before the latest controls took effect.

And although the dollar volume of Chinese investment in Manhattan commercial real estate rose slightly in the first four months of 2017 — up to $2.3 billion from $2.1 billion during the same period a year ago — that number is skewed by HNA’s Park Avenue deal. There were a mere two Manhattan commercial property sales to Chinese buyers during the period, down from eight a year ago.

While the Chinese government appears to be more focused on megacompanies, individuals are also being impacted.

For the wealthiest of buyers — including some who’ve purchased multimillion-dollar condos in New York’s most prized trophy buildings, like 432 Park and One57 — the capital controls are a mere speed bump.

But that class of uber-wealthy buyers, which fueled the latest condo boom, has been followed by a new wave of purchasers from China who’ve been later to the game and might not have the resources to get their money out of the country.

Overall, New York’s real estate saw $14.3 billion in Chinese investment in 2016, a sizable chunk of the $33 billion poured into U.S. commercial property that year, according to a JLL Global Capital Flows report.

And while the spigot isn’t being turned off entirely, the pace of growth is projected to slow.

Chinese investors are expected to deploy $58 billion into U.S. real estate between 2016 and 2020, a more than 50 percent drop from the $110 billion invested in the slightly longer six-year period spanning 2010 and 2015, the Asia Society reported last year.

Arthur Margon — one of the report’s authors and a partner at Rosen Consulting Group, which specializes in real estate economics — predicted an 18- to 24-month investing “hiatus” from Chinese investors thanks to capital controls.

“They’re trying to get righted while they defend their currency and fight inflation,” he told TRD.

The residential pullback

On an overcast evening last month, more than 150 guests gathered in a $16.6 million condo at 212 Fifth Avenue to celebrate the launch of a 298-page guide to Chinese investment in U.S. real estate. Clad in a candy-red sheath, co-author Nikki Field of Sotheby’s International Realty — who has courted Chinese clients for more than a decade — quieted the crowd and introduced developer Robert Gladstone, who couldn’t resist pitching the building’s remaining condos.

“Hopefully, they’re all gone by the end of this evening,” he told the crowd of mostly Chinese brokers and buyers.

Gladstone dismissed concerns about China’s financial crackdown. “No one is going to tell Jack Ma what to do with his money,” he said, referring to the founder of the Alibaba Group, the massive Chinese e-commerce company.

But not everyone shares the billionaire’s clout and political connections.

While individual Chinese investors, especially the wealthy, have long been moving their money overseas through an array of back channels — including bank accounts in Hong Kong and London — there are still plenty of investors with money stuck in mainland China.

The new regulations add to existing measures for all of them. In addition to the $50,000-per-year currency exchange quota that has been in place for years, investors must now also disclose how they plan to use the funds and sign a pledge confirming that they won’t purchase securities or life insurance abroad. The new rules also close a popular loophole to the $50,000 limit by banning individuals from pooling funds from family and friends, a practice known as “smurfing.” Those who violate the rules will also now be investigated, added to government watch lists or prevented from transferring money for three years.

And fear of defying the government is real.

“Everyone is scared,” said the Corcoran Group’s Victoria Ye.

Robert Dankner, the president of the residential brokerage Prime Manhattan Realty, said this round of tightening is more severe than past controls.

“It’s not a one-off,” said Dankner, who works closely with Chinese clients. “There are lots of people who have real money to spend who’d like to invest. And for no reason other than the Chinese government doesn’t want to see these capital outflows continue, they are stopping transactions.”

While it’s impossible to quantify in hard numbers, developers, brokers and attorneys are anecdotally reporting that Chinese buyers are struggling to free their cash.

That could have serious implications for New York condo developers, who have billions of dollars’ worth of residential units on the line — and, in many cases, are relying on those buyers. And it comes as developers are racing against a softening market and looking to unload units as soon as possible.

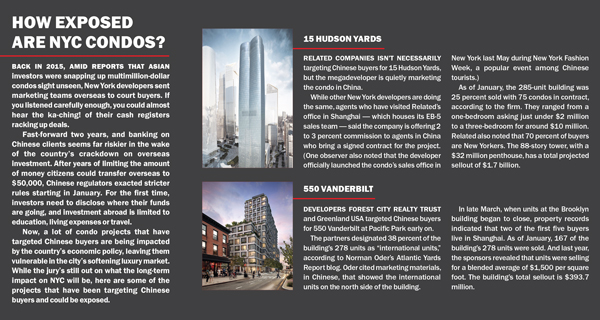

The new restrictions have already taken a toll on deals throughout the city, particularly in new-development projects that have targeted Chinese investors.

“You see 50 percent of inquiries come from Chinese brokers or individuals,” said Douglas Elliman’s Janice Chang, who works regularly with Chinese buyers. “All the projects will be impacted.”

Scattered reports of how this is unfolding are already popping up.

At the 216-unit Oosten in Williamsburg, for example, the buyer of a $1.4 million condo backed out of a deal this year, according to Cindy Morin, marketing director for Xin Development, the property’s sponsor. “They couldn’t get the money out,” she said.

Meanwhile, at Sky View Parc in Flushing, Onex Real Estate Partners — the real estate arm of Canada’s largest private equity firm — is preparing for a new landscape.

Onex’s David Brickman said that while the latest capital controls haven’t yet hurt sales, the company is on high alert that the pace of closings could soon slow as buyers need to plug funding gaps.

“Anyone buying now doesn’t have the time to gather the capital,” he said, referring to those going into contract who have not yet pulled their money out of China.

Buyers’ brokers are even more intimately aware of the challenges Chinese buyers have been facing over the last few months.

Last month, Anne Chang, principal at Manhattan-based Jade Stone Real Estate Consulting, which works with international clients including many from China, took a Chinese client with a budget of $1.3 million to see 25 Manhattan apartments in two days — to no avail.

“They have the money, it’s just not 100 percent here,” she said of a couple she’s working with who are $150,000 short of a $450,000 down payment because they can’t get their money out of the country.

And it’s not just brokers and developers seeing the drop-off. The entire web of professionals servicing the residential industry in New York has noticed a shift in the last few months.

Esen Edip, president of Titles of New York, which provides title insurance on residential deals, put it this way: “There is an eerie silence in the market.”

A tighter cash spigot

Brokers say even those Chinese residential buyers who are still active in New York are doing far fewer all-cash deals in 2017 than they were in the past.

So far Onex has seen several instances at the Grand at Sky View Parc in which buyers — who would previously have paid all cash — need to take a 25 percent mortgage.

“It’s obviously something that’s on our radar, and we’re trying to make sure we stay ahead of it,” Brickman said.

To that end, Onex has compiled a “preferred lender” list of banks with loan products available for Chinese nationals. The developer met with banks late last year to narrow down reputable lenders for buyers. “It’s our job. We’ve got to get them to closing,” Brickman said.

“If borrowers are saying, ‘I’m buying a $1 million apartment and I have $900,000, so I need to borrow $100,000,’ I’ll give them time to borrow that $100,000,” he added.

Brokers who work closely with Chinese buyers said they, too, have seen a move toward financing residential purchases since the latest round of capital controls took effect.

Elliman’s Chang cited one client who put $1.5 million down on a $6 million condo in Tribeca before the regulations took effect. Overnight, the controls became so strict that the client couldn’t get the rest of the money out and ultimately turned to a hard-money lender to finance the deal.

Meanwhile, Town Residential’s Vicki Zhi Saali said one of her clients signed a contract in June to pay cash for a $2.2 million unit at 389 East 89th Street, but hit a wall with Chinese regulations this year and is now taking a loan.

“Earlier this year, the wife kept telling me, ‘It’s really tight to get money out,’” Saali said. “And her family is really connected. His grandfather was a Red Army guy.”

Several smaller banks and other lenders in the city — including Quontic Bank, GuardHill Financial and Abacus Federal Savings Bank — have stepped in to fill the void where prospective Chinese buyers are short on cash. While these lenders have been issuing loans to Chinese buyers for several years, their business has seen a substantial bump in the last few months.

“More and more people who were all-cash buyers are now coming in and borrowing 40, 50 and 60 percent,” said Steven Schnall, CEO of Quontic, which is on track to lend $50 million to Chinese buyers this year, double the amount it lent in 2016.

“More and more people who were all-cash buyers are now coming in and borrowing 40, 50 and 60 percent,” said Steven Schnall, CEO of Quontic, which is on track to lend $50 million to Chinese buyers this year, double the amount it lent in 2016.

But with the New York luxury condo market softening, mortgage lending in general is more stringent. And closing a deal with financing obviously takes a lot longer than closing a cash deal — a reality that is not lost on developers who are trying to sell units before the market further weakens.

Much like Onex, other developers have already shown a willingness to work with these buyers to get deals done.

Developer Danny Fishman of Gaia Real Estate told TRD this year that he’s let buyers spread cash payments over 12 months.

“We’re not doing it across the board,” he said, “but in some cases, we can work with them.”

And Town’s Saali said HFZ Capital Group is giving her client until September 1 to close on a $4 million apartment at the Bryant on West 40th Street. That will give the buyer enough time to move her money to the U.S. or to obtain a mortgage.

“She wants to have that backup,” Saali said. “China doesn’t want any money to flow out — even those with influential families have to obey orders on the surface.”

Though they don’t promote the practice in the U.S., sources said, some Chinese developers with New York projects are selling condos in China, where they’ll accept yuan rather than having buyers pay in dollars.

“They shift the burden to the developer [to convert it to dollars],” said Daniel Chang, who heads the Asia desk for Field’s team at Sotheby’s. “It’s a gray area.”

Closing the floodgates

For almost a decade, Chinese companies and institutions have been ramping up their investments in the U.S., particularly in gateway cities like Los Angeles, Washington, D.C., and New York.

Those investments have grown increasingly bigger since 2012, when the Chinese government — looking to spur economic growth in its own flagging economy — loosened restrictions on the amount of money Chinese insurance companies could invest abroad.

The move opened the floodgates, leading to massive U.S. real estate investments. Think Anbang’s 2014 purchase of the Waldorf Astoria for a record $1.95 billion.

But amid concerns that too much capital was fleeing the country and that Chinese companies were overpaying for foreign assets — a potential vulnerability for the economy — Chinese officials have started tightening the screws again.

Unlike in the U.S., where things are hashed out in a very public fashion, in China directives are often issued behind closed doors. That’s what happened in November and December, when government officials reportedly began telling Chinese companies that foreign investment would be coming under greater scrutiny.

The government now requires companies to report any foreign investment of $5 million or more to the State Administration of Foreign Exchange, which can recommend review by other agencies and effectively veto it.

Sources said that for the last few years, most deals were rubber-stamped. “It used to be an approval process; then they changed it to more of a registration process,” said Joel Rothstein, an attorney at Sidley Austin who splits his time between Hong Kong and Los Angeles.

In the last few months, that’s changed as Chinese officials have more readily required companies to prove that any overseas investments directly relate to their core business. If they don’t, the deals are not likely to pass muster.

Real estate deals get especially close scrutiny, sources say, because so many other industries use it to park and grow cash.

Last month Yi Gang, the deputy governor of the People’s Bank of China — the country’s central bank, which is responsible for regulating financial institutions — said Beijing will be closely monitoring international capital flows in the coming months.

“We have to watch that kind of phenomenon [of capital outflows] and see what is the underlying reason,” he told a room of about 200 guests at a Manhattan conference hosted by the China General Chamber of Commerce.

A senior executive at a large Chinese bank said the latest clampdown will be felt far more by Chinese companies and individuals than previous efforts.

“The Chinese government probably wasn’t very serious about how they were trying to impose capital controls in the past. But now they are very serious,” noted the executive, who asked to go unnamed.

Institutional players in the crosshairs

Anbang, the most active Chinese insurance investor in New York, reportedly began talks with Kushner Companies about investing in 666 Fifth Avenue in mid-2016.

By February, Bloomberg reported that a deal was imminent and that Anbang’s partial-stake purchase would value the property at a massive $2.85 billion. The two firms would then borrow $4 billion and redevelop the building into a 1,400-foot-tall tower made up of luxury condos and a vertical mall, Bloomberg reported.

The potential deal made national news, with Democratic lawmakers raising concerns over a possible conflict of interest because the Kushners were considering a Chinese partner while Jared Kushner, the president’s son-in-law and senior adviser, was in the White House dealing with foreign policy. Then, on March 29, Anbang backed out of any potential deal, though Kushner Companies issued a statement saying it was a mutual parting.

Several sources told TRD they heard Anbang received a phone call from regulators telling it to put the kibosh on the deal. But others said Anbang’s may have just been a business decision.

Further complicating matters is that the social-media rumor mill exploded last month with reports that Wu Xiaohui, Anbang’s chairman, had been detained by Chinese authorities. Anbang denied those rumors and said the company was doing business as usual. However, some media outlets in China reported that the government was investigating Wu in connection with an allegedly illegal $14.5 billion loan. It’s unclear whether any of this — if even true — is also tied to the firm’s overseas investments.

But Anbang’s withdrawal from two major transactions in 12 months comes as the Chinese government is cracking down on insurers, raising questions of what exactly was at play behind the scenes.

“The groups most impacted will be the Goliaths, including the insurers, the banks, the state-owned enterprises and some of the larger non-state-owned enterprises,” said Omer Ozden, CEO of the international real estate merchant bank RockTree Capital, who has worked with Chinese investors for 25 years.

“We have seen currency successfully converted in 2017 for some smaller transactions of the $10 million-to-$40 million range, but forget about amounts above $100 million,” he added. “We are at a standstill right now for large tickets.”

Ludwig Chang — the recently retired co-founder of COAMC International, a subsidiary of leading state-owned asset management firm China Orient Asset Management — said that insurance companies are already being squeezed.

“Some insurance companies, who shall remain unnamed, have had two or three failed [NYC] transactions,” he said during an event at the China Institute in Lower Manhattan last month. “One was a building on Fifth Avenue that was quite well known. I think [that was] the handiwork of the new insurance regulatory regime.”

The hit to insurance companies could spell trouble for the New York market.

With the Chinese buyers on the sidelines it does mean that there are fewer buyers in the market today so that should have a quieting effect on some of the commercial property sales trends,” said Real Capital Analytics’s Jim Costello, although he added that uncertainty over U.S. economic policy and the market cycle played a far bigger role in slowing deals than Chinese regulators.

One investment-sales broker at a major real estate firm, who asked to remain anonymous, said insurance companies have been noticeably absent from the New York market in 2017.

“Groups that were previously active are now on the sidelines,” the source said, noting that the companies still looking to invest are avoiding big, splashy purchases that may raise the ire of regulators.

“If it’s too big, it may raise red flags and raise too much attention,” the source said.

Over the past five or so years, Chinese insurers have been among the most active foreign investors in New York’s real estate market, spending $6.3 billion on real estate in the New York area in 2015 and 2016 alone, according to Real Capital Analytics.

Taiping Asset Management, a subsidiary of Chinese Insurance International Holdings, for example, bought a $229 million stake in Steve Witkoff, Fisher Brothers and Howard Lorber’s condo development at 111 Murray Street in 2015.

Meanwhile Ping An, another insurance giant, launched a U.S. real estate investment arm, also in 2015, and vowed to spend billions over the coming years.

That vow could now be difficult to keep.

Complicating matters is that the head of the Chinese Insurance Regulatory Commission, which oversees the country’s insurance industry, just stepped down.

Headquarters of the People’s Bank of China (PBoC) in Beijing.

“We expect that this will trigger a slowdown of offshore investments and in particular direct real estate investments,” said Julian Lin, an analyst at Z-Ben Advisors, a Shanghai-based consultancy.

He said that until a new agency head is installed, “insurers will be less inclined to do these kind of aggressive investments offshore” because they don’t have regulatory clarity and will fear punishments.

Others say they are having trouble raising Chinese cash, a major source of financing for New York projects.

Al Tarar, a former Pricewaterhouse-Coopers executive in China who now heads the financial advisory firm Arcis Capital, said he was about to raise money in China for a $70 million debt fund to invest in Florida when the capital controls threw a wrench into his plans. Ultimately, his partners managed to get money to the U.S. by taking a loan in dollars from a bank and securing it with Chinese assets, but only after a delay.

The capital controls have had “a huge impact on institutional investors,” he said.

Since 2016, Chinese regulators have also made it harder for insurance firms to sell risky, short-term financial products that are bankrolling U.S. real estate investments. The fear is that the companies might be vulnerable to an investor run.

Regulatory pressure hasn’t just impacted investment sales, but also projects in New York and other cities where Chinese firms have already invested, sources say.

The abovementioned senior Chinese banking executive said Chinese firms are already showing signs of weakness. “We have seen capital calls where investor money was going to come in but didn’t,” he said.

Bypassing capital controls

To be sure, there are plenty of Chinese firms, both large and small, that already have their money out of China or have connections to get it out, putting them beyond the immediate reach of capital controls.

Some, including the development firms Xinyuan Real Estate and Greenland Group, have sold shares on New York or Hong Kong stock markets.

Others, like HNA, have for years been buying up overseas assets that now provide income in dollars that they can reinvest. That may explain why HNA — which started out as a local airline in the southern province of Hainan — was able to buy 245 Park for such a massive price.

And Chinese buyers on the residential side of the market have their own strategies in the works. According to a recent report from Knight Frank Real Estate, China is creating 100,000 millionaires a year — meaning more Chinese investors with resources and connections.

While the superwealthy have underground ways to get money out, even the less wealthy and less politically connected are searching for ways to make an end run around government — in some cases surreptitiously wiring funds to the U.S., sources say.

Optimists point to the large number of Chinese companies with offshore money and argue that the capital controls will have a limited effect on commercial real estate investment in New York.

“For those global Chinese institutions, it’s gone back to almost business as usual,” said David Green-Morgan, JLL’s global capital markets research director, who’s based in Singapore.

He expects the controls to have “more of a plateauing effect,” keeping Chinese investment in overseas real estate in 2017 close to its 2016 total of $33 billion.

Scott Latham, a senior investment-sales broker at Colliers International, said that the cyclical slowdown in New York’s market did more to curtail Chinese investment than regulations. It started in mid-2016 “with uncertainty because of the election and Brexit, and then [capital controls] started to pile on,” he noted. “It’s not as simple as just singling out the Chinese.”

Latham said he believes that Chinese institutions are sophisticated enough to get around capital controls and will continue to be drawn to New York amid global market volatility.

And Hodges Ward Elliott’s Will Silverman said he believes that while insurers from mainland China may pull back in 2017, Hong Kong companies could jump into the fold.

“A lot of them think this is their moment because there’s less competition,” he noted.

But deploying money out of Hong Kong or other offshore locations might not sit well with Chinese regulators, Oenus Capital’s Cai-Lee pointed out.

“If something is discouraged and you go and make a splashy deal, how do you expect the Chinese government to allow you to move more money out of China [in the future]?” she said. “It’s not like they don’t read the news.”

While the majority of the players TRD interviewed agreed that Beijing’s capital controls are already having an impact on New York’s real estate market, there is less consensus over how long that will last.

Economist Sam Chandan, an associate dean at NYU’s Schack Institute of Real Estate, argued that capital controls — in one form or another — are here to stay.

As China’s economy continues to mature and economic growth continues to slow over the medium term, it will become more difficult to earn high returns within the country, he noted.

And if Beijing wants to push those players to invest in China to stimulate growth there, it will have to keep capital controls in place, Chandan said.

Others argued that Beijing’s desire to make the yuan a dominant global reserve currency will lead it to loosen capital controls again. Several sources told TRD they expect restrictions, at least for institutions, to start loosening again in the fall.

RockTree’s Ozden said that Beijing goes through phases of tightening and loosening regulations. “Just because the restrictions are there, it does not mean the appetite is suppressed,” he said. “In fact, you can say just the opposite. As regulators build levees, the Chinese demand to invest abroad sometimes increases. And ultimately, the levees may erode.”