WeWork is quietly setting the stage for the launch of a brick-and-mortar retail platform as it continues to branch out into new business lines ahead of an expected public offering.

Several sources told The Real Deal that work on retail concepts gained momentum over the past six months and is shaping up to be a priority for the firm. What WeWork’s retail business could look like is still unclear, but sources said extending the firm’s co-working model — furnished spaces on short-term leases — to retailers is a possibility. The firm is also considering the addition of WeWork-managed retail spaces in its buildings as a potential amenity for its office tenants, the sources said.

WeWork declined to comment.

In October, WeWork and its private equity partner Rhone Group announced the $850 million acquisition of the Lord & Taylor building in Midtown from retail giant Hudson’s Bay Company. As part of the deal, Rhone and WeWork’s joint real estate investment vehicle is investing $500 million in preferred shares in HBC. According to the Wall Street Journal, WeWork Property Advisors’ Eric Gross is getting a seat on HBC’s board.

“Retail is changing and the role that real estate has to play in the way that we shop today must change with it,” WeWork’s co-founder Adam Neumann said in a statement at the time. “The opportunity to develop this partnership with HBC to explore this trend was too good to pass up.”

Other signs point to WeWork’s growing interest in retail. Unnamed WeWork principals invested in retail technology startup Outernets, which produces intelligent advertising screens for storefronts, according to Outernets co-founder Omer Golan. Golan said he has been working with WeWork on retail concepts, but was instructed not to share any details.

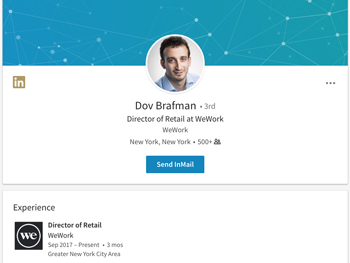

Over the summer, several employees of the online electronics retailer Sharkk became employees at WeWork, according to their Linkedin profiles, and its founder, Dov Brafman, is now listed on LinkedIn as WeWork’s director of retail (In response to a query from TRD, WeWork said his title on LinkedIn was being changed). In an interview he gave to the K-Factor podcast earlier this month, the show describes him as an entrepreneur who sold his startup to WeWork.

The retail push comes as WeWork increasingly branches out into new business lines. The company opened its first Rise by We gym in Manhattan in October and acquired the coding school Flatiron School. It has also announced plans for an elementary school.

WeWork has plenty of money to fund its new ventures. In August, the company announced a $4.4 billion investment from Japanese conglomerate Softbank, reportedly at a $20 billion valuation, although much of that money is earmarked for the firm’s expansion into East Asia. The infusion made WeWork one of the five most valuable startups in the U.S.

Is WeVacation next?

Hospitality is another potential new business line for WeWork, according to a source familiar with the company, although it has yet to disclose any specific forays into the space.

Neumann is an investor in the Panamanian hospitality company Selina Hostels, which runs hostels and co-working spaces in several Latin American countries, according to the source and a May report in the Mexican news outlet Cancunissimo. The Journal also reported that WeWork bought a stake in Wavegarden, a company that makes wave pools, in 2016.

WeWork has already dabbled in hospitality, renting out some rooms in its WeLive co-living space at 110 Wall Street on a nightly basis. Several high-level WeWork executives have a hospitality background. Michael Gross, the company’s vice chair, used to run Morgans Hotel Group. The firm’s head of co-working, Richard Gomel, is a former Starwood Hotels & Resorts executive. WeWork’s regional manager for Latin America, Pato Fuks, founded the hotel operator Fën Hoteles.

WeWorld

“It’s important to understand that our intent with our business from the beginning was to do multiple We-based businesses, for lack of a better term,” the company’s co-founder Miguel McKelvey said at a Cornell Tech at Bloomberg event this month. “When we made the first proposal for a building after Green Desk, it was a multi-use building that included WeLive, WeWork, a hotel concept, a restaurant concept, a barber shop, fitness concept and there was an education idea there too. So the premise from the beginning was that this is a multi-dimensional support system for people who think differently in the world.” McKelvey took issue with the description of his firm as a co-working company, saying he prefers community company.

WeWork’s expansion into retail, then, should not come as a surprise. It never made a secret out of its aspiration to become the “physical social network,” Facebook’s equivalent in the real world.

But the retail plans may also speak to the limits of scaling WeWork’s two original business lines, co-working and co-living.

Although WeWork continues to add new co-working locations at a rapid clip, competition has become fierce, particularly in its first market, New York. In September, Crain’s reported that WeWork offered tenants at rival flexible office-space provider Knotel 12 months free rent if they switch to one of its spaces — an indicator of how the fight for customers is squeezing revenues. Meanwhile Luxembourg-based IWG, whose Regus brand is a leading global provider of flexible office space, saw its share price plunge by 30 percent in a single day in October in the wake of disappointing earnings. WeWork has also hedged its co-working bets; it is the lead investor in a $32 million Series B round for the Wing, a women-only co-working space. And it’s had success with renting out entire spaces to blue-chip corporate tenants, such as IBM and Amazon.

WeWork’s co-living business has faced headwinds. The company once predicted it would have more than 30 WeLive spaces open by the end of 2017, but it currently has just two, with a third on the way. Industry sources said banks have been squeamish about financing co-living developments. At the Cornell Tech event, McKelvey blamed the complexity of new development.

“The cycle for ground-up development, to do it with partners, is so much longer,” he said. “So there are many projects that are in process but you just don’t hear about them yet.”