After getting pummeled in the first quarter, Manhattan’s luxury condominium market looks to be getting off the mat. Brokers say they have seen a rise in sales activity since April, spurred by lower asking prices, stabilizing financial markets, and warmer weather.

“The real estate market winter was very cold, and then things warmed up again,” said Leonard Steinberg, president of the residential brokerage Compass. Sales at ultra-luxury apartment buildings like 432 Park Avenue have picked up noticeably in recent weeks, he added. In early May, for example, a penthouse at Macklowe Properties and CIM Group’s supertall condo tower went into contract for $76.5 million. And on Wednesday, Vornado Realty Trust’s CEO Steve Roth noted the sales office for his 220 Central Park South project “is noticeably busier than it was three months ago.”

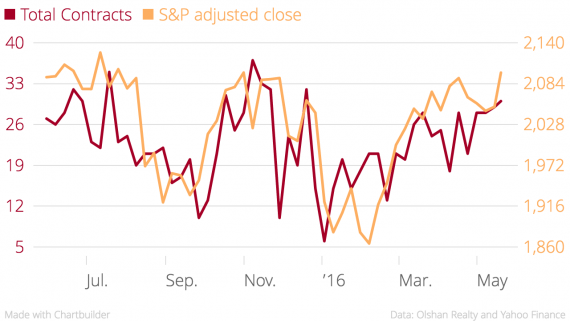

Although still well below 2015 levels, the weekly number of contracts signed on Manhattan properties above $4 million has been steadily inching up since February, according to Olshan Realty (see chart above).

Renderings of 432 Park (credit: DBOX for CIM Group and Macklowe Properties)

Part of that increase is seasonal – winter tends to put a freeze on apartment purchases. But brokers say the rebound also reflects adjusted expectations on the part of sellers.

“May and June are the Super Bowl of the year for housing sales in Manhattan,” said Jonathan Miller, CEO of real estate appraisal firm Miller Samuel. The recent softening at the top of the market, he said, was a disconnect between value and price, brought about by an abundance of inventory.

“In 2014, value and price were relatively the same,” he said. “You were asking $20 million and it was worth $20 million.” As new inventory came online, those same apartments were worth $17 million but sellers weren’t negotiating. “It takes a year-and-a-half for sellers to capitulate to a new market,” he said. “We’re starting to see it.”

CORE’s Emily Beare said that in March and April alone, she signed $48 million worth of contracts on the sell-side. Typically, she’ll handle that volume over several months.

A penthouse at the Chelsea Mercantile asking $8.75 million, for example, went into contract after a few weeks at close to the asking price. “The sellers didn’t want to fool around, they wanted to sell quickly,” Beare said. “It’s a different seller that says, ‘If I can get this [price], I will sell.’”

Asking prices for luxury apartments have fallen by more than 10 percent in some cases, brokers say, while prices for lower-end product continued to grow.

“Finally the sellers got the message, because for a long time sellers were holding on to their fort,” said Douglas Elliman’s Jacky Teplitzky. She added that placing offers and negotiating – virtually absent from the high-end market over the past two years – have returned.

$24 million co-op at the San Remo

While there are still plenty of overpriced properties on the market, well-priced listings — even big-ticket pads — will sell, according to Brown Harris Stevens’ Lisa Lippman. One of her listings, a co-op at the San Remo asking $24 million, received multiple offers and went into contract after a month, though Lippman didn’t provide the in-contract price.

And as prices fall, New York buyers who were priced out by foreigners in recent years are making a comeback, according to brokers.

“The first quarter was a ghost town,” said Sotheby’s International Realty’s Nikki Field. “In the second quarter we were saved and the white knights were the New York buyers. In the next week alone we are closing three prewar co-ops over $10 million with all local buyers, which for us is very unusual.”

Douglas Elliman’s Michael Graves said it’s hard to point to one reason for the recent “burst in activity” in the high-end market. But he reckoned that buyers who remained on the sidelines amid skepticism over where the market was heading simply got tired of waiting.

“There hasn’t been a whole lot in the tea leaves to explain why it hasn’t been as healthy and people are tired of waiting. They’re moving on property,” he said. The U.S. economy is in decent shape, he said, and while global economies are not – that makes New York real estate all the more appealing.

The recent stabilization in global financial markets, too, adds another boost to luxury sales. In the first two months of the year, stock market slides and tumbling oil prices wiped out wealth and triggered recession fears, leading many high-end buyers to table apartment purchases. But markets have recovered since, and luxury sales followed suit (see chart).

But it’s not all good news for developers. The downward trend in prices that has enabled activity to recover hurts developers’ profits. Some have slashed their projected sellouts, others are opting to wait before launching sales, while still others are putting luxury conversion plans on ice. And Field said she expects prices to continue to slide through the rest of the year. “This is a new era of aggressively marketed new development,” she said.

Donna Olshan, of Olshan Realty, said that luxury apartments spent an average of 275 days on the market in May – up from 211 a year ago. This, she argued, indicates many sellers have yet to accept the downward correction in prices.

“There are a tremendous number of overpriced units that are choking the luxury market,” she said, adding that the 57th Street corridor is particularly hard hit by oversupply. To claim that the luxury market has recovered, she said, “is overstating the case.”