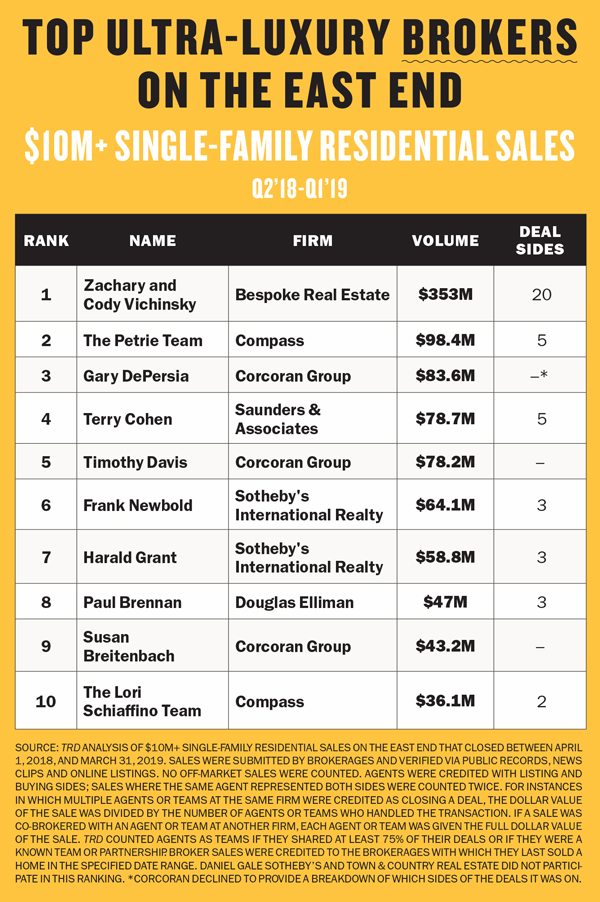

For Bespoke Real Estate’s Vichinsky brothers, sitting atop a ranking of the top residential brokers in the Hamptons is not unfamiliar territory.

The duo landed in the No. 1 spot in The Real Deal’s 2019 ranking of ultra-luxury brokers — those who closed the highest sales volumes of homes priced at $10 million or more. And in years past, the Vichinskys sat atop previous TRD rankings that included sales of homes priced under that amount on the East End, too.

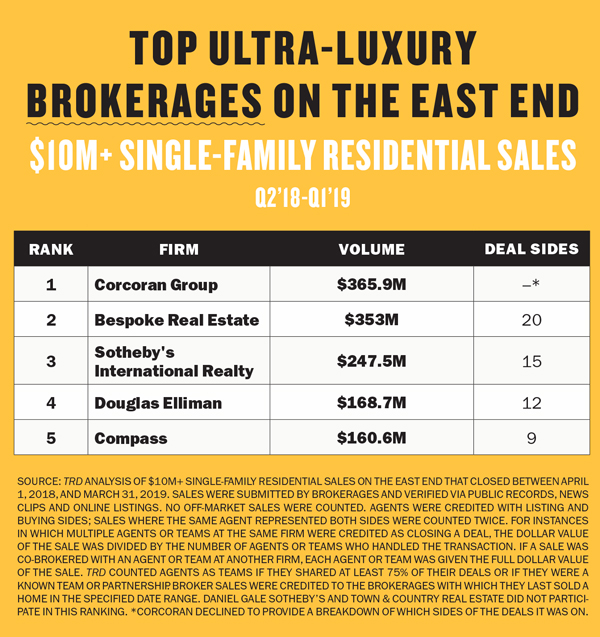

TRD also set out this cycle to list the top 10 Hamptons brokerages by volume of single-family sales in excess of $10 million between April 1, 2018, and March 31, 2019. Perhaps not surprisingly, Bespoke, which focuses specifically on the $10 million-plus market, came in at No. 1. Notable trades handled by the firm within the last year include the $32 million sale of a Southampton oceanfront estate and the $26.1 million sale of Montauk’s Villa Maria compound.

The brothers Vichinsky began making waves on the South Fork residential scene in 2015. A year earlier, Cody Vichinsky and his older brother, Zachary, both former Corcoran Group brokers, left to start Water Mill-based Bespoke.

While the team closed a whopping $353 million in sales over the 12-month period analyzed in the ranking, it would be a mistake to assume it’s boom times for the local luxury market as a whole.

In fact, a sluggish pace of deals for local high-end homes has brokerages and their agents wringing their hands. Cody Vichinsky had a simple analysis of the unrest.

“You don’t need to buy a home in this market — it’s a desire,” he said.

Vichinsky echoed the sentiment of many of his East End agent colleagues: that as Manhattan’s luxury market has stagnated, the once-hot Hamptons have cooled. The difference between a primary and secondary market, Vichinsky noted, is that even during times of economic volatility, sellers don’t have the same urgency to offload excess homes.

“It becomes like a Hamptons standoff,” he said. “There are qualified folks on both ends, but there’s just not a meeting of the minds.”

Sagging sales

As staunch sellers and cautious buyers continually fail to meet in the middle, Christopher Burnside’s life entails being perpetually buried in seemingly endless negotiations.

The Brown Harris Stevens broker has been cutting all kinds of deals — on everything from his own commissions to home repairs — in order to get homes sold. With three properties currently in contract, Burnside has been successful, but the current market has made his job tougher.

“They were difficult every step of the way,” said the Bridgehampton-based Burnside, noting that after the inspection of one home he promised to take on maintenance work by fixing a gate and broken light fixtures. “I can’t imagine many other brokers going through that painstaking agony.”

Such is the plight of the Hamptons broker, a cohort that caters to ultra-affluent and highly demanding clients. As the luxury sales slowdown in New York City has spread to the South Fork, inventory has piled up, with many sellers having little sense of urgency — thanks in part to a robust rental market — and well-heeled buyers waiting for attractive deals. Many buyers are still grappling with broader economic concerns, such as the much-publicized state and local tax (SALT) deduction cap.

Hamptons home sales have been steadily declining since the end of 2017, and the number that traded during the first three months of 2019 fell nearly 20 percent year over year to 297, the lowest mark in seven years and a sign of a general downturn in the market, according to data from Douglas Elliman. First quarter reports from Corcoran and Town & Country offered a similarly sobering market outlook. Town & Country and Daniel Gale Sotheby’s International Realty declined to participate in TRD’s 2019 rankings.

Inventory soared 87.8 percent, to 2,407 listings, during the first quarter when compared to the same period last year, per Elliman data. At the same time, Elliman said, the median Hamptons sales price dropped 5.5 percent year over year, to $850,000, a nearly 15 percent plummet from the $995,000 seen in the fourth quarter of 2018. In the luxury sector, defined by Elliman as the top 10 percent of sales, inventory swelled 191.6 percent year over year, even as the median sales price rose 18.2 percent, to $6.56 million.

Overlay onto that the ever-present churn among firms and the ongoing technological changes in how brokers do business, and you have a mood of uncertainty casting a pall over the market.

“It’s different,” said Susan Breitenbach, a veteran Corcoran broker in Bridgehampton. “People are cautious. And there’s so much inventory.”

Taxing issues

Breitenbach and her Corcoran colleagues Timothy Davis and Gary DePersia — a perennial trio among the East End’s broker elite — came in ninth, fifth and third, respectively, in TRD’s top-brokers ranking.

While Corcoran declined to provide a breakdown in individual agent sides, all three boast a number of big listings. DePersia is currently marketing talk show host Dick Cavett’s oceanfront Montauk home for $34 million, and he brought in the buyer this year for a 23,000-square-foot Southampton new build priced at $35 million, a deal that also involved Davis. Breitenbach has the listing for fashion designer and artist Helmut Lang’s oceanfront East Hampton estate, which could seek $100 million.

Such megatrades have become harder to find. Elliman’s first quarter analysis found that the number of East End homes selling for more than $10 million hit a six-year low, while the 21 purchases at or above the $5 million level were well below the 31 that has remained the quarterly average for the past decade.

In another sign of the headwinds facing the high-end Hamptons market, the Peconic Bay Region Community Preservation Fund had a 29 percent decline in revenue during the first quarter of this year due to the dramatic decline in income from the taxes derived from home sales, according to reporting by the East Hampton Star. While the fund raises money through charitable gifts and payment for professional services, it also depends upon a 2 percent real estate transfer tax levied in East Hampton, Riverhead, Southampton, Shelter Island and Southold.

Beyond local market concerns, macroeconomic factors such as the federal tax overhaul, rising interest rates and market fluctuations have all contributed to buyers feeling more cautious, brokers said. Under the Trump administration-led revamp of the tax system, SALT deductions are limited to $10,000, a point of contention for those looking to acquire luxury homes. Roughly half of Manhattan’s taxpayers sought such SALT relief in the past, with the average deduction at more than $60,000.

To mitigate the impact of the new legislation, some New Yorkers seeking second or third homes outside of Manhattan are now moving to low-tax states or seeking out properties with tax abatements. Enzo Morabito, a seasoned Elliman broker based out of Sag Harbor and Westhampton Beach, said many potential Hamptons homebuyers are instead looking to states like Florida, North Carolina and Texas.

“They think, ‘If I didn’t have the New York state taxes, I could afford a nice condo on the ocean down in Florida or someplace,’” said Morabito, whose Bridgehampton- and Sagaponack-based Elliman colleague Paul Brennan came in at No. 8 on TRD’s list of top brokers. (Brennan had the listing for a Montauk estate once owned by playwright Edward Albee that was sold to fashion designer Ralph Lauren for $16 million in March.)

Earlier this year, big-city brokers feared the enactment of a pied-à-terre tax on secondary homes in order to help fund the Metropolitan Transportation Authority’s capital budget. The proposal never came to fruition, having been replaced by a mansion tax — a one-time levy on residential sales — along with a heftier state transfer tax.

But the confusion, anxiety and ambiguity that those myriad measures created in Manhattan and elsewhere, as well as the SALT deduction drama, have fueled a broader sense of unease among buyers and the brokers who serve them.

“Any time you tip the scales toward more fees, it’s a nail-in-the-coffin type of situation,” Morabito said.

Changing tactics

With buyers taking more time to navigate and evaluate high-end properties due to changes in price trends and inventory, brokers like BHS’ Burnside are having to do more to guide clients if they want to get to closing.

“I like to make deals,” said Burnside about his approach. “I just look at the deal and think, ‘How do I make this work?’”

Bespoke’s Vichinsky said that buyers need to be educated on the economics of the micro-market they’re looking at, a process that requires a different kind of patience since the ultimate purchase price depends on desire, not necessity. In his view, some East End brokers lack the experience and resources to adjust to that slower pace.

“In times like this, many brokers get uncertain about where their next deal is coming from, so they put their interests first instead of serving clients’ long-term needs,” Vichinsky said. “They instantly go to price reductions, which isn’t necessarily bad — but a lot of sellers look at the market different than in New York City.”

And competition continues to be intense for deluxe deals. If an agent isn’t proactive, a seller will quickly find someone else, brokers said. Top brokers benefit from their existing base of clients and referrals — and their track record — but those who spoke to TRD for this story said they have noticed a greater number of agents vying for a smaller amount of business.

Smart consumers know how to work with the right people, Breitenbach said. Nonetheless, the Corcoran agent is always tweaking her marketing strategies to get the right exposure. Aside from her own website, Breitenbach has expanded her presence on Instagram, including videos, and recently bought a drone (see how tristate area brokers utilize social media on page 10).

“You need the best of everything. I’m always looking for new things,” she said. “I spend double what most people spend on photography. I have expensive brochures. I don’t skimp.”

A new threat?

As if Hamptons brokers didn’t have enough hurdles to overcome, they now face a new menace. In April, Zillow’s Hamptons portal launched a back-end listing system that major East End firms said was plagued by a series of bugs.

“This system is unusable,” Town & Country CEO Judi Desiderio wrote in an email to Zillow’s New York general manager, Matthew Daimler. “In dictating an instant changeover, it’s disabled thousands of agents who populate your site.”

Zillow declined to comment for this story.

The back-end listing system is what brokers use to enter and search listings, and it feeds aggregators such as Zillow’s Out East portal — the consumer-facing successor to Hamptons Real Estate Online — as well as the New York Times and News Corporation-owned Realtor.com. Until recently, Hamptons brokers had used RealNet, a database developed by the former owners of HREO, which was acquired by Zillow in 2017. While RealNet still exists in read-only mode, its Seattle-based owner has rolled out a new back-end product called Out East Agent Tools.

One broker, who requested anonymity in criticizing Zillow, said the new platform feels archaic and complained about its lack of features and difficulty using existing ones. East End agents acknowledged that RealNet needed a refresh, but told TRD that its replacement could have been more thoroughly tested before its debut.

Despite technology snafus and a soft sales market, some Hamptons brokers are feeling optimistic heading into summer.

Saunders & Associates agent Vincent Horcasitas said he recently had a property priced above $10 million go to contract and has two more closings slated for June.

In the $3 million-to-$5 million market, brokers need to work for more deals due to an abundance of new construction coming online, he said, leading him to focus more on open houses and staging for those homes. In the $10 million-to-$20 million bracket, the Bridgehampton-based Horcasitas sees signs of an East End sales turnaround.

“The market has been knocked down and declining for so long,” he said. “It can’t go down forever.”