When President Trump made his son-in-law Jared Kushner [TRDataCustom] a top White House aide, he also made a family real estate firm from New Jersey a front-page staple. Talks with investors tied to the Chinese government, pitching foreign nationals on the cash-for-green-card program, and a host of potential political conflicts of interest stemming from the company’s vast and cryptically disclosed holdings are generating mounting public interest in what is no ordinary landlord.

In light of this, The Real Deal put together a dossier on Kushner Companies to explain what it is, what real estate it controls, and how it rose to such prominence in the first place.

What does Kushner Companies own?

Kushner Companies holds around 20,000 apartments and 13 million square feet of commercial space across the U.S., according to its website. This puts it in the same league as a behemoth like Equity Residential (which owns more than 80,000 apartments but little to no office space).

Kushner stands out in two ways. First, while many other firms of its size typically specialize in either multifamily or commercial real estate, Kushner does both. Second, while most firms of comparable size are either publicly listed real estate investment trusts or private fund managers, Kushner is a family-owned firm. This means it can’t just raise billions by selling shares or pitching pension companies to invest in its funds. It makes up for that handicap by regularly partnering with big institutions on real estate deals.

When Kushner risked losing its trophy Manhattan skyscraper at 666 Fifth Avenue, for example, it brought in REIT Vornado Realty Trust and fund manager Carlyle Group to inject much-needed cash into the building. The company also regularly partners with California-based fund manager CIM Group. It’s now looking for a new partner to help fund the conversion of 666 Fifth into a condo and retail tower after talks with Chinese insurer Anbang fell apart.

(To view Manhattan properties owned by Kushner Companies in TRData’s research database, click here)

Rendering of Dumbo Heights

A little history

Yossel (Joseph) Kushner, grandfather to Jared, was born in Belarus and immigrated to the U.S. in 1949. He and his wife Rae, who met in Hungary and married in 1945, settled in New Jersey after living in a refugee camp in Italy for more than three years. Joseph was one a group of Holocaust survivors in the Newark suburbs who went into real estate, a group that included the Wilf family and became known as “The Holocaust Builders.” Joseph died in 1985, leaving behind a company that had by then built 4,000 apartments.

Charlie Kushner and Murray Kushner, Joseph’s sons, took over the company in the 1980s, although the two brothers often butted heads. In 1999, Murray was behind a decision to drop a bid to buy Berkshire Realty, which owned 25,000 units, a portfolio that eventually went to the Blackstone Group. In 2000, the brothers got into an all-out screaming match over Passover. The following year, Murray sued Charlie, alleging he diverted money from the company to political candidates.

The disputes played a big part in Charlie’s eventual downfall—one of the charges that sent him to prison stemmed from him orchestrating a plan to film his brother-in-law William Schulder with a prostitute in order to compromise him as a witness in the investigation into Charlie’s campaign finance and tax violations.

“I don’t believe God and my parents will ever forgive my brother and sister for instigating a criminal investigation and being cheerleaders for the government and putting their brother in jail because of jealousy, hatred and spite,” Charlie told TRD in 2007.

The Murray branch of the family has since operated its own, New Jersey-focused company called Kushner Real Estate Group, largely a commercial landlord but with residential holdings in New Jersey and Pennsylvania.

(To view Brooklyn properties owned by Kushner Companies in TRData’s research database, click here)

How risky are its latest deals?

Once known for staid multifamily investments, the Kushners reinvented themselves as major commercial players since their acquisition of 666 Fifth. They’ve made more than $4.2 billion worth of acquisitions over the last decade, according to data from Real Capital Analytics, and it’s hard to think of another company that is working on as many big-ticket development projects in greater New York.

But they’re somewhat weighed down by certain big bets that are at risk of turning sour. Despite a weakening luxury apartment market and a retail crisis in Manhattan, the company reportedly wants to borrow $4 billion to build a vertical mall and condos at 666 Fifth to replace the old office building. “The capital stack [for 666 Fifth],” one luxury condo developer recently said, “is insane.” After Anbang backed out in March, the Kushners are in search of a new partner.

In Dumbo, Kushner and its partners paid $715 million for a cluster of office buildings formerly owned by Jehovah’s Witnesses in two deals in 2013 and 2016 and are spending a fortune to renovate them. It’s a bold bet on the continued rise of the Brooklyn office market that could pay off handsomely, but also carries plenty of risk. Bloomberg recently reported that Brooklyn has struggled to land big-name tenants.

Meanwhile, Kushner plans to build a $400 million mixed-use development at One Journal Square in Jersey City. The town is considered up-and-coming and land values are lower than in nearby Manhattan, But Kushner lost its anchor tenant WeWork, and looks likely to miss out on a 30-year tax break at the property.

Who’s in charge?

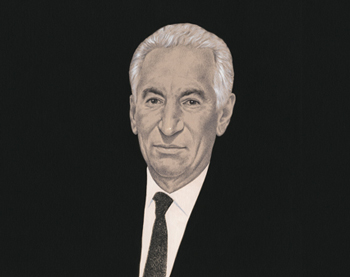

Charlie Kushner (Illustration by Edward Kinsella)

For more than a decade after Charlie went to prison, his son Jared was the face of the company. But sources familiar with the firm say Charlie continued to wield considerable influence behind the scenes and it is highly unlikely any key decisions were made without his blessing. Charlie’s importance to the company only increased after Jared left for the White House in January. Officially, Jared’s replacement is Laurent Morali, a Frenchman who joined the firm in early 2008 and was promoted to president last year. But the title belies the true balance of power. “Laurent is going to operate as chief operating officer, and over time, more and more responsibility will be given to him,” Matt Galligan, who runs CIT Real Estate Finance, a company that has financed several Kushner properties, said recently. But if “Steve Roth was to put a call in, he’s going to put a call in to Charlie.”

Nicole Kushner Meyer, Jared’s sister, could be in line for a leadership position in the future, but she only recently joined the firm and sources say she may not yet be ready for the top job. She recently represented Kushner at a promotional event in Shanghai, where the company is looking to raise $250 million from EB5 investors for a Jersey City development. Joshua Kushner, the third sibling, runs the venture investment firm Thrive Capital and appears to have little interest in the family business.

(To view office leasing transactions involving Kushner Companies, check out our Deal Sheet)

Who does it work with?

The list of Kushner Companies’ partners and lenders reads like a who’s-who of international real estate. In 2013, the company teamed up with Gary Barnett’s Extell Development to buy a 235,000-square-foot building at 80 West End Avenue for $84 million. Less than a year later, they turned around and sold it to real estate investor Frank Ring for $195 million.Its partner on 666, Vornado, is one of the city’s biggest landlords, with a portfolio spanning over 30 million square feet. The founder and CEO of the firm, Steven Roth, is also the majority owner of Trump’s most valuable asset, 1290 Sixth Avenue, and is heading up the president’s infrastructure advisory committee along with Richard LeFrak.

At Dumbo Heights, its partners include RFR Realty, a real estate investment firm lead by Aby Rosen and Michael Fuchs that owns assets such as the Seagram Building, Lever House and 90 Fifth Avenue. A minority partner in the deal is LIVWRK, a firm started by Two Trees Management alumnus Asher Abehsera.

And at 184 Kent Avenue in Williamsburg, also known as the Austin Nichols House, one of its partners is the Rockpoint Group.

Its lenders include Deutsche Bank, Citibank, Natixis, Bank Leumi and M&T Bank.

It also has over $550 million in loans backed by Fannie Mae and Freddie Mac outstanding, which some critics have said could pose a conflict of interest as Jared may be in a position to influence Fannie and Freddie, which are currently in government conservatorship.

It’s also become an active lender in its own right, funding projects such as 9 Dekalb Avenue, the supertall project planned in Downtown Brooklyn by JDS Development Group and the Chetrit Group. Morali recently told the New York Post that the company plans to lend $200 million annually to developers over the next five years.

Recent spotlight

Investigations by the New York Times and Bloomberg revealed in April that another major Kushner partner is none other than Raz Steinmetz, nephew of Israeli diamond mogul Beny Steinmetz, who is the subject of bribery and money laundering investigations in the United States, Israel, Switzerland and Guinea. Kushner and Steinmetz have together spent $188 million on more than a dozen Manhattan properties.

The company attracted new scrutiny in May when Jared’s sister Nicole, a relative newcomer to the company, gave a presentation to potential EB-5 investors at a Beijing hotel, mentioning her brother’s role in the White House and telling the audience that the Jersey City project at One Journal the company was raising funds for “means a lot to me and my entire family.” The Trump administration has the power to significantly alter the EB-5 program, which was recently renewed till September but which is facing huge pressure to be reformed, in ways that could potentially benefit Kushner Companies.