Developer Bruce Brickman started slashing prices at his luxury condo tower at 1280 Fifth Avenue a year after it hit the market. But even then, sales at the Robert A.M. Stern-designed building were sluggish and only about 20 of its 114 units had been sold.

Developer Bruce Brickman started slashing prices at his luxury condo tower at 1280 Fifth Avenue a year after it hit the market. But even then, sales at the Robert A.M. Stern-designed building were sluggish and only about 20 of its 114 units had been sold.

CORE took over marketing the property from Brown Harris Stevens the following year. And instead of cutting prices even more, the brokerage opted for a name change. The building was rebranded One Museum Mile to lure in buyers who were more attracted to the idea of living in Carnegie Hill than East Harlem.

“The press and the consumer defined the neighborhood and said, ‘Oh it’s all the way up there — it’s near 125th Street, that’s Harlem,” said CORE CEO Shaun Osher, who spearheaded the rebranding in 2012.

“We are storytellers,” he noted. “There’s nothing misleading about that. It’s just another way of saying the same thing.”

The building, which StreetEasy currently lists as in Upper Carnegie Hill, sold out within 18 months of the name change, according to Osher. Perhaps not surprisingly, the average sales price in Upper Carnegie Hill in the second quarter of 2017 was $2.2 million, compared to $652,000 in East Harlem, per figures from appraisal firm Miller Samuel.

In the competitive world of new development marketing, sponsors know nothing gets buyers over the line like a prime location. Neighborhoods bring with them a certain cachet and, more importantly for sponsors and brokers, an established price tag. And while developers play a crucial role in the evolution of the city by pushing an area’s boundaries, there’s a fine line between clever marketing strategies and manipulating the facts for profit, industry players told The Real Deal.

“People will try to suggest their location is in a higher-priced neighborhood or a more established neighborhood,” said Doug Steiner, president of Steiner Equities Group, who is currently building an 82-unit condo project in the East Village. “It’s a creative stretch of the imagination. I think it’s a mix of misleading and wishful thinking.”

That’s being exacerbated by the city’s increasingly competitive residential market. Condo inventory in Manhattan hit roughly 5,900 in the second quarter of 2017, a 35 percent increase from the previous year, according to Halstead Property Development Marketing. So the pressure is on for developers to move product and for brokers to get deals done. Industry players pointed to several condo buildings across the city — including the Woolworth Building condo conversion and the Chetrit Group’s 49 Chambers Street — that sit on the edge, or just outside, of desirable neighborhoods. Yet in an effort to entice buyers, their marketing materials may suggest otherwise.

But the practice has a deep-rooted history, according to some veteran players.

“It’s been going on for decades. Part of it is fact and deserving, and other parts are fiction,” said Town Residential CEO Andrew Heiberger. “Sometimes when a property is on the border, or over the border, then the marketing agent needs to be careful not to misstate or misrepresent the actual location … Real estate property law and the conditions of having a license require you to be truthful.”

Alternative facts

There’s no doubt that linking a development to a pricey neighborhood opens the door for upselling, but it often depends on how murky the area’s boundaries are in the first place.

The Chetrit Group, for instance, described its condo conversion at 49 Chambers Street as “where Tribeca meets City Hall Park.” Some sources said the location is accurate, while others said the new 99-unit tower is really in the Financial District.

“A lot of the developments in Tribeca have pushed way beyond Tribeca,” said one source who asked not to be named. “Forty-nine Chambers is a good example — it’s across the street from City Hall Park, which is near Tribeca but definitely not Tribeca.”

The difference in price between the two neighborhoods is significant: Tribeca’s average sale price in the second quarter was $6.2 million, well above the $3.8 million in the Financial District, according to Miller Samuel. In City Hall Park, it was just under $860,000.

The Chetrit Group and the development’s marketing firm, the Marketing Directors, did not return requests for comment.

It’s a similar story at the historic Woolworth Building, where the penthouse hit the market for $110 million last month. Alchemy Properties is converting the Cass Gilbert-designed building at 2 Park Place into 33 luxury condos and describes it as the “gateway to Tribeca” in marketing materials.

It’s a similar story at the historic Woolworth Building, where the penthouse hit the market for $110 million last month. Alchemy Properties is converting the Cass Gilbert-designed building at 2 Park Place into 33 luxury condos and describes it as the “gateway to Tribeca” in marketing materials.

“The Woolworth building is not in Tribeca,” Osher said.

A spokesperson for the Woolworth noted that while StreetEasy lists the property as in Tribeca, it borders several neighborhoods and is actually in “Parkside Tribeca” — an area that couldn’t be found in any city records.

That said, the exact borders of NYC neighborhoods are not defined by a universally recognized metric. Even the boundaries and names on the Department of City Planning’s maps are not considered official designations, and a source close to the agency said the visual data is for “informational purposes only.”

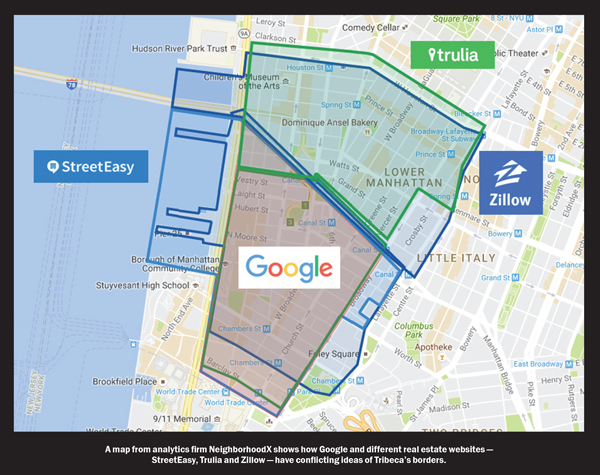

In some cases, it’s virtually impossible to reach a conclusion on the true borders of a city neighborhood. StreetEasy and the Downtown Alliance, for instance, have different definitions of where Tribeca begins and ends.

“When [Minskoff Equities’] 101 Warren Street was built, everyone said, ‘That’s not Tribeca!’ Now it’s the heart of Tribeca,” said Compass President Leonard Steinberg, who added that there were similar questions about Steve Witkoff’s 111 Murray Street and Magnum Group’s 100 Barclay. “History changes,” he said.

But while developers can be canny in fudging boundaries and playing the facts to suit them, some brokers said it’s important to push back — for the sake of both their own reputations and the buyers.

Corcoran Group’s Vickey Barron, who marketed Property Markets Group and JDS Development’s Stella Tower at 425 West 50th Street when it launched in 2014, said that in the early stages of the marketing process, the sponsors wanted to brand the condo’s location as Clinton — a special zoning district in Hell’s Kitchen. Barron argued against it, saying, “You can slice and dice it any way, but it’s in Hell’s Kitchen.”

Misleading a potential buyer about a property’s location, she said, is akin to passing off a three-and-half-bedroom apartment as a four-bedroom. It may not be ethical, she said, but some agents get away with it. “For sure, it’s wrong … but are people being arrested? No.”

The gray areas

Other brokers said it’s unfair — or even misleading — to market a building as being in one neighborhood when it can be the beneficiary of two.

“Everyone wants everything to be black and white,” said Steinberg. “I think it’s unfair to certain properties to just define them as one area or another when they are centered between two neighborhoods.”

Steinberg is marketing Urban Muse’s six-unit condo building at 347 Bowery, which is right on the edge of the East Village. Compass’ website describes the location as “a south-west, light-infused corner at the crossroads of Noho and the East Village.” The two neighborhoods may be close, but the price comparisons are stark. The average sales price in Noho in the second quarter was just over $3 million, roughly twice the average of $1.5 million in the East Village, Miller Samuel’s figures show.

For Stribling Marketing Associates’ Steven Rutter, whose firm is marketing Quinlan Development Group and Tavros Capital Partners’ One Vandam at 180 Sixth Avenue, it’s more black and white. “You have to be careful about getting too cute,” he said.

One Vandam is being marketed as in Soho, where the average sales price in the second quarter was just under $3 million. If it were one block west, according to Rutter, it would have been in Hudson Square, where the average sales price was $3.1 million.

“We’ve had discussions about it with developers,” Rutter said. “I’m not going to say it’s a battle, but we convince them to use the neighborhood that it’s in.”

But others have gone as far as using entirely made-up neighborhoods to sell a project. In 2000, the Edgar House at 25 Ann Street near the South Street Seaport was marketed as being in the “Tribeca Annex.”

“We were really trying to relate it to the projects that were having success in Tribeca that were 300 yards away,” said Terra Development Marketing’s Stephen Kliegerman, who was hired to promote the condo at the time. “When I first entered the business in 1989, Chelsea was 14th Street to 23rd Street — now Chelsea arguably goes up to 30th Street.”

Kliegerman also pointed to Savanna’s plans for a 170-unit condo at 543 West 122nd Street, which he describes as an “extension of the Upper West Side.” While the neighborhood is considered Morningside Heights, he explained that “the boundaries of neighborhoods expand as the development opportunities present themselves.”

Some argue that arbitrarily rebranding or renaming a part of the city should not be in the hands of the real estate industry. And there have been new efforts in Albany to establish ground rules. “There should be some level of regulation to that,” said New York State Sen. Brian Benjamin, who is working on a bill that would require brokers to consult with community members before they begin using a new name like “SoHa” for South Harlem to market real estate.

“You should not be able to walk into a historical neighborhood with a lot of money, take a 15-block radius and make a name change,” he added.

Reliable sources

Because city agencies and online portals measure neighborhoods differently, some people look to historic districts and community boards as the authorities on where a neighborhood starts and ends.

StreetEasy, for its part, uses a mix of such things as zip code boundaries, community districts, rivers, large avenues and “widely accepted conventions” to determine a neighborhood’s footprint. The listing site reviews the boundaries multiple times a year, a StreetEasy spokesperson said.

Constantine Valhouli, co-founder of the real estate research firm NeighborhoodX, said that when his company began mapping data on neighborhood prices, the ambiguity of boundaries became evident.

“As soon as we started looking into it, we were like, ‘Oh shit, the maps are terrible and often contradictory, and the data based on those is now completely suspect,” he explained.

But since there are no official neighborhood borders, there is limited legal action that a buyer who feels misled can take against a sponsor or broker. “There’s never been a case on the subject,” said real estate attorney Adam Leitman Bailey.

Only under certain circumstances could a buyer argue that a sponsor or broker committed fraud or misrepresentation — for example, if a person did not know the city well and relied entirely on a seller’s false information about a condo’s location.

“If the broker lied to them, and the purchaser relied on that, then [maybe] they’d have a case,” Bailey noted.

Attorney Terrence Oved, a partner with the law firm Oved & Oved, said that while sponsors and brokers need to exercise “extreme care” in how they geographically describe certain neighborhoods, they still have room within the law to embellish their marketing materials.

“A sophisticated developer’s marketing team will know the difference between statements that flirt with an appropriate amount of accuracy as well as incorporating certain exaggerations that are sure to grab a buyer’s attention,” Oved said. “If they say, ‘gateway to Tribeca’ or ‘gateway to Soho,’ you can’t blame them for trying.”

And sometimes that difference hardly matters when it comes to a building’s core value. Miller Samuel’s CEO, Jonathan Miller, said that the advertised locations of properties don’t weigh heavily when he’s doing appraisals. Instead, he looks at comparable buildings or units nearby to determine a property’s worth.

“The ultimate test is [to ask], ‘If a person were looking at an apartment in this building, would they pay the same or less or more for a very similar apartment in adjacent neighborhood?’” he noted.

The geographic pitch

Still, some sponsors rely on an area’s name recognition to get buyers to tour their properties in the first place.

The development and construction firm Wonder Works Construction, for example, is marketing its condo the Vitre at 302 East 96th Street, as being on the Upper East Side rather than in the more specific neighborhood of Yorkville.

“We wanted to cast a net for everyone to know it’s the Upper East Side,” said Eric Brody, the firm’s CEO. “For our decision-making it was [about asking], ‘What is most recognizable to someone within New York and outside of New York?’”

And like many other areas in the city, there are varying opinions of where the Upper East Side begins and ends. Some people think the name should only be used for the area between East 59th and 96th streets and west of Lexington Avenue. Others believe the neighborhood stretches as far as the East River and includes the areas often referred to as Lenox Hill, Carnegie Hill and Yorkville. And the average prices in that part of Manhattan vary, too. In the second quarter of this year, the average sales price west of Lexington on the Upper East Side was $3.8 million, much steeper than the average price of $1.5 million east of Lexington.

“Sometimes I find it amusing that there will be developments on Third Avenue, or even east of Third, showing pictures of Gold Coast institutions like the Metropolitan Museum of Art and the Cooper Hewitt,” said Stribling’s Christine Miller Martin, an active broker in the area. “They are selling the lifestyle brand of the Upper East Side.”

Others pointed out that neighborhood names have become more fluid and change regularly — particularly in Brooklyn. “Biggie Smalls always said he lived in Bed-Stuy, but now where he lived would be considered Clinton Hill,” said Slate Property Group’s David Schwartz, who acknowledged that brokers and developers adapt quickly to branding neighborhoods to suit trends.

“In 2005 and 2006, people would call everything East Williamsburg,” he added. “Now that Bushwick has so much cachet, those same areas that were once called East Williamsburg are being called Bushwick again.”

The same has happened in Gowanus, the largely industrial Brooklyn neighborhood centered around the heavily polluted Gowanus Canal. Just a few years ago, developers would do all they could to avoid associating their properties with that area, one broker said.

But when the Lightstone Group began marketing its 430-unit rental at 365 Bond Street in Gowanus last year, while it played up the project’s proximity to the “charming Smith Street and Court Street in Carroll Gardens,” it never misstated the development’s true location.

“We made a conscious decision to embrace Gowanus rather than turn our backs on it,” said Mitchell Hochberg, Lightstone’s president. “The developer always wants to put their best foot forward, [but] you’re not going to pull wool over the eyes of today’s buyer or renter. Ultimately, when they get there, they are going to know where it is.”

It was a similar situation for Steiner of Steiner Equities, whose six-story condo building at 438 East 12th Street in the East Village is scheduled for completion this winter. The project’s average asking price is $2.7 million, according to StreetEasy, compared to the neighborhood’s $1.5 million average sales price. Still, Steiner never tried to disguise the project’s location, he said.

“If I like a neighborhood, I like a neighborhood and I don’t try to change where it is,” he noted. “I try to embrace it as it is and not dupe people.”