The mood was gloomy in late January when rental giant Equity Residential faced investors during an earnings call. Rents were falling and concessions were rising — all thanks to the glut of new construction inventory in New York.

“Financial services are contracting and tech-job growth has stalled,” COO David Santee bluntly reported.

Speaking about the market broadly, he added, “We are hearing some crazy stuff like three and four months free on 12-month leases.”

According to Santee, the Sam Zell-led company budgeted $4 million for lease concessions in New York City for 2017 — far more than the company did for other U.S. cities like Seattle (where it set aside $80,000) and Washington, D.C. (where it earmarked $90,000).

Welcome to New York’s new rental reality.

Since September, median rents have been on a year-over-year downswing. With a surge of new inventory to contend with, landlords, like Equity Residential and others, have become increasingly desperate to fill empty apartments.

But landlords and developers aren’t the only ones with financial skin the game. New York City rental agents are also scrambling to get tenants to sign leases, and failing to do so means losing out on commissions. This increasingly high-stakes environment has led to a heightened level of jockeying for plum assignments and exclusives in new construction buildings.

“There’s a lot going on behind doors,” said David Schlamm, founder of City Connections Realty. “Owners and managers are talking quietly, trying to figure out how much business they’re going to get.”

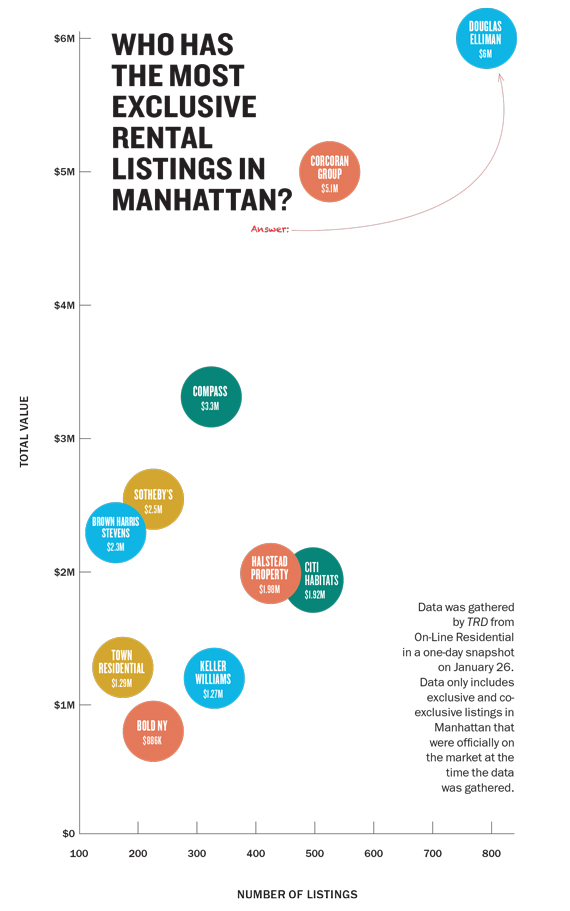

This month, The Real Deal ranked residential firms based on their exclusive and co-exclusive Manhattan rental listings — calculated by adding up the monthly rents on each unit — and talked to industry players about the fierce competition that’s defining today’s landscape.

Taking the top spot was the city’s largest firm, Douglas Elliman, which had $6 million worth of listings at buildings like the 114-unit luxury rental 393 West End Avenue and the 110-unit rental Madison Park Tower on East 34th Street. At No. 2 was the Corcoran Group with $5.1 million, followed by upstart brokerage Compass with $3.3 million, Sotheby’s International Realty with $2.5 million and Brown Harris Stevens with $2.3 million.

Rounding out the Top 10 were Halstead Property ($1.98 million), Citi Habitats ($1.92 million), Town Residential ($1.29 million), Keller Williams NYC ($1.27 million) and relative newcomer Bold New York with $886,090. None of those figures, however, include so-called “shadow inventory,” or available units that the firms can lease up but have strategically held off the market. The figures also represent just a small slice of the overall rental market, which is dominated by open listings.

The tallies — which were pulled from the listings portal On-Line Residential on Jan. 26, and vetted with most of the firms — are undoubtedly small potatoes compared to the sales market, where individual apartments regularly fetch seven-figure sums and higher.

Still, global economic uncertainty plus a simultaneous surplus of high-end condo development in New York has put a brighter spotlight on rentals — a fairly recession-proof corner of the residential market. And sources say there is money to be made for the brokerages that handle rental deals, especially when done in bulk at new developments and for super-pricey units.

Still, global economic uncertainty plus a simultaneous surplus of high-end condo development in New York has put a brighter spotlight on rentals — a fairly recession-proof corner of the residential market. And sources say there is money to be made for the brokerages that handle rental deals, especially when done in bulk at new developments and for super-pricey units.

“The rental prices in this city are still high,” said Gary Malin, president of Citi Habitats. “You can make substantial dollars in the rental game.”

New firms, new rivals

Not surprisingly, brokerages are fighting tooth and nail to land rental business.

From poaching agents and hiring new managers to sharpening their focus on new development and leveraging technology, firms have been pouring resources into their rental operations of late.

With nearly 40,000 new units slated to come to market in the next three years, there will be plenty of New York apartments to lease up — potentially too many, especially on the luxury end. While it may seem counterintuitive to see competition among brokers heat up with so much business to go around, agents are going after new developments harder than ever because they have the biggest financial upside if the building is a winner.

So far, two recent upstarts — Compass and Bold New York — have made the biggest dent in the status quo. And both were bolstered by winning new development assignments.

“We’re all going after [new] buildings because exclusivity is king,” said Jordan Sachs, the CEO of five-year-old Bold. “The open marketing [of listings] is more challenging, and the days of leaving keys with a doorman isn’t going to help rent apartments.”

In the last year, Bold has landed marquee assignments like the 200-unit rental portion of Macklowe Properties’ 1 Wall Street as well as Slate Property Group and GreenOak Real Estate’s 393-unit RiverTower on East 54th Street, which is undergoing a $60 million gut renovation that includes the addition of 82 apartments, a new lobby and penthouse level with a gym, lounge, library and activity room with rock climbing.

Bold recently launched 60 apartments at the building — renamed the Oriana — with studios starting at $2,700 a month and two large penthouses asking $12,650 and $30,000 a month. (However, only nine of those units were officially listed at the time TRD pulled data from OLR.)

While the brokerage has handled leasing for Slate’s Manhattan properties for the last three years — starting with two units in a Murray Hill walk-up — it had to beat out several other firms to land the Oriana. At 1 Wall, CORE’s Shaun Osher, which is handling sales for the hybrid building, brought Bold in to focus on the rentals. “We still had to prove our value. We pitched directly to Harry Macklowe,” Sachs said.

Sachs said he thinks Bold’s small size (it has about 100 agents) — and the fact that it devises unique marketing strategies for each building — makes it more nimble and gives it a leg up. His team, he said, scrutinizes everything from the décor to the doorman’s clothing to the scent of the lobby.

“It’s not just checking boxes. As a brokerage, you have to rethink your value-add to the project,” Sachs said, noting that big firms that haven’t re-evaluated stale strategies are being edged out by boutique agencies that are hungry for business.

“If you just wash, rinse and repeat and do the same thing you’ve been doing since 2010, [that] isn’t going to work today,” he said.

Strategy sessions

Some established players have clearly been rethinking their own strategies for competing in today’s cutthroat rental arena.

After seeing its new development rental business decline, Elliman shook up its rental strategy last year.

It booted Cliff Finn, who was overseeing new development rentals, and consolidated his division under Hal Gavzie, who was hired away from Town Residential earlier in the year to oversee all other rentals. Gavzie has been working more closely with Elliman’s sales brokers, who can feed leads to rental agents from investors looking to lease out units.

Meanwhile, Citi Habitats acquired Brooklyn-based Aptsandlofts.com in late 2015 in a bid to gain a foothold in Brooklyn and an edge in the new development world.

“If we didn’t have a [new development marketing] team in place, we’d be giving up business,” said Malin, who noted that the company has landed a “considerable” amount of business since the acquisition.

With the competition stiffening for assignments, however, he said he’s been personally pitching developers along with Aptsandlofts.com founder David Maundrell and Jodi Stasse, senior managing director for new developments.

And, he noted, unlike small boutique firms, the 800-agent Citi Habitats has massive resources at its disposal — including the new development expertise of its sister firm Corcoran Sunshine.

Those resources do seem to be winning over major developers.

The firm is handling leasing at JDS Development Group’s 760-unit American Copper Buildings at 626 First Avenue as well as sales and leasing at Sheldon Solow’s 550-plus unit 685 First Avenue, among other high-profile projects. (However, many of those units have not officially launched and are not yet listed in OLR, so they were not captured in TRD’s ranking.)

Citi Habitats’ longstanding relationships have also played a big role in securing business. Malin said the firm did not need to pitch for 685 First because it successfully leased up Solow’s 2 Sutton Place North — and the developer just called him up.

But that doesn’t mean it isn’t brawling for listings elsewhere.

To ensure that listing websites, apps and other firms don’t eat into its market share, the firm has been implementing a multiyear plan that includes moving away from retail offices and upgrading its own website — a move designed to capture more of the online apartment hunters.

Other brokerages are attempting to bulk up their ranks by cherry-picking talent from rivals, picking over brokerages that have recently gone under or merging with other firms.

In December, for example, City Connections and DSA Realty merged, doubling down on the less glamourous stock of existing (mostly family-owned) rentals. The newly merged firm claimed to have about $500,000 worth of exclusive rentals.

“When you’re a rental broker in this town, you want to have exclusives versus the open-listing game. That’s a tough, ugly game in my opinion,” said Schlamm, who noted that the companies each brought roughly130 rental-building exclusives to the table.

“When you’re a rental broker in this town, you want to have exclusives versus the open-listing game. That’s a tough, ugly game in my opinion,” said Schlamm, who noted that the companies each brought roughly130 rental-building exclusives to the table.

Meanwhile, Mdrn., a residential firm started in 2013, swooped in and made three key hires — Meza Eythel, Dan Berman and Olinda Turturro — after longtime firm Bellmarc Realty shuttered its last office in 2016 amid founder Neil Binder’s financial woes. “We’ve managed to pick up the pieces,” said Zach Ehrlich, the CEO of Mdrn., which had about $290,000 worth of exclusives and did not make the ranking.

“Their business was a cash machine,” said Ehrlich, citing Bellmarc’s relationships with mom-and-pop landlords. “For agents, that’s a gold mine.”

Ehrlich said his 50-agent firm also aggressively courted (and landed) Bellmarc agents, who were also being wooed by Citi Habitats and suburban powerhouse Weichert Realtors, but the latter firm shuttered its rental office in July after a short New York City stint, citing the “contracting rental market.”

Other firms are simply altering their hiring strategies to reposition themselves in today’s fierce environment.

Rather than targeting more young and relatively inexperienced brokers, as it had been doing in the past, William Raveis hired seasoned Elliman alum Otari “Terry” Bater last summer to lead its New York rental division.

Kathy Braddock, the managing director of the firm’s three-year-old New York office, said that Bater’s knowledge of specific buildings and leasing requirements has allowed the brokerage to expedite and log more transactions.

“Rentals are a huge part of New York City, so you have to have a rental expertise or you’re not in the game,” she said.

Muted demand, high prices

While renting in New York isn’t cheap by any stretch of the imagination, the market fell precipitously last year.

Manhattan’s median rent in January dropped for the sixth straight month to $3,259, according to appraisal firm Miller Samuel. And with an overload of inventory stemming from the recent development boom, landlords have no choice but to dangle carrots in front of tenants.

In January, a shocking 30.9 percent of Manhattan rental deals involved landlord concessions, nearly double the 16.4 percent a year earlier.

Renters are proving to be a tough sell. New leasing activity slipped 4.8 percent to 3,212 transactions in January year over year.

Despite those seemingly troubling numbers, some say it’s not time to panic.

Citi Habitats’ Malin, for one, believes the price drop is a correction after years of landlords pushing up rents. “It’s not that there isn’t demand — there’s plenty of demand — but the demand is being muted by pricing,” he said.

Still, as Schlamm put it, “It hasn’t been fun to be a broker for rentals,” since many renters walk away if the deal isn’t sweet enough.

“The average person looks and says, ‘No, I won’t pay that and yes, I want concessions,’” he said.

In addition to paying brokers’ fees, landlords are offering two, or sometimes three, months of free rent to tenants — a sign of just how desperate they’ve become to fill vacancies.

The giant pipeline of new units is only expected to make things more difficult for landlords and brokers.

More than 38,000 market-rate rental units are set to hit the market citywide over the next three years, according to Ten-X, a Silicon Valley-based online real estate company.

In 2016, 13,000 new units launched — a record high, according to the company’s chief economist, Peter Muoio.

“It is unlike anything we’ve seen historically,” he said of the burgeoning pipeline.

Along with lower rents, Ten-X predicted that by 2020 New York could see vacancy rates pierce 10 percent — a massive increase from the 2.4 percent logged in January.

“It becomes a major digestion problem for that many units to be delivered at once,” Muoio said.

Heyday for hybrids

Despite hurdles in the rental market, it’s still a good time to be a rental broker.

Condo developers and their lenders are more interested than ever in fallback plans for new construction, should the market turn further south.

“You know how many calls I get a week saying, ‘I have to talk about Plan B, and that’s rental’?” one brokerage chief said. “As the market shifts, if you don’t have a rental [plan], that’s money on the table.”

A recent marketing campaign by the outer-borough rental brokerage Rapid Realty — which is selling franchises nationwide — billed its business as one that’s “proven resilient enough to thrive in even the worst economic conditions.”

But with the exception of Rapid Realty and a handful of others, New York City brokerages have for the last several years been shifting away from the pure rental and pure sales models.

“I need my guys to go into sales. That’s the bigger margin. It’s less volume to make more money, and not working seven and a half days a week,” said Sachs.

Agents also see the value in diversifying their expertise.

“As time evolves, more agents are crossing the aisle from one to the other,” said the Corcoran Group’s Dennis Hughes, a 25-year veteran specializing in high-end rentals.

Brown Harris Stevens’ Paul Anand, who handles sales and rentals for investor clients, said it’s crucial to have a foot in both worlds.

“This town is a rental market. If you’re not serving that market, you’re missing a revenue opportunity,” he said.