For the last six years, Eastdil Secured [TRDataCustom] has beat out the competition, landing the top spot on The Real Deal’s ranking of New York City investment sales firms. While the brokerage continued that streak in 2016, the stage has already been set for a major shakeup in the coming year.

That’s because in October, the firm’s two biggest brokers, Doug Harmon and Adam Spies, stunned the industry and fled to Cushman & Wakefield after a combined 40 years at Eastdil.

That’s because in October, the firm’s two biggest brokers, Doug Harmon and Adam Spies, stunned the industry and fled to Cushman & Wakefield after a combined 40 years at Eastdil.

But before the duo departed, they helped Eastdil reel in a record $22.9 billion worth of investment sales for the year.

That was roughly three and a half times what the second-place citywide finisher, CBRE, brokered. In fact, the other four firms in the top five didn’t even come close to Eastdil when their numbers are added together.

TRD’s ranking of the top 40 investment sales firms in NYC — which included closed investment sales of $1 million and up, ground leases and leasehold interests — found that those four firms racked up a combined $16.5 billion. CBRE had $6.7 billion in closed deals, Cushman had $4.6 billion, JLL had $3.2 billion, and Rosewood Realty Group came in with $2 billion, according to TRD’s ranking, which looked at citywide numbers and borough breakdowns, and was culled from Real Capital Analytics, CoStar Group and many of the firms.

| Rank | Brokerage | Dollar Volume | % change from '15 | # of Deals | Estimated commission |

|---|---|---|---|---|---|

| 1 | Eastdil Secured | $22.9 billion | 1% | 47 | $79 million |

| 2 | CBRE | $6.7 billion | -24% | 27 | $28 million |

| 3 | Cushman & Wakefield | $4.6 billion | 37% | 331 | $74 million |

| 4 | JLL | $3.2 billion | 8% | 13 | $13 million |

| 5 | Rosewood Realty Group | $2.0 billion | -37% | 69 | $24 million |

| 6 | HFF | $1.58 billion | -45% | 17 | $11 million |

| 7 | Eastern Consolidated | $1.57 billion | -18% | 84 | $22 million |

| 8 | Meridian Capital Group | $1.55 billion | N/A | 36 | $15 million |

| 9 | Marcus & Millichap | $1.47 billion | 10% | 213 | $36 million |

| 10 | Hodges Ward Elliott | $1.3 billion | -28% | 39 | $10 million |

| 11 | Westwood Realty Associates | $1.1 billion | -9% | 24 | $10 million |

| 12 | Ariel Property Advisors | $1.06 billion | 74% | 51 | $10 million |

| 13 | Savills Studley | $940 million | -50% | 14 | $6 million |

| 14 | GFI Realty Services | $782 million | 29% | 49 | $12 million |

| 15 | ABS Partners Real Estate | $755 million | 1349% | 10 | $5 million |

| 16 | Robert Douglas | $598 million | N/A | 6 | $4 million |

| 17 | Savitt Partners | $525 million | N/A | 1 | $2 million |

| 18 | Newmark Grubb Knight Frank | $522 million | -11% | 20 | $7 million |

| 19 | Besen & Associates | $439 million | -23% | 57 | $10 million |

| 20 | Cignature Realty Associates | $403 million | 457% | 17 | $6 million |

| 21 | Highcap Group | $323 million | 102% | 30 | $6 million |

| 22 | HPNY | $291 million | 172% | 17 | $5 million |

| 23 | TerraCRG | $287 million | -29% | 34 | $5 million |

| 24 | Friedman-Roth Realty | $267 million | -28% | 36 | $6 million |

| 25 | Pinnacle Realty of New York | $222 million | 8% | 34 | $5 million |

| 26 | Compass | $213 million | N/A | 84 | $7 million |

| 27 | Bluegate Partners | $211 million | N/A | 1 | $1 million |

| 28 | RKF | $202 million | 0% | 13 | $4 million |

| 29 | Venture Capital Properties | $192 million | -75% | 9 | $3 million |

| 30 | Prince Realty Advisors | $191 million | N/A | 6 | $2 million |

| 31 | Voda Bauer Real Estate | $185 million | N/A | 30 | $3 million |

| 32 | Capital Property Partners | $173 million | N/A | 8 | $3 million |

| 33 | Epic Commercial Realty | $155 million | -43% | 58 | $5 million |

| 34 | Douglas Elliman | $146 million | -57% | 31 | $4 million |

| 35 | CPEX Real Estate | $128 million | -42% | 23 | $3 million |

| 36 | Carollo Real Estate | $125 million | N/A | 1 | $1 million |

| 37 | Alpha Realty | $125 million | N/A | 16 | $3 million |

| 38 | MHP Real Estate Services | $124 million | 30% | 3 | $1 million |

| 39 | Corcoran Group | $123 million | -18% | 21 | $3 million |

| 40 | DY Realty Services | $112 million | N/A | 12 | $2 million |

| 41 | Majestic Acquisitions | $112 million | N/A | 1 | $1 million |

| 42 | Barcel | $99 million | 50% | 27 | $3 million |

(Source note: Ranking compiled through industry databases such as Real Capital Analytics and CoStar Group, as well as information from the firms. In addition to investment sales of $1 million and up, sales for ground leases and leaseholds were included. All firms that represented an ownership interest in a transaction were credited with the value of the stake that they brokered. Minority interest deals were not included. The commission figures are estimates made solely by TRD using a sliding scale based on the size of the deal.)

“For the last several years, Eastdil has eaten CBRE’s lunch,” said one high-level source, referring to the growing divide between two firms that were once on a much more level playing field.

Eastdil did indeed handle eight of NYC’s 10 largest deals in 2016, representing the owners in the $1.9 billion sale of 787 Seventh Avenue, the $1.7 billion sale of 1285 Sixth Avenue and the $1.4 billion sale of the Sony Building.

But at the very top of the investment sales world, where firms fight for $1 billion-plus trophy building deals, everything that happened in 2016 might as well be a distant memory.

In addition to the Harmon-Spies move, there were other big broker reshufflings, most notably JLL’s high-profile investment sales team of Richard Baxter, Yoron Cohen and Scott Latham fleeing for Colliers International (see related story on page 46). So the spotlight will undoubtedly be on Eastdil, Cushman, JLL and Colliers as they all adjust to their new situations — and the ranking order is likely to change when the 2017 comes to a close.

“These moves create a larger competitive base so that, for example, Cushman now joins Eastdil and CBRE at the top of the investment sales space,” said Will Silverman of Hodges Ward Elliott, which ranked No. 10 with $1.3 billion in deals. “It will be a little fragmented. But more competition is a good thing.”

The slowdown showdown

The burgeoning Eastdil-Cushman rivalry isn’t the only subplot unfolding in today’s investment sales world.

The changes that did take shape in 2016 did so against the backdrop of a significant slowdown in the overall investment sales market. After a blockbuster 2015, investment sales dollar volume dropped 25 percent citywide in 2016 to $58 billion, from $71 billion, Cushman data shows.

Amid those conditions, CBRE held on to its No. 2 spot but saw its $6.7 billion in deal volume sink by more than $2 billion, from $8.8 million in 2015. The firm did, however, handle some of the biggest sales in the city, including PGIM’s $1.04 billion purchase of a 40 percent stake in 11 Madison and China Investment Corporation’s $683.5 million purchase of a 49 percent stake in One New York Plaza. (It should be noted, however, that minority-stake deals were not included in the ranking because they are not generally publicly recorded.)

Amid those conditions, CBRE held on to its No. 2 spot but saw its $6.7 billion in deal volume sink by more than $2 billion, from $8.8 million in 2015. The firm did, however, handle some of the biggest sales in the city, including PGIM’s $1.04 billion purchase of a 40 percent stake in 11 Madison and China Investment Corporation’s $683.5 million purchase of a 49 percent stake in One New York Plaza. (It should be noted, however, that minority-stake deals were not included in the ranking because they are not generally publicly recorded.)

Meanwhile, Cushman continued an upward climb that started in 2015 after it bought Massey Knakal Realty Services for a reported $100 million. The firm’s $4.6 billion may seem paltry next to CBRE and Eastdil, but it’s actually a strong showing given its less-than-stellar performance just prior to its Massey Knakal acquisition.

In addition, the firm — which went from closing $875 million in investment sales deals in 2014 to $3.4 billion in 2015, post-Massey Knakal acquisition — is now poised for more growth with Harmon and Spies in its camp. Sources say Cushman, which closed 331 deals in 2016 (more than any other firm), could corner both the high-volume lower end of the market through its former Massey Knakal players and the billion-dollar-plus trophy market with its two new star brokers.

JLL also had a strong year, piling up 13 deals for its $3.2 billion total and jumping up one spot on the ranking. But its overall showing was boosted by one big deal: representing the Olayan Group and Chelsfield on their $1.4 billion Sony Building acquisition in June. Aside from that, JLL’s biggest deal was the $463 million sale of 850 Third Avenue. In addition, the company is regrouping after the departure of Baxter and Co. (JLL has three remaining midlevel investment sales brokers, but it’s unclear if the firm plans to replace the team that just left. A JLL spokesperson declined to comment.)

In addition to Eastdil, Cushman and JLL, Marcus & Millichap and Ariel Property Advisors were among the firms that saw an increase in dollar volume. Ariel Property, a multifamily-centric investment sales brokerage, saw a big jump, increasing its dollar volume by 74 percent to $1.06 billion year-over-year and snagging the No. 12 spot.

But other firms saw business drop in 2016. In addition to CBRE, Rosewood, HFF, Hodges Ward Elliott and Eastern Consolidated all fell into that camp.

Rosewood’s Aaron Jungreis, whose small 10-broker shop has managed to muscle its way into the big leagues in the last few years by handling large multifamily portfolios, saw deal volume drop to $2 billion, from $3.2 billion. Yet Jungreis didn’t seem overly concerned.

“Everyone had their hall-of-fame year in 2015,” he told TRD. “Last year wasn’t as good, but it was still an all-star year.”

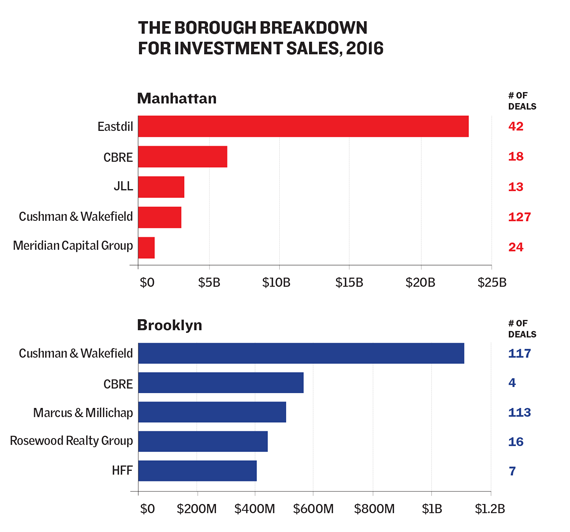

Battle of the boroughs

The fight for dominance is obviously not just limited to Manhattan. It’s also being taken to the boroughs, where large multifamily portfolios are still changing hands.

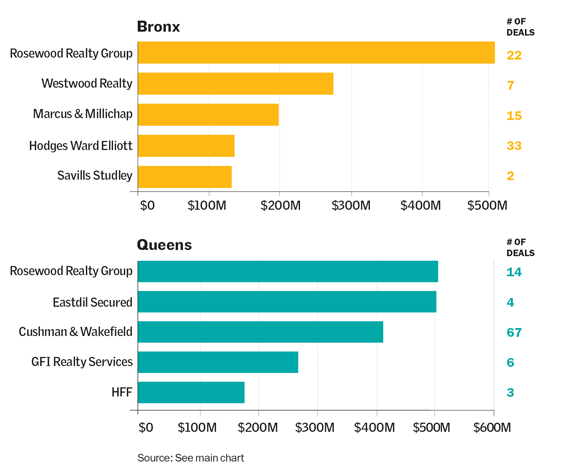

Rosewood, Cushman, Marcus & Millichap, Ariel Property Advisors and Steven Vegh’s one-broker shop Westwood Realty Associates are all dominant players in that space.

Cushman emerged as the top dog in Brooklyn, Massey Knakal’s former stomping ground, with $1.1 billion in deals, including the Kushner Companies-led group’s $340 million purchase of the Watchtower building in Dumbo.

Rosewood, meanwhile, bested the competition in Queens and the Bronx with $509 million and $468 million in closed deals, respectively. The firm brokered the $133 million purchase of a 10-building Queens portfolio by A&E Real Estate and Benedict Realty Group.

But Rosewood, which last year took the No. 1 spot in Brooklyn, fell to fourth place in that borough, with $437 million.

Overall, Queens had a stronger showing than its counterpart boroughs.

The borough saw $1.5 billion in multifamily deal volume in 2016 — a massive 59 percent increase, according to Ariel Property Advisors data. In Brooklyn and the Bronx, however, multifamily volume declined — by 28 percent and 17 percent, respectively. That put Brooklyn at $2.6 billion and the Bronx at $1.4 billion.

“Queens did extremely well pricing-wise throughout the year,” said Shimon Shkury, president of Ariel Property Advisors. “Brooklyn, not as much.”

Meanwhile, changes are afoot in the midmarket under-$100 million space.

Meridian Capital Group — which launched its investment sales division in mid-2015 and poached Eastern Consolidated’s David Schechtman and Lipa Lieberman — ranked No. 8 this year with $1.55 billion across 36 deals. That was one spot below Eastern Consolidated, which brokered 84 deals totaling $1.57 billion.

Yoni Goodman, president of Meridian Investment Sales, said the division, which now has 30 people, including 15 brokers, is expected to grow to 25 brokers in the next year.

Daun Paris, president of Eastern Consolidated, said the firm is “very pleased” with its performance.

“Both our retail and capital advisory businesses grew significantly last year,” she said. “Our New York City investment sales results were in line with the market, and our investment sales business outside of New York City grew substantially.”

Amid the slowdown, brokers say the climate for closing deals is tough.

Goodman said it’s increasingly based on finding a buyer with a very specific motivation, such as someone looking to make a purchase because of a 1031 tax exchange or someone amassing buildings and air rights for an assemblage.

“In 2012, selling a Class B office building at a record price in Midtown East would have been a jump ball,” Goodman said. “Today it’s the job of a good broker to find the outlier among a pool of buyers to get a deal done.”

Nat Rockett of Marcus & Millichap, which ranked ninth with $1.47 billion and 213 deals, added that he has found “thinner bidding pools and pricing that is not meeting sellers’ expectations.”

While they are not expecting dire conditions going forward, brokers acknowledged that there won’t be a reversal of this downward trajectory in the very short term. Cushman’s Bob Knakal said he expects the first half of 2017 to be “very slow” and the second half to be “less slow.” He’s projecting a 10- to 15-percent drop in citywide dollar volume to the low $50 billion range in 2017, from 2016’s $58 billion.

CBRE’s Stacom pointed out that many of 2016’s biggest deals were actually started in 2015. For example, 787 Seventh Avenue and 1285 Sixth Avenue, both unloaded by AXA Financial, went into contract in 2015 before closing in early 2016.

“It took a long time to complete several of them,” Stacom said. “Not a lot of deals actually launched in 2016.”

She noted that this year there are fewer carryover deals.

“It needs to pick up a lot to make up for that change of volume,” Stacom told TRD.

Many deals in 2016 involved partial-stake sales. In fact, an analysis of RCA data shows that in 12 of the biggest 20 deals of the year, investors took a slice of a deal — rather than the entire pie. Foreign buyers were also gunning for many of those deals: Cushman data shows they had a hand in 67 percent of Manhattan’s partial-stake purchases in 2016, up from 50 percent in 2015.

Stacom said she expects to see more of these partial-stake purchases in 2017 — perhaps even for multiple stakes at the same building. That’s what happened at Brookfield’s 50-story office building One New York Plaza, where CIC took its abovementioned 49 percent stake in May 2016 and then AEW Capital Management took 16 percent later in the year. “That’s a way to create more trade value in the market,” said Stacom, explaining that those pricey stake deals increase the building’s gross value.

Hodges Ward Elliott’s Silverman said he expects foreign investors to ramp up dealings in the multifamily market. “If you’re here for the preservation of capital, it just makes too much sense to buy multifamily,” said Silverman.

HFF’s Eric Anton said Japanese investors, in particular, will be on the make in 2017 — much like their days of aggressive NYC investing in the 1980s.

The drop in investment sales dollar volume and other market changes, brokers said, do not necessarily signal total doom and gloom. “I don’t see bankruptcies and malaise in 2017,” said Meridian’s Goodman.

He added, “While dollar volume may be down year-over-year, we haven’t seen a material drop in valuations.”

Jungreis was also optimistic. “We went from going 90 miles an hour to 80 miles an hour,” he said. “It’s a 10 percent drop, but it’s still very fast.”

Visit our annual investment sales rankings page to view the last five years of rankings.

Correction: An earlier version of this article incorrectly identified Pinnacle Realty of New York, and the Queens and Bronx charts were incorrectly named.