Mega-office tenants often initiate a hunt for new space even if they plan to stay put. It’s an age-old strategy to gain leverage when it comes time to negotiate a new lease.

But that wasn’t the case for McGraw-Hill, which seriously considered relocating some of its offices across the Hudson River before renewing its 900,000-square-foot lease early at 55 Water Street in March 2016.

CBRE [TRDataCustom] heavyweights Ken Meyerson and Paul Myers had spent two years working with the publishing and financial-information giant trying to figure out what to do when its lease expired in 2020 at the Lower Manhattan building.

The company — which owns Standard & Poor’s Ratings Services and was in the process of rebranding itself as S&P Global — was considering giving up its anchor space and splitting its footprint between a New Jersey back office and another building in the city.

But the company locked in a deal that will give it a renovated office years earlier than if it had relocated.

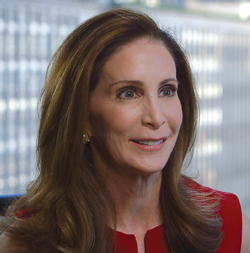

“I think they were looking forward to rebranding and getting on with their lives,” said CBRE’s Howard Fiddle, who along with fellow CBRE power broker Mary Ann Tighe represented the building’s owner, the pension fund Retirement Systems of Alabama.

The deal — the largest Manhattan office lease of 2016 — not only gave an early shot in the arm to the leasing market but proved a windfall for the brokers, who by the end of the year had notched millions of square feet of deals.

The deal — the largest Manhattan office lease of 2016 — not only gave an early shot in the arm to the leasing market but proved a windfall for the brokers, who by the end of the year had notched millions of square feet of deals.

In the upper echelons of the Manhattan office-brokerage world, a relatively small cluster of players close deals as big as McGraw-Hill’s. But those who do are usually household names in the industry.

This month, The Real Deal looks at the agents and firms who brokered the most space in Manhattan’s lucrative office-leasing arena in 2016. The ranking — which was culled from CoStar Group data and supplemented by news reports and information from some (but not all) brokers and firms — was far from easy. Unlike building sales, leases are not publicly reported, and CoStar does not have a complete tally of deals. As a result, the agents and firms who did not provide complete lists of deals to TRD may be undercounted.

Compounding the complexity of the task was the fact that agents often team up with different colleagues on different deals, creating a messy web of collaborations.

But TRD’s ranking shines a light on an important corner of the market and wades into an area that is rarely reported on.

What our research found was that CBRE swept the top four spots on the list. Tighe, who brokered nearly 3.5 million square feet in 2016, landed the No. 1 spot. She was followed by Fiddle, who closed more than 3 million square feet worth of deals, and Meyerson, who clocked in with nearly 1.9 million square feet. Bob Alexander rounded out CBRE’s perch atop the list with nearly 1.8 million square feet, including Swiss bank UBS’s 890,000-square-foot renewal at 1285 Sixth Avenue, Manhattan’s second-largest deal of the year.

CBRE — despite not fully cooperating with TRD — was also the market leader with 14.6 million square feet of deals.

Cushman — which also did not participate, arguing that the list “contains limited information and therefore does not fully showcase the depth” of the firm’s deals —clocked in at No. 2 with 10.1 million square feet. Newmark Grubb Knight Frank ranked third with 8.7 million square feet. JLL took the No. 4 spot with 3.8 million square feet. Savills Studley and Colliers International rounded out the top six with 3.1 million square feet and 2.8 million square feet, respectively.

This all took place as Manhattan saw office-leasing volume — including renewal activity — climb year over year. That was a sharp contrast with the investment-sales market, which dropped a massive 25 percent. Given that drop, leasing was even more crucial to firms’ bottom lines.

To put the numbers in perspective, leasing accounted for the “majority” of CBRE’s $6.2 billion in revenue in the Americas in 2015, according to the firm’s financial filings with the U.S. Securities and Exchange Commission.

To put the numbers in perspective, leasing accounted for the “majority” of CBRE’s $6.2 billion in revenue in the Americas in 2015, according to the firm’s financial filings with the U.S. Securities and Exchange Commission.

At Newmark, leasing generated $513.8 million worth of revenue in fiscal year 2016 — or 48.5 percent of all revenue. At JLL, leasing accounted for the largest single line item at $1.7 billion, or nearly 28 percent of all revenue.

For the brokers putting those deals together, the hustle rarely stops.

As CBRE’s Fiddle put it: “You’re only as good as the deal you did yesterday.”

No blockbusters

While 2016 was a healthy year for leasing, there were few blockbuster deals.

Outside of large renewals by McGraw-Hill and UBS, the largest lease of the year was Coach’s 694,000-square-foot sale/leaseback of its office condo at 10 Hudson Yards, in which the fashion retailer stayed put.

There were no new industry-altering deals on par with Condé Nast’s 2011 lease for 1 million square feet at One World Trade Center, or Time Inc.’s 700,000-square-foot 2014 deal at Brookfield Place, in which both media companies relocated Downtown from Midtown.

Further reading on Bruce Mosler,

including deals and stories.

Even Tighe, who has leased up trophy towers in the past, acknowledged as much. In a telling sign, she didn’t submit anything to be considered for the Real Estate Board of New York’s famed Most Ingenious Deal of the Year Award.

“Normally, when I’m having a really big year, there’s at least one landmark deal,” Tighe told TRD. “What we had here was a number of substantial transactions. I would describe it as good, workmanlike brokerage.”

Early this year, Tighe notched another solid deal when her eight-member CBRE team represented Silverstein Properties in its high-profile lease with Spotify. The digital music-sharing service took 378,000 square feet at Four World Trade Center. While that was not a blockbuster deal in terms of size, it was significant because it closed out leasing at the 2.3 million-square-foot tower.

Overall, Manhattan saw 35.3 million square feet of office leasing in 2016, according to data from Cushman. That was up 4.2 percent from 2015, but down about 16 percent from 2014’s 42 million square feet.

In addition, less-sexy renewals accounted for more than 25 percent of all deals — up from 16.5 percent in 2015, Cushman found.

And unlike the investment-sales side of the business, which was marked by brokers jumping to rival firms, the poaching scene on the leasing side was relatively quiet.

Mark Weiss, who joined Cushman in January after 14 years with Newmark and ranked No. 35 with 570,000 square feet in deals, was one of the exceptions.

Because of his noncompete agreement with Newmark, Weiss spent a good chunk of 2016 completing deals he had initiated before switching firms.

In one of his holdover deals, Weiss represented the Washington, D.C-based law firm Hogan Lovells, alongside Newmark’s Moshe Sukenik, in its 206,720-square-foot lease as the anchor tenant at L&L Holding Company’s 390 Madison Avenue, which is in the midst of an overhaul that’s scheduled for completion in 2018.

The space, which includes two terraces, was a tricky one. The building’s irregularly shaped floor plates made the space challenging for a law firm that was used to a traditional office layout. Weiss initiated an architectural design contest to show Hogan Lovells’ top brass how the space could work — a move he said convinced them to sign on.

“We had to help them reimagine how they would practice in a building that most law firms rejected because of the geometry on the base floors,” he said.

But Weiss — who was also tapped last year by billionaire Leonard Stern to serve as the agent on 667 Madison Avenue, one of Manhattan’s priciest boutique buildings — said he expects 2017 to be a far better year for him, with the transition of moving firms behind him.

“There was a lot of cleanup and a lot of adjustment to the new firm,” he said, adding that the groundwork he laid in 2016 in building up a new book of business will “start to pay off this year.”

While that may turn out to be true for Weiss, for New York’s office-leasing sector on the whole, 2017’s fate is still up in the air.

While overall leasing was up, absorption — or the difference between how much space is added to the market and how much is snapped up — fell for the first time since 2009. According to Colliers, 2016 ended with negative absorption of 3.79 million square feet, meaning that demand failed to keep up with new supply. That is likely tied to a drop-off in job growth: After six years of NYC outpacing the national average in that category, 2016 saw a recalibration, as office-using jobs grew by only 0.6 percent compared to 2.1 percent for the national average.

JLL’s Robert Martin, who ranked No. 32 with 589,435 square feet of deals, said that market fundamentals and competition from new construction will put pressure on landlords to offer more at the negotiating table.

“I think that now, especially in Midtown, landlords see all this vacancy and pending potential vacancy, and they’re going to need to do whatever they can to keep their tenants,” he said.

All about the agency

For those brokers who can land large agency assignments for landlords, it can mean a pipeline of hundreds of thousands of square feet of deals — or more.

Cushman’s Bruce Mosler has one of Manhattan’s biggest agency assignments, at Brookfield Property Partners’ under-construction 2.1 million-square-foot One Manhattan West.

In December, the veteran leasing broker — who ranked No. 5 with 1.7 million square feet — and his team signed the National Hockey League for 160,000 square feet. That came on the heels of the white-shoe law firm Skadden, Arps, Slate, Meagher & Flom signing a 550,000-square-foot anchor-tenant lease in 2015.

Mosler attributed his success at the project — which still has 1.4 million square feet of available space to lease — to ensuring that he doesn’t spread himself too thin with simultaneous assignments.

“We want to ensure that we can produce,” he said. “What you don’t want is to take on something and then be replaced.”

One firm that knows the sting of being replaced on a high-profile project is Newmark, which was booted from leasing up the Empire State Building in 2015. The building’s owner, Empire State Realty Trust, replaced the firm with a team led by Paul Glickman at JLL, who ranked No. 22 with 773,347 square feet of deals in 2016.

He and his JLL team last year signed the sales and marketing firm ZS Associates to 20,000 square feet and the outdoor-advertising company JCDecaux to another 46,000 square feet at the tower.

Glickman said the strategy was to promote the iconic 2.7 million-square-foot building — which has undergone a $550 million renovation — as an “urban campus” by playing up features such as a tenant-only conference center and the first Starbucks to make office deliveries.

Glickman, who mostly represents landlords, said owners are well aware of the concessions the market is demanding, and leasing agents know there’s plenty of competition for tenants.

“There’s a lot of ground to cover based on the supply,” he said. “[It’s] a lot of canvassing and prospecting and promoting the product.”

But while Newmark may have lost its Empire State Building business in 2015, another team at the firm picked up its own big agency in 2016.

Along with CBRE, Newmark was tapped by Trinity Real Estate and Norges Bank to lease nine of the 11 buildings — former printing plants that are roughly a century old — in their 5 million-square-foot Hudson Square portfolio.

Further reading on Tara Stacom,

including deals and articles.

The partners made headlines in 2015 when Norges bought a 44 percent stake in the portfolio, valuing it at $3.5 billion. The duo is now planning to renovate lobbies and rooftop amenity spaces to capitalize on Midtown South’s white-hot market.

Newmark’s David Falk and Peter Shimkin landed five of the buildings, while CBRE’s Fiddle and Paul Amrich snagged the four others.

Fiddle said he spent five months pitching for the assignment — also known as the “beauty contest” phase in industry-speak — and that he selected a team of 10 CBRE agents to handle the leasing.

“We created sub-teams for each of the five assets,” he said, adding that he and Amrich will personally handle the largest property, the nearly 1 million-square-foot 345 Hudson Street.

When asked how he juggles his various agency assignments — 20 agencies on buildings totaling 21 million rentable square feet — Fiddle said: “If you want something done, give it to a busy person.”

Tenants get their turn

When it comes to the tenant side of the leasing game, brokers say the increase in supply gave tenants an upper hand.

Since 2013, Manhattan added 6.67 million square feet of office space, bringing the island’s total office inventory to 506 million square feet at the end of 2016, according to Colliers.

That inventory surplus allowed brokers on the tenant side of the table to wrest more incentives, like free rent and cash for build-outs, from landlords.

As of late July, landlords were giving concessions valued at about 13 percent of a lease for 2016, up about 22 percent year over year, according to data from market analytics firm CompStak. And with starting rents — before factoring in all the freebies landlords foot the bill for — up only 14 percent to about $71 a foot, landlords were somewhat squeezed.

Jeff Peck of Savills Studley, the only firm on TRD’s ranking that focuses exclusively on tenant representation, said landlords are undoubtedly opening their wallets more these days.

“Furniture was always a tenant responsibility, and now we’re seeing negotiating for furniture credits,” said Peck, who along with his partner, Daniel Horowitz, ranked No. 36 with 497,768 square feet worth of deals.

The Peck-Horowitz duo — who in 2016 represented clients like the City University of New York in its lease near Bryant Park and the commercial real estate information provider Reis at 1185 Sixth Avenue — said that brokers need to provide more than the standard lease negotiating to stay competitive these days. They almost always bring in additional services like labor-analytics consultants who can evaluate their clients’ workforce, and workplace strategists who can help them optimize their space.

But sometimes the best advice they can offer is to tell a client not to make a move.

“We’re not like a surgeon who’s always looking to cut someone open,” Horowitz said. “Sometimes the best thing to do is to reorganize and double back to become more efficient.”

But as Peck noted: “You better have a good book of business to do the gravitas of what Dan just described.”

Tenant demand has also shifted in the last decade, another reality landlords have needed to respond to.

In the Lower Manhattan market, for example, the finance, insurance and real estate industries — aka FIRE tenants — accounted for 31 percent of the square footage leased in 2016, down from more than 51 percent of the market a decade ago, according to Cushman.

Technology tenants, meanwhile, are taking a bigger slice of the pie, representing more than 30 percent of Lower Manhattan demand in 2016, compared to roughly 17 percent in 2006. And in some cases, these companies are making decisions a lot faster than their traditional corporate counterparts.

Spotify, for example, started looking for a new home late last year and finalized its space at Four World Trade Center about four months later, in January.

“The time between previewing properties and shortlisting them and sending out requests for proposals was definitely condensed,” said JLL President Peter Riguardi, who represented the digital music company in its deal just 10 days after wrapping a 345,000-square-foot lease for the state attorney general’s office at 28 Liberty.

But Eric Ferriello, a 32-year-old Colliers agent who has spent the last eight-plus years building up a tech-heavy clientele, said his tenants had a lot more urgency in 2015 than they did last year.

“[There] was a lot of, ‘Go find it; we need it now’ kind of thing,” he said. “[But in] 2016 there was a lot more strategy as limitations came into play.”

He and his partner Bob Tunis — who ranked No. 24 with 725,113 square feet of deals last year — represented Facebook in its 200,000-square-foot lease at 225 Park Avenue South in March 2016.

The social-media giant’s goal was to find large floor plates so it could replicate, to the greatest extent possible in New York City, the company’s 430,000-square-foot, Frank Gehry-designed headquarters in Menlo Park, California. Company CEO and fellow millennial Mark Zuckerberg described that West Coast office as having “the largest open floor plan in the world.”

“Any transaction of that significance is time-consuming,” Ferriello explained.

But he said that didn’t mean less time with smaller clients, who “live and breathe by their office space.”

“The smaller jobs take as much hand-holding,” he said. “Even more, actually.”

—Mairaj Haider contributed reporting

(To see how this list compares to our 2012 Manhattan leasing broker ranking, click here)

(To view more leasing transaction data, click here)

Correction: A previous version of this story erroneously omitted Savills Studley broker Greg Taubin.